Arkansas Revocable Trust for Lottery Winnings is a legal instrument designed to help lottery winners effectively manage and protect their newfound wealth. A revocable trust allows individuals to retain control over their assets during their lifetime while providing flexibility and privacy in managing the distribution of their lottery winnings upon their death. One of the types of Arkansas Revocable Trust for Lottery Winnings is the Standard Revocable Trust, which provides a straightforward approach to estate planning for lottery winners. This type of trust allows the granter (the lottery winner) to maintain control over the trust assets, make changes to the trust terms, and even revoke the trust if desired. It also allows the granter to designate beneficiaries who will receive the assets held within the trust after their passing. Another type is the Special Needs Revocable Trust which is designed for lottery winners with beneficiaries who have special needs or disabilities. This trust ensures that the lottery winnings are properly managed and used to provide for the ongoing care and support of the disabled beneficiaries without jeopardizing their eligibility for government benefits. Additionally, there is the Charitable Revocable Trust which allows the granter to allocate a portion or the entirety of their lottery winnings to charitable organizations or causes of their choosing. This type of trust not only assists in maximizing the impact of the granter's philanthropic objectives but also provides potential tax benefits by facilitating charitable contributions. Another popular option is the Family Revocable Trust, which is suitable for lottery winners who wish to safeguard their winnings for future generations. This trust allows the granter to determine how and when the assets held within the trust will be distributed to their family members, ensuring the preservation and continued growth of their lottery winnings for the benefit of their loved ones. In conclusion, an Arkansas Revocable Trust for Lottery Winnings is a valuable estate planning tool that enables lottery winners to maintain control over their assets and dictate how their winnings will be managed and distributed. The various types of revocable trusts available, such as the Standard, Special Needs, Charitable, and Family trusts, cater to specific needs and objectives of the lottery winners and their beneficiaries.

Arkansas Revocable Trust for Lottery Winnings

Description

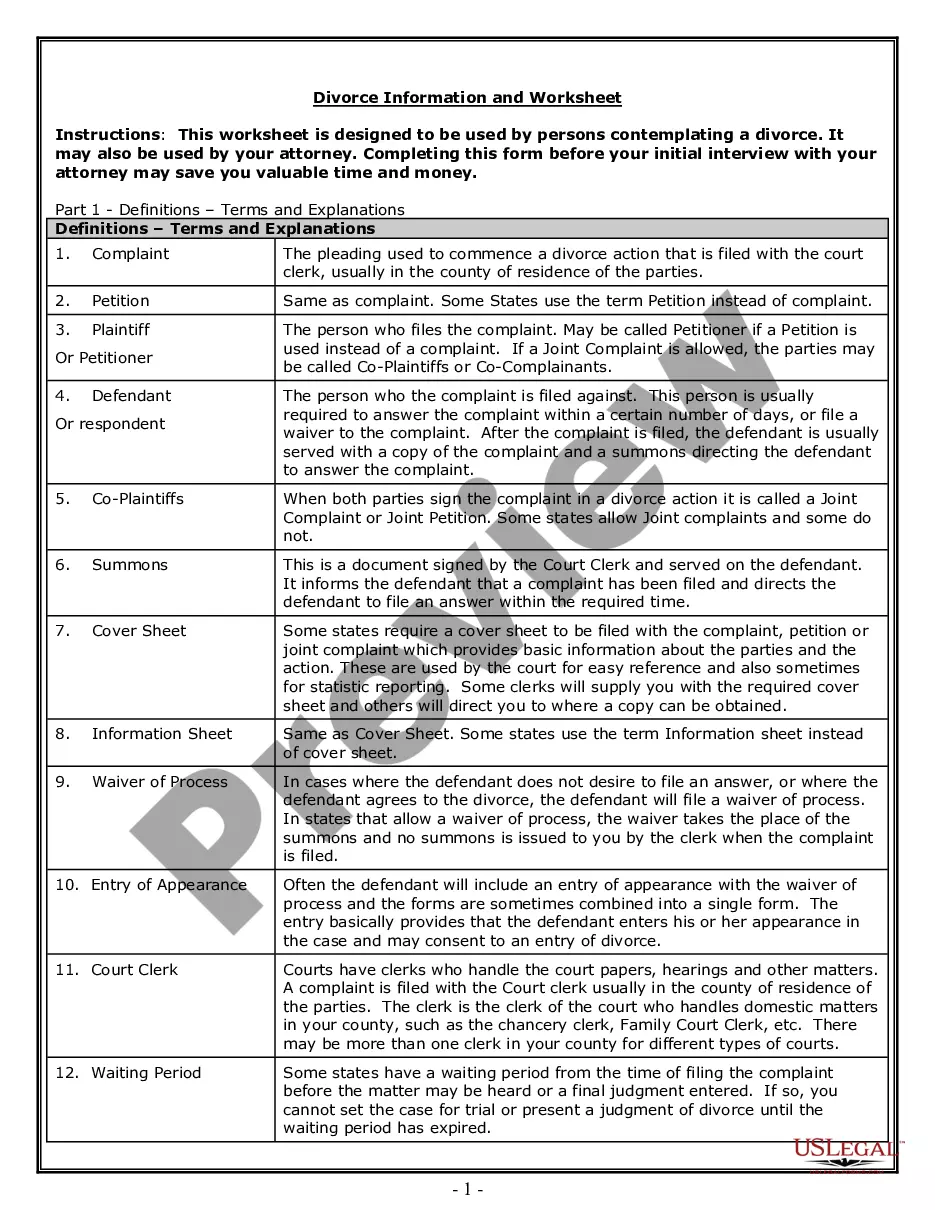

How to fill out Arkansas Revocable Trust For Lottery Winnings?

If you desire to complete, acquire, or print sanctioned document templates, utilize US Legal Forms, the premier repository of legal forms, which is accessible online.

Utilize the site’s straightforward and user-friendly search to locate the documents you require.

A variety of templates for professional and personal purposes are categorized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, select the Purchase now option. Choose the pricing plan that suits you and enter your details to create an account.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Arkansas Revocable Trust for Lottery Winnings within a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to obtain the Arkansas Revocable Trust for Lottery Winnings.

- You can also access forms you previously stored from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Take advantage of the Preview feature to review the form’s content. Remember to check the description.

- Step 3. If you are not satisfied with the document, utilize the Search function at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Several states allow lottery winners to remain anonymous, but the rules vary significantly. States like Delaware, Maryland, and New Jersey provide strong protections for winners’ identities. In Arkansas, setting up an Arkansas Revocable Trust for Lottery Winnings is one effective way to remain private. It's advisable to consult local laws and seek legal counsel to understand your options fully and ensure your anonymity.

An Arkansas Revocable Trust for Lottery Winnings is often the best choice for managing lottery prizes. This type of trust allows you to maintain control over your assets while offering flexibility to make changes as your circumstances evolve. Additionally, it can provide significant privacy benefits, shielding your identity from public scrutiny. Working with a qualified attorney can help you set up this trust properly, ensuring it meets your financial goals.

If you win the lottery in Arkansas, the first step is to sign the back of your ticket and consider your options for claiming the prize. Forming an Arkansas Revocable Trust for Lottery Winnings can help you claim your winnings privately and manage your assets efficiently. Next, consult with financial and legal advisors to help you navigate tax implications and investment strategies. Taking these steps will ensure your lottery winnings work for you in the long run.

Arkansas law requires some identification from lottery winners, but there are methods to keep your name out of the spotlight. By creating an Arkansas Revocable Trust for Lottery Winnings, you can claim your lottery prize while preserving your privacy. This approach minimizes public attention and allows you to manage your newfound wealth effectively. Legal advice can guide you through this process, ensuring compliance with state laws.

Yes, you can remain anonymous if you win the lottery in Arkansas. However, this typically requires establishing an Arkansas Revocable Trust for Lottery Winnings to claim your prize without disclosing your identity publicly. This strategy not only helps you maintain privacy but also offers better control over your winnings. Consulting legal professionals can help ensure that your trust is set up correctly and meets all necessary requirements.

To avoid gift tax on your lottery winnings, consider establishing an Arkansas Revocable Trust for Lottery Winnings. By placing your winnings into this trust, you can manage distributions to family members or friends without incurring a gift tax. Additionally, this method allows you to retain control over your assets while minimizing tax liabilities. Using a reliable platform like USLegalForms can help you set up your trust efficiently and ensure compliance with state and federal regulations.

In Arkansas, lottery winners are required to reveal their identity upon claiming their prize. While this might feel invasive, there are ways to maintain some privacy through estate planning tools. Establishing an Arkansas Revocable Trust for Lottery Winnings may help you manage your assets discreetly while still complying with state regulations.

Handling large lottery winnings requires careful planning and strategic financial management. Consider consulting with financial advisors, accountants, and legal professionals to create a comprehensive plan. An Arkansas Revocable Trust for Lottery Winnings can simplify the process and ensure your winnings are used wisely and securely.

Yes, Arkansas has had several lottery winners since the state's lottery began. These winners often find themselves needing guidance on how to manage their prizes wisely. Utilizing an Arkansas Revocable Trust for Lottery Winnings can help these individuals protect their winnings and plan for the future.

Several states allow lottery winners to remain anonymous when claiming their prizes. However, each state has different rules and regulations regarding anonymity. In Arkansas, lottery winners must disclose their identity, but using an Arkansas Revocable Trust for Lottery Winnings may offer some level of privacy in terms of asset management.

Interesting Questions

More info

Dairy Free Recipes for Diet Lovers We have a new, easy to use, easy to follow dairy free food menu. Our recipes contain no dairy or dairy substitutes and are 100% plant based. Enjoy these easy to follow, dairy free, vegan or paleo recipes to keep you healthy and satisfied. We have a new, easy to use, easy to follow dairy free food menu. Our recipes contain no dairy or dairy substitutes and are 100% plant based. Enjoy these easy to follow, dairy free, vegan or paleo recipes to keep you healthy and satisfied. Sugar Free Recipes for People with Diabetes Our sugar-free recipes are high in antioxidants and very low in carbs. Enjoy this collection of sugar-free recipes for people with diabetes. Try our Paleo Gluten Free Recipes. Gluten Free Cookies and Bars, Gluten Free Pasta, Pizza and Pasta Recipes Gluten Free Foods Recipes Low Carb Recipes, low-carb low fat recipes are ideal for diets with an abundance of sweets.