A receipt is a written acknowledgment by the recipient of payment for goods, payment of a debt or receiving property from another. An acknowledgment receipt is a recipient's confirmation that the items were received by the recipient.

Arkansas Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children

Description

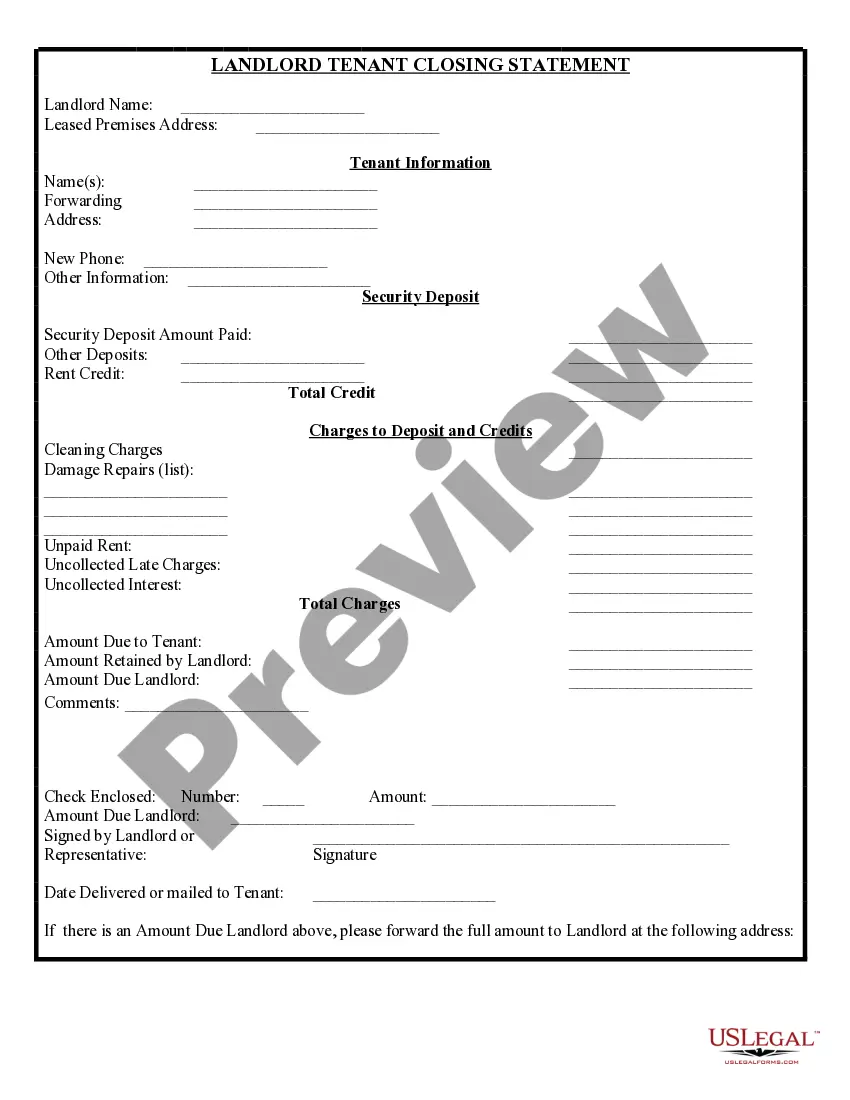

How to fill out Receipt For Money Paid Or Expenses Incurred On Behalf Of Payor's Children?

If you have to total, download, or print lawful file web templates, use US Legal Forms, the biggest collection of lawful types, which can be found on the web. Make use of the site`s simple and easy convenient lookup to discover the files you need. A variety of web templates for business and personal reasons are categorized by categories and states, or keywords and phrases. Use US Legal Forms to discover the Arkansas Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children with a handful of mouse clicks.

In case you are currently a US Legal Forms client, log in to the account and then click the Download option to get the Arkansas Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children. Also you can entry types you previously downloaded from the My Forms tab of your own account.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the right area/country.

- Step 2. Make use of the Review option to look through the form`s articles. Do not forget about to see the information.

- Step 3. In case you are unhappy using the form, use the Look for field near the top of the display to get other types in the lawful form format.

- Step 4. When you have discovered the shape you need, click the Purchase now option. Choose the pricing prepare you choose and add your credentials to sign up on an account.

- Step 5. Approach the transaction. You should use your credit card or PayPal account to complete the transaction.

- Step 6. Find the formatting in the lawful form and download it on your own system.

- Step 7. Total, modify and print or indicator the Arkansas Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children.

Every single lawful file format you get is your own property for a long time. You may have acces to every single form you downloaded with your acccount. Select the My Forms section and decide on a form to print or download yet again.

Contend and download, and print the Arkansas Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children with US Legal Forms. There are millions of skilled and condition-specific types you may use for your business or personal requirements.

Form popularity

FAQ

When Does Arkansas Child Support Stop? The child turns 18 and is not enrolled in high school. ... The child is over 18 and graduates from high school. ... The end of the school year after the child turns 19. The child is emancipated. ... The child marries. The child dies. The child's parents remarry. The child is adopted.

The Arkansas statute of limitations on enforcement of child support arrears is five years past age 18 for any arrears that have not been adjudicated. Adjudications are valid for ten years and may be revived every ten years thereafter. Judgments are automatically renewed for 10 years each time there is a payment.

Arkansas has recently updated its method of calculating child support obligations through Administrative Order No. 10. The previous method only considered the income of the non-custodial parent, but the new ?income-sharing? model takes into account the income of both parents.

In Arkansas, the duty to pay child support for a minor child ends automatically when a child turns 18 unless the child is still attending high school. If the child is attending high school, then the child support will continue through the end of the school year or graduation, or the child turns 19, whichever is sooner.

The new order shifts away from basing all child support obligations solely on the non-custodial parent's income and instead is based on an ?income-sharing? model.

Arkansas, however, does not have a statute or case law upholding parents to a duty to college support without a prior agreement. Once the child reaches majority, the legal duty of the parents to provide support ends.

Congress established the Child Support Enforcement Program in 1975 under Title IV-D of the Social Security Act to collect child support. The program's goal is to ensure that all children are supported financially by both parents and to reduce the number of children receiving public assistance.

In Arkansas, the duty to pay child support for a minor child ends automatically when a child turns 18 unless the child is still attending high school. If the child is attending high school, then the child support will continue through the end of the school year or graduation, or the child turns 19, whichever is sooner.