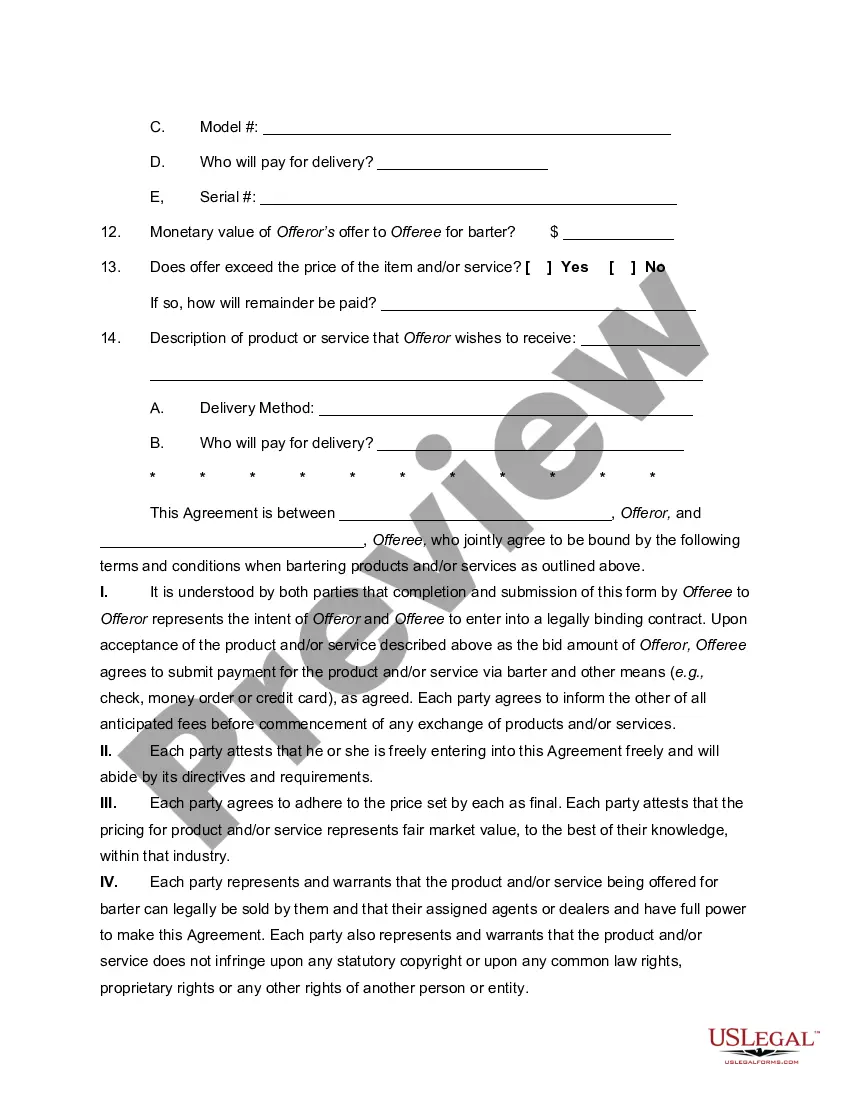

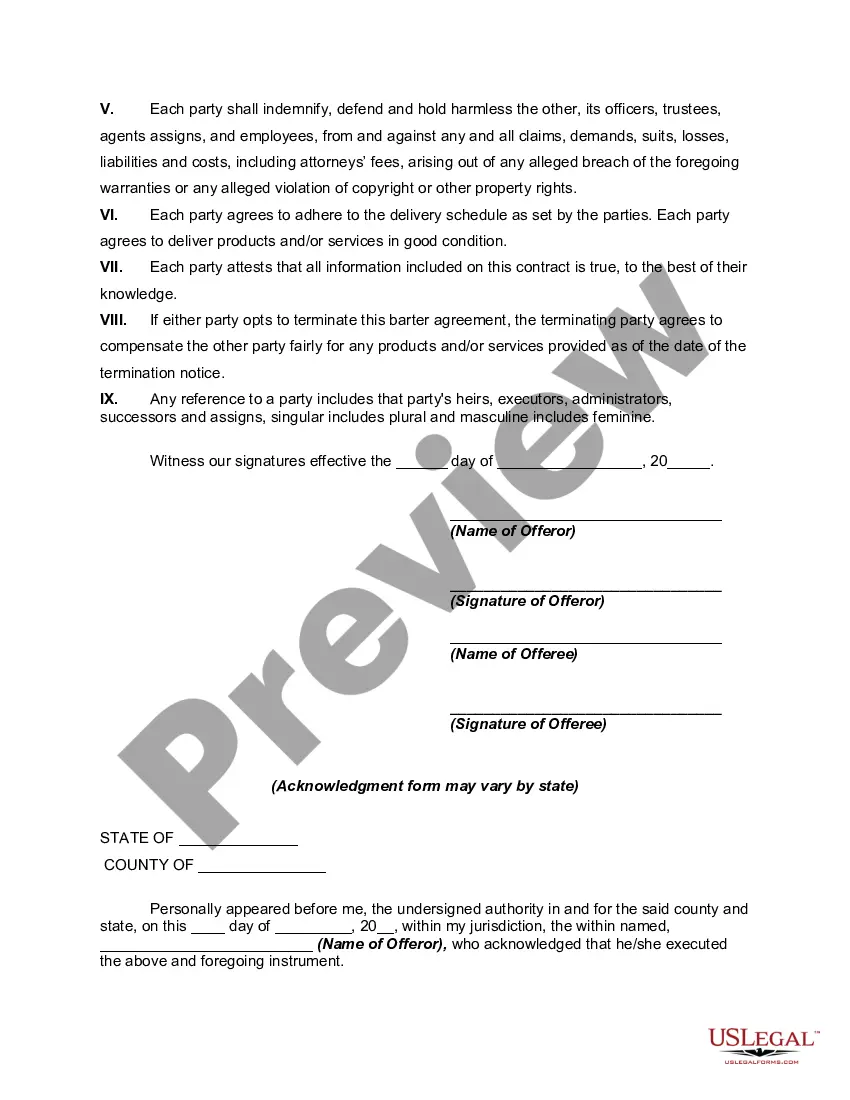

Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Bartering Contract or Exchange Agreement is a legally binding agreement that governs the exchange of goods or services between two or more parties without involving the use of monetary currency. Bartering has been used for centuries as a means of trade, and its popularity remains prevalent today. One type of Arkansas Bartering Contract or Exchange Agreement is a general barter agreement. This agreement outlines the terms and conditions of the exchange, including the identification of the parties involved, a detailed description of the goods or services being exchanged, the value assigned to each item, and any additional terms agreed upon by the parties. It highlights the mutual understanding and intention of the parties to exchange items of value without the need for traditional currency. Another type of bartering agreement specific to Arkansas is the agricultural bartering agreement. This type of agreement is often used by farmers, ranchers, or other individuals in the agricultural industry to exchange goods or services related to agricultural activities. It may include the exchange of livestock, crops, machinery, labor, or other valuable resources relevant to the farming or ranching sector. Furthermore, Arkansas offers bartering agreements in the business-to-business (B2B) sector. These agreements facilitate the exchange of goods or services between businesses, often with the aim of reducing costs and strengthening business relationships. For example, one company may provide marketing services to another company in exchange for IT support or manufacturing capabilities. Additionally, Arkansas Bartering Contract or Exchange Agreement may encompass professional services bartering. Professionals such as lawyers, accountants, or consultants may engage in bartering arrangements where they exchange their services for goods or services of equivalent value. This type of agreement allows professionals to acquire necessary goods or services without the need for monetary transactions. Overall, Arkansas Bartering Contract or Exchange Agreement serves as a comprehensive legal document that ensures a fair and mutually beneficial exchange of goods or services between parties. It provides a framework for conducting bartering transactions, protecting the rights and obligations of the involved parties. Whether it's a general barter agreement, agricultural bartering agreement, B2B bartering agreement, or professional services bartering agreement, all these contracts contribute to fostering trade and relationships within the Arkansas business community.