Subject: Arkansas Sample Letter concerning State Tax Commission Notice — Detailed Description and Types Dear [Recipient's Name], I hope this letter finds you well. I am writing in response to the State Tax Commission Notice you recently received from the Arkansas state tax authorities. Kindly find below a detailed description of what this letter entails, along with brief explanations of different types that one may encounter. The Arkansas Sample Letter concerning State Tax Commission Notice is an official document issued by the State Tax Commission of Arkansas, a governing body responsible for administering and enforcing state tax laws. This letter is typically sent to individuals or businesses to address issues related to their state taxes, compliance, or potential discrepancies found after reviewing their tax returns. The Arkansas State Tax Commission Notice aims to provide essential information, clarify any doubts or concerns, and request specific actions or responses from the recipient to address the tax-related matter at hand. It is vital to carefully review the notice, understand its contents, and take the necessary steps to ensure timely compliance with state tax laws and regulations. Different types of Arkansas Sample Letter concerning State Tax Commission Notice can be categorized based on the nature of the issue raised. Some common types include: 1. Tax Payment Reminder Notice: This type of notice typically reminds individuals or businesses about an outstanding tax liability and urges them to promptly settle the amount due within a specified timeframe to avoid penalties and interest charges. 2. Tax Return Discrepancy Notice: This notice highlights discrepancies discovered between the tax return submitted by the taxpayer and the information available to the State Tax Commission. It may request additional documentation or clarification regarding certain income, deductions, or other aspects of the tax return. 3. Audit or Examination Notice: This type of notice informs the recipient about a forthcoming audit or examination of their tax records, often requiring them to provide supporting documentation or to appear in person for an interview with a representative from the State Tax Commission. 4. Tax Refund Delay Notice: Sometimes, taxpayers may receive notices informing them of delays in processing their tax refunds due to various reasons such as incomplete information, errors in the tax return, or high volume of refund requests. 5. Tax Assessment or Deficiency Notice: This notice typically notifies taxpayers of a tax assessment or deficiency, indicating an amount the state believes is owed in addition to what was originally reported. It usually includes explanations and instructions regarding payment or the dispute process. It is crucial to respond promptly and accurately to any Arkansas Sample Letter concerning State Tax Commission Notice. Failure to respond or take the necessary actions within the specified timeframe can lead to additional penalties, interest charges, or even more severe consequences. If you have any questions or require further assistance regarding the notice you received, I recommend contacting the State Tax Commission of Arkansas directly to seek clarification or consult a tax professional to ensure proper compliance. Best regards, [Your Name]

Arkansas Sample Letter concerning State Tax Commission Notice

Description

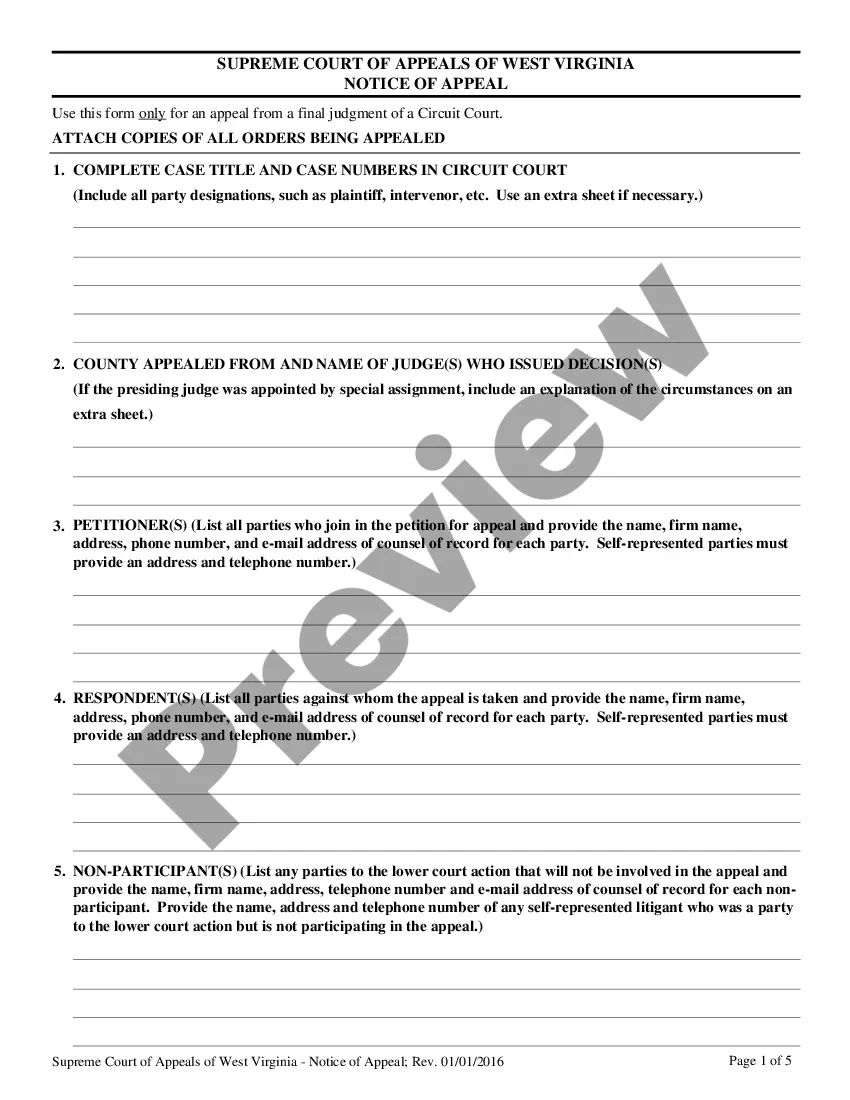

How to fill out Arkansas Sample Letter Concerning State Tax Commission Notice?

It is possible to spend several hours online looking for the lawful record format which fits the state and federal requirements you need. US Legal Forms gives thousands of lawful kinds that happen to be reviewed by professionals. It is possible to download or produce the Arkansas Sample Letter concerning State Tax Commission Notice from our assistance.

If you already have a US Legal Forms bank account, you may log in and then click the Acquire key. Afterward, you may total, change, produce, or signal the Arkansas Sample Letter concerning State Tax Commission Notice. Each and every lawful record format you get is yours forever. To acquire an additional backup for any purchased develop, visit the My Forms tab and then click the related key.

If you work with the US Legal Forms internet site the very first time, stick to the straightforward directions listed below:

- Initial, ensure that you have selected the best record format for the county/metropolis that you pick. Look at the develop description to make sure you have selected the proper develop. If offered, use the Preview key to search with the record format at the same time.

- If you want to discover an additional model from the develop, use the Search industry to obtain the format that meets your requirements and requirements.

- After you have located the format you would like, click on Acquire now to proceed.

- Find the pricing program you would like, type your references, and sign up for a free account on US Legal Forms.

- Complete the deal. You may use your credit card or PayPal bank account to cover the lawful develop.

- Find the structure from the record and download it to the device.

- Make alterations to the record if necessary. It is possible to total, change and signal and produce Arkansas Sample Letter concerning State Tax Commission Notice.

Acquire and produce thousands of record layouts utilizing the US Legal Forms Internet site, which offers the greatest variety of lawful kinds. Use specialist and status-specific layouts to tackle your small business or specific needs.

Form popularity

FAQ

If you are filing your return late and owe the state money, you will generally have to pay a failure to file penalty of 5% of the tax owed for each month or part of a month you are late, up to a maximum of 35%.

Arkansas law requires that all property owners assess their personal and business personal property between January 1st and May 31st each year. A 10% late assessment penalty will be applied to all property not assessed before the deadline.

If the Secretary determines that an additional amount of tax is due, then a Notice of Proposed Assessment shall be issued to the taxpayer. The taxpayer may seek relief from the Notice of Proposed Assessment as outlined above.

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Use Form AR3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). If the new workplace is outside the United States or its possessions, you must be a U.S. citizen or resident alien to deduct your expenses.

Penalties and interest will be charged from the original due date of the tax return. Once your account has been sent to the Collections Section, you will receive a follow-up notice from collections. If you do not pay the tax along with any penalties and interest, a tax lien will be filed.

Steps To Applying For Tax Exemption In Arkansas A copy of the IRS Determination Letter (proof of 501c3 status) Copies of the first and second pages of the IRS Form 1023 (or 1024) A statement declaring Arkansas tax exemption.

The Notice of Proposed Assessment (NPA) informs you that we intend to assess additional tax and/or penalties. You have a right to protest the NPA, which must be submitted within 60 days of the NPA date, or submitted by the Protest By date.