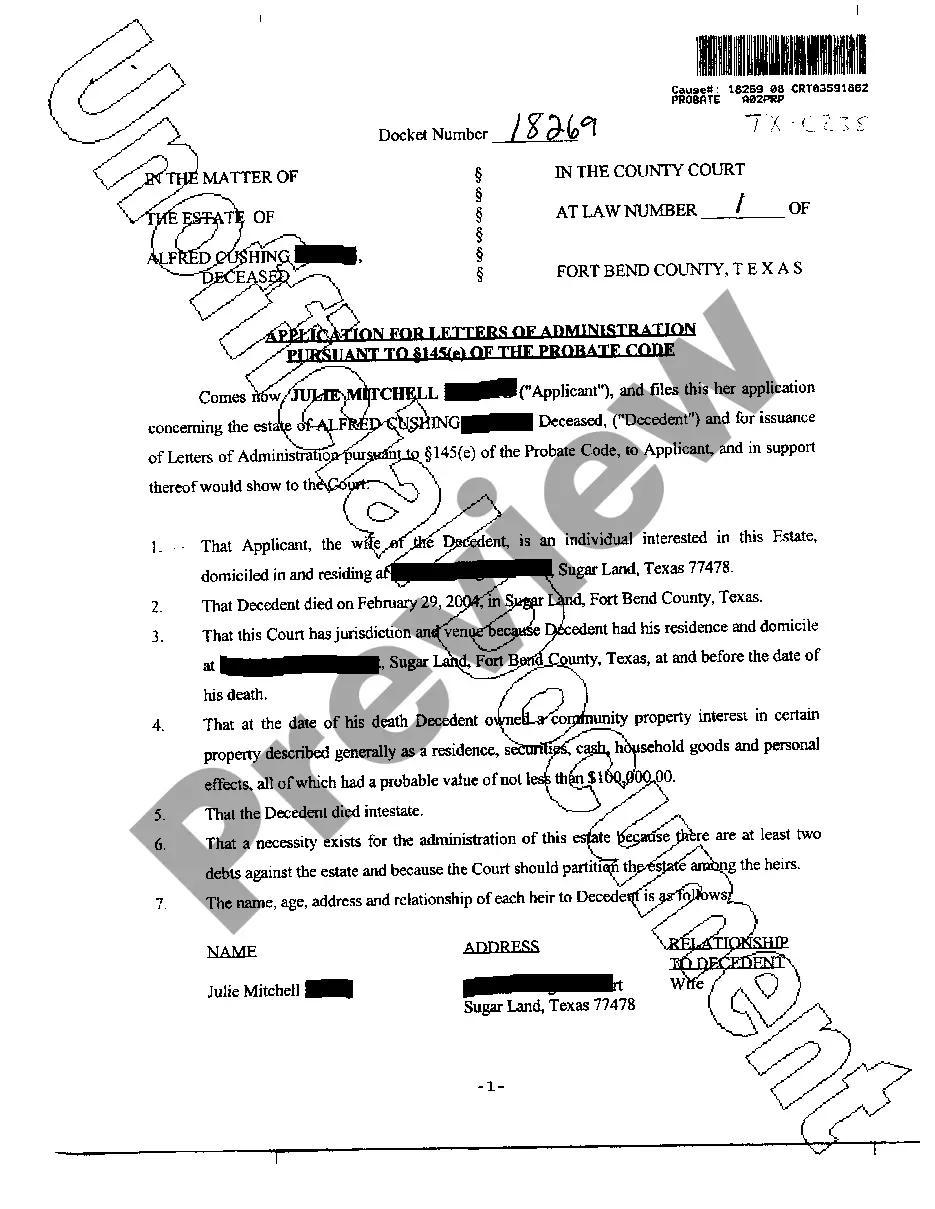

Agreements among family members and claimants for the settlement of an intestate's estate will be upheld in the absence of fraud and when the rights of creditors are met. Intestate means that the decedent died without a valid will. The termination of any family controversy or the release of a reasonable, bona fide claim in an intestate estate have been held to be sufficient consideration for a family settlement.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Arkansas Agreement Between Heirs and Third Party Claimant as to Division of Estate is a legally binding document that outlines the terms and conditions for the division of an estate among the heirs and a third party claimant in the state of Arkansas. This agreement is typically used when there is a dispute or disagreement regarding the distribution of assets among the beneficiaries. The purpose of this agreement is to provide a fair and equitable solution to the distribution of the estate, ensuring that all parties involved are satisfied with their share. It establishes the rights and responsibilities of the heirs and third party claimant, ensuring that each party's interests are protected. Some relevant keywords for this topic include: 1. Arkansas: This indicates that the agreement is specific to the state's laws and regulations, ensuring compliance with local legal requirements. 2. Agreement: The document is a formal agreement between the heirs and third party claimant, providing a legal framework for the division of the estate. 3. Heirs: Refers to the individuals who are legally entitled to inherit from the estate, either based on a will or state laws of intestacy. 4. Third Party Claimant: Refers to an individual or organization who has a legitimate claim to a portion of the estate, not as a direct heir but due to some legal or contractual arrangement. 5. Division of Estate: This refers to the process of dividing the assets, liabilities, and property of the deceased among the heirs and claimants. There may not be different types of Arkansas Agreement Between Heirs and Third Party Claimant as to Division of Estate. However, variations or additions may be included based on the specific circumstances of the estate and the nature of the third party claimant's involvement. It is important to consult with an attorney experienced in estate law in Arkansas to ensure that the agreement accurately reflects the intentions of the involved parties and is legally enforceable.