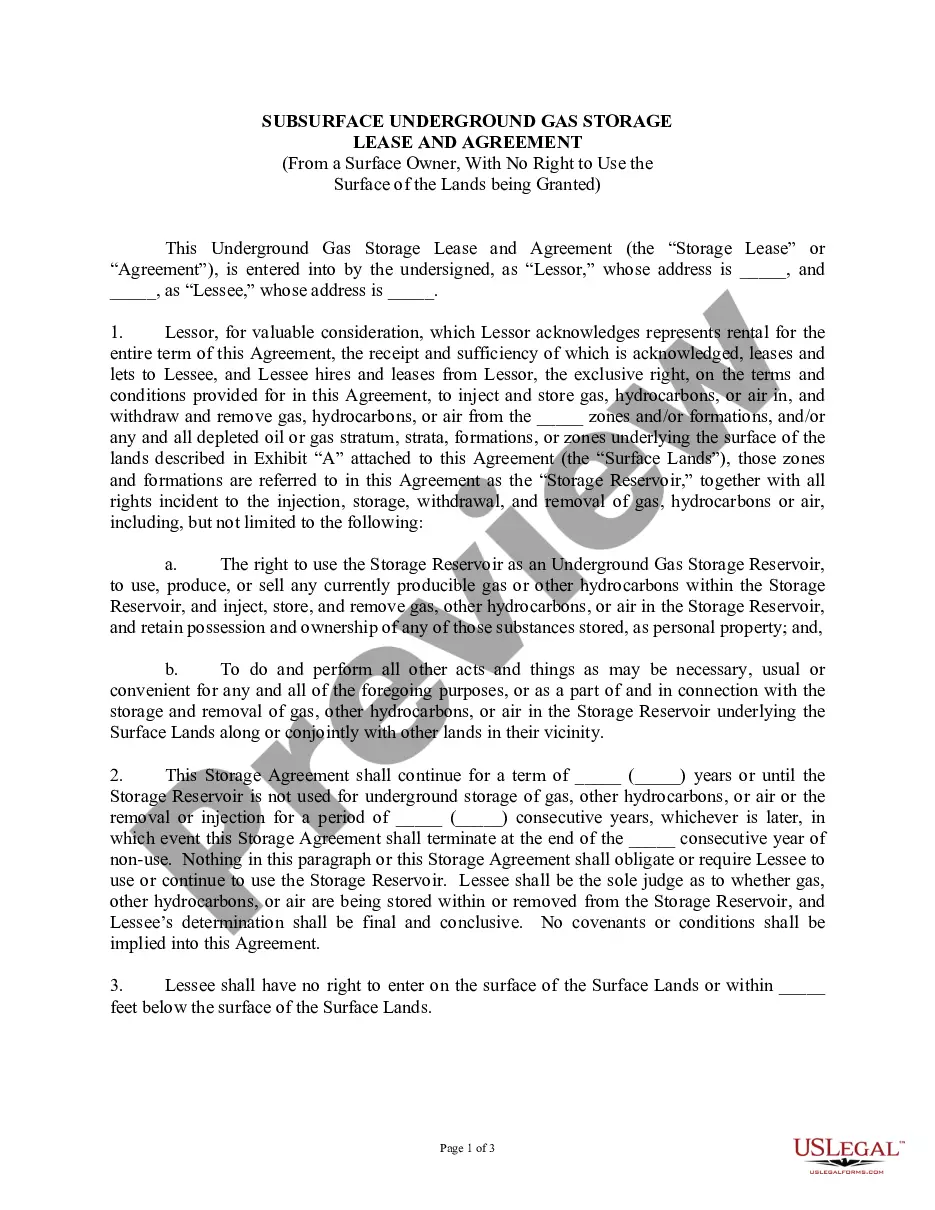

Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description

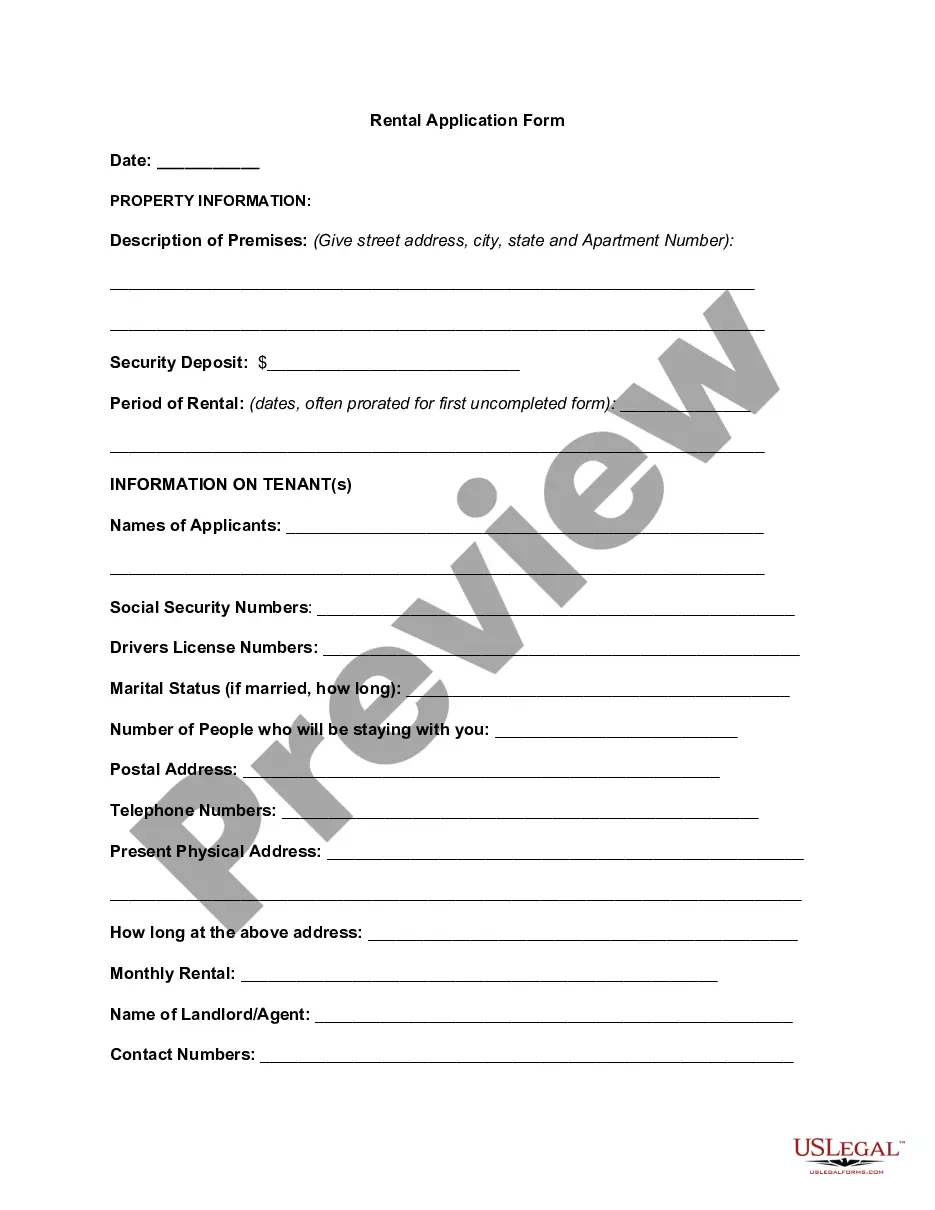

How to fill out General Consultant Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

It is feasible to dedicate numerous hours online searching for the legal document template that satisfies the state and federal requirements you seek.

US Legal Forms provides thousands of legal forms that are reviewed by experts.

You can easily download or print the Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping from our service.

To find another version within the template, use the Search field to locate the template that fulfills your needs and specifications.

- If you possess a US Legal Forms account, you may Log In and then click the Obtain button.

- Next, you can complete, modify, print, or sign the Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping.

- Each legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for your chosen state/city.

- Review the form description to confirm that you have chosen the right template.

Form popularity

FAQ

The area of accounting that relates to providing audit, tax, and consulting services is often referred to as public accounting. Professionals in this field can utilize an Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping to formalize their advisory roles. Through these agreements, clients gain access to a range of expertise, ensuring they receive comprehensive support tailored to their unique financial situations.

Accounting firms engage in consulting to provide comprehensive support to their clients, addressing a wide range of financial challenges. By offering services like those outlined in the Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, firms can enhance their relationships with clients and deliver greater value. Consulting allows firms to leverage their expertise and guide clients towards effective decision-making, ultimately fostering long-term growth.

Advisory services in accounting involve offering strategic advice that helps clients improve their financial performance and compliance. With an Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, firms can assist clients in areas such as tax planning, financial management, and regulatory compliance. These services go beyond standard accounting tasks, aiming to provide actionable insights that drive business success.

The purpose of advisory services is to provide expert guidance to clients, helping them make informed decisions in various areas, including accounting and tax matters. With an Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, clients can benefit from tailored advice that addresses their specific needs. This agreement fosters clear communication and outlines the scope of services offered, ensuring clients understand the value being delivered.

Writing a consultant agreement involves several key steps, including identifying the service scope, establishing payment terms, and incorporating confidentiality clauses. It is crucial to create a clear document that aligns with the Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping framework, ensuring all details are explicit to avoid future disputes. You can find templates and guidance on platforms like uslegalforms to simplify this process.

Yes, government contracts for accounting services do exist and can be a vital source of work for consultants in the field. These contracts often require adherence to specific regulations and standards, which are designed to ensure accountability and transparency in financial reporting. Utilizing services like the Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can help navigate the complexities inherent in such contracts.

The contract for the provision of accounting services outlines the expectations and responsibilities of the accountant and the client. It typically specifies the types of accounting services provided, including tax preparation and financial advising. An effective Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping will detail these services to ensure all parties are aligned and prevent misunderstandings.

The contract for the provision of services is a binding agreement where one party agrees to provide specific services to another in exchange for compensation. This type of contract includes details such as the service scope, timelines, and payment terms, ensuring both parties fulfill their obligations. Including elements related to the Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can enhance clarity and protective measures.

A contract for the provision of accounting services is a legal document that formalizes the relationship between a client and an accountant or consulting firm. This contract outlines the specific accounting services to be delivered, expectations, and compensation. In the context of the Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, this contract ensures clarity on responsibilities and compliance with financial regulations.

A consultancy agreement typically includes sections detailing the parties involved, the duration of the agreement, the services provided, and payment arrangements. The Arkansas General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping should also specify deliverables and any necessary compliance with federal or state regulations. You can visualize this agreement as a structured document that protects both the consultant and the client.