A corporation whose shares are held by a single shareholder or a closely-knit group of shareholders (such as a family) is known as a close corporation. The shares of stock are not traded publicly. Many of these types of corporations are small firms that in the past would have been operated as a sole proprietorship or partner¬ship, but have been incorporated in order to obtain the advantages of limited liability or a tax benefit or both. This type of employment agreement might be in order for the chief operating officer of such a corporation.

Arkansas Employment of Executive or General Manager in a Closely Held Corporate Business

Description

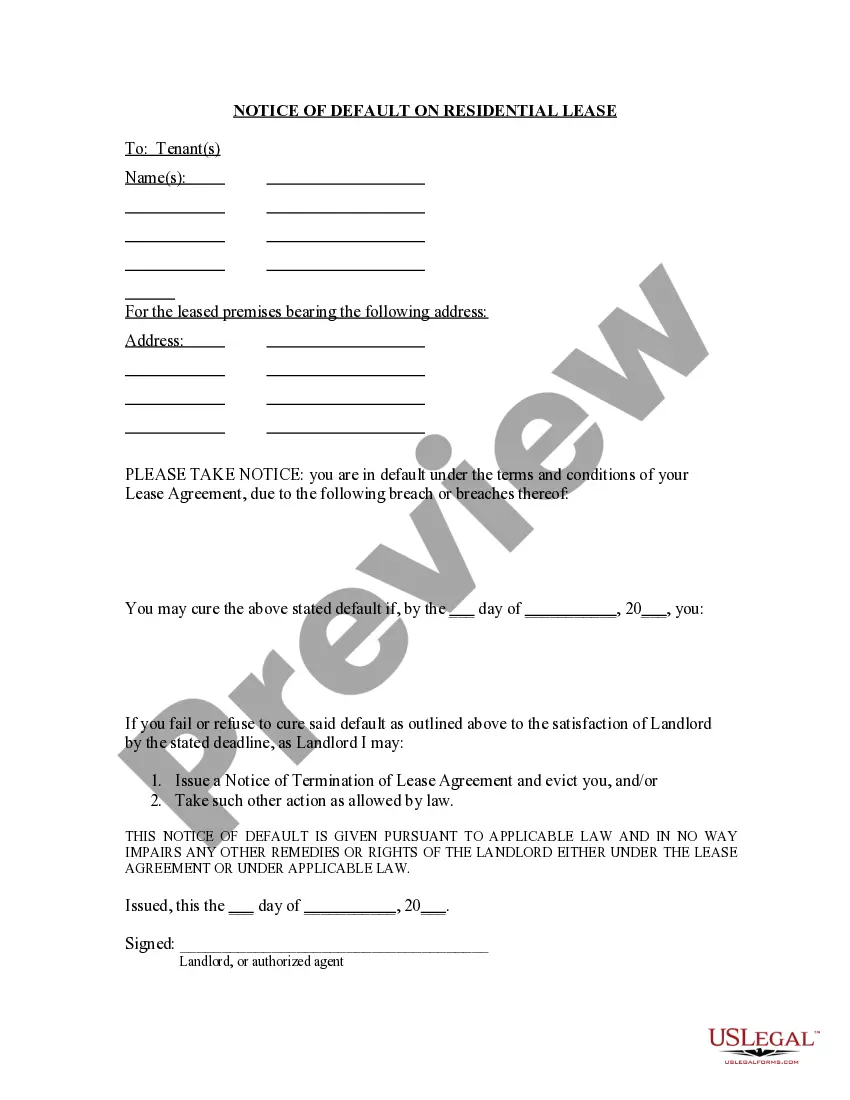

How to fill out Employment Of Executive Or General Manager In A Closely Held Corporate Business?

If you require thorough, acquire, or reproducing sanctioned document templates, utilize US Legal Forms, the most extensive assortment of legal forms, accessible online.

Employ the site’s straightforward and efficient search to locate the documents you need.

Various templates for corporate and personal purposes are categorized by types and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other versions of the legal form template.

Step 4. Once you have located the form you want, click on the Purchase now button. Select the payment plan you prefer and submit your information to create an account.

- Utilize US Legal Forms to find the Arkansas Employment of Executive or General Manager in a Closely Held Corporate Business with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and hit the Download button to obtain the Arkansas Employment of Executive or General Manager in a Closely Held Corporate Business.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for your appropriate city/state.

- Step 2. Use the Review method to examine the form's details. Don’t forget to read the description.

Form popularity

FAQ

Under Arkansas law, employees are entitled to certain leaves or time off, including jury duty leave, crime victim leave, military leave, voting leave and organ or bone marrow donation leave. See Time Off and Leaves of Absence.

The online state filing fee for Arkansas Articles of Incorporation is $45. If you mail your Articles, the filing fee jumps to $50. Hire us for a one-time fee of $270, including the state filing fees, a year of registered agent service, business address and more.

Under Arkansas law employment is protected under multiple circumstances. If a company violates Arkansas employment law the terminated employee can sue for compensation, reinstatement, or both.

Work Hours in ArkansasThere are no state or federal guidelines regarding how many hours Arkansas adults may work within a day or week. There are, however, guidelines that dictate how often and how long 14, 15 and 16-year-olds can work.

Here are a few scenarios that could be considered wrongful termination in Arkansas: You were fired because of your race, gender, or religion. Your employer fired you in retaliation for exercising your rights (such as whistleblowing or participating in an investigation of your employer).

From a tax perspective, there is no magic number of earnings that says when you must incorporate. Basically, if your business is earning more than you need to match your lifestyle, you'll be able to take advantage of tax deferral.

A. Arkansas recognizes the doctrine of employment at will. This means that, as a general rule, either the employer or the employee may end the employment relationship at any time for any reason or for no reason at all. There are, however, a number of exceptions to this general rule under state and federal law.

To start a corporation in Arkansas, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Arkansas Secretary of State. You can file this document online or by mail. The articles cost $50 to file ($45 online).

The three major common law exceptions are public policy, implied contract, and implied covenant of good faith.

Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.