Arkansas Corporate Asset Purchase Agreement refers to a legally binding contract that outlines the terms and conditions of a transfer of assets between two corporate entities in the state of Arkansas. This agreement governs the purchase and sale of a corporation's assets, ensuring a smooth and transparent transaction. The Arkansas Corporate Asset Purchase Agreement includes several key components. Firstly, it identifies the parties involved, i.e., the buyer and the seller. It details their legal names, addresses, and other relevant information. Additionally, it specifies the effective date of the agreement and any conditions precedent to the completion of the transaction. The agreement then lists and describes the assets being purchased, including but not limited to tangible assets (property, inventory, equipment) and intangible assets (intellectual property, trademarks, patents). It details the quantity, quality, and condition of each asset, as well as any encumbrances or liens that may exist. Another important aspect covered in the agreement is the purchase price and payment terms. This section outlines the total consideration to be paid by the buyer, whether in cash, stocks, or a combination of both. It may also include provisions for future or contingent payments, such as earn-outs or seller financing. The Arkansas Corporate Asset Purchase Agreement includes representations and warranties, wherein the seller assures the buyer of the accuracy and completeness of information provided about the assets and the corporation itself. These representations and warranties serve to protect the buyer from any undisclosed liabilities or defects associated with the assets. Furthermore, the agreement addresses the allocation of risk between the buyer and the seller. It outlines the indemnification provisions, detailing which party will be responsible for any claims, liabilities, losses, or damages arising from the transaction. It is worth noting that there may be different types of Arkansas Corporate Asset Purchase Agreements, depending on specific circumstances or industries. Examples include: 1. Technology Asset Purchase Agreement: This type of agreement focuses on the acquisition of technology-related assets, such as software, algorithms, or databases. 2. Real Estate Asset Purchase Agreement: Specifically tailored for the acquisition of real estate assets, this agreement may include additional clauses related to zoning, environmental assessments, or lease agreements. 3. Intellectual Property Asset Purchase Agreement: This agreement is designed for the transfer of intellectual property assets, such as copyrights, trademarks, or patents. In conclusion, an Arkansas Corporate Asset Purchase Agreement is a vital legal document in facilitating the sale and acquisition of assets between corporate entities. It ensures clarity, fairness, and protection for both the buyer and the seller involved in the transaction.

Arkansas Corporate Asset Purchase Agreement

Description

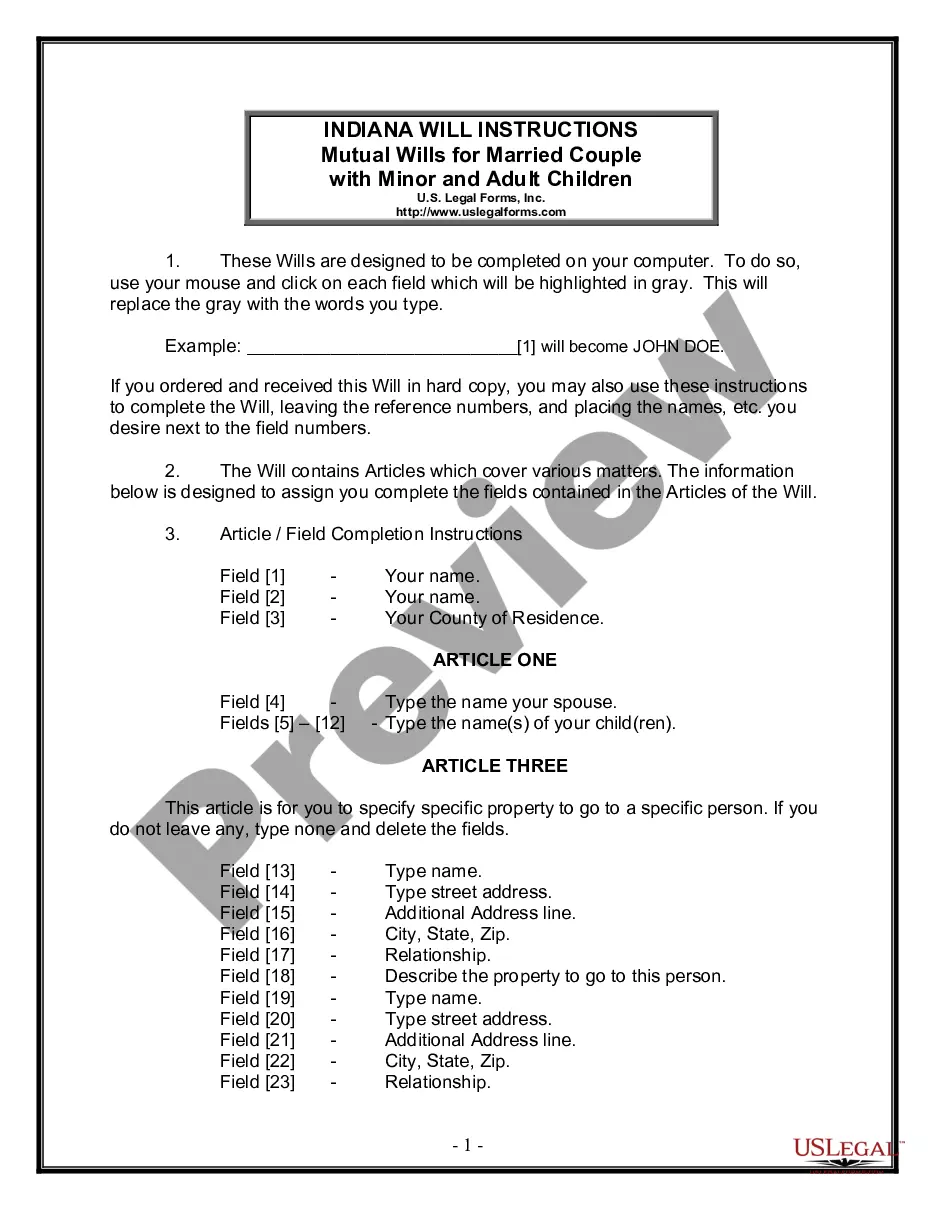

How to fill out Arkansas Corporate Asset Purchase Agreement?

You can devote several hours on-line looking for the authorized document web template which fits the federal and state specifications you need. US Legal Forms supplies a huge number of authorized kinds which can be examined by pros. It is possible to acquire or print the Arkansas Corporate Asset Purchase Agreement from my assistance.

If you have a US Legal Forms bank account, you can log in and click on the Down load button. Following that, you can comprehensive, modify, print, or sign the Arkansas Corporate Asset Purchase Agreement. Every authorized document web template you get is the one you have permanently. To acquire an additional version of the bought form, check out the My Forms tab and click on the related button.

If you are using the US Legal Forms internet site initially, keep to the straightforward directions beneath:

- Very first, make certain you have selected the right document web template for that region/area of your choice. Look at the form explanation to make sure you have selected the right form. If readily available, take advantage of the Preview button to look with the document web template too.

- If you would like discover an additional variation in the form, take advantage of the Search field to find the web template that suits you and specifications.

- Once you have located the web template you want, simply click Purchase now to proceed.

- Pick the costs program you want, enter your references, and sign up for an account on US Legal Forms.

- Full the purchase. You should use your Visa or Mastercard or PayPal bank account to pay for the authorized form.

- Pick the format in the document and acquire it to the device.

- Make adjustments to the document if necessary. You can comprehensive, modify and sign and print Arkansas Corporate Asset Purchase Agreement.

Down load and print a huge number of document web templates utilizing the US Legal Forms site, that offers the largest collection of authorized kinds. Use expert and status-distinct web templates to handle your business or individual requirements.

Form popularity

FAQ

What is a Definitive Agreement? A definitive agreement may be known by other names such as a purchase and sale agreement, a stock purchase agreement or an asset purchase agreement. Regardless of its name, it is the final agreement that spells out details agreed upon by buyer and seller.

Also known as a sales contract or a purchase contract, a purchase agreement is a legal document that establishes the parameters of the sale of goods between a buyer and a seller. Typically, they are used when the value is more than $500.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

An LLC Membership Purchase Agreement is a document used when a member of an LLC (a limited liability company) wishes to sell their interest, or a portion of their interest, to another party.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

A purchase and sale agreement, also known as a purchase and sale contract, P&S agreement, or PSA, is a legally-binding document that establishes the terms and conditions related to a real estate transaction. It defines what requirements the buyer must meet as well as purchase price, limitations, and contingencies.

More info

Legal Templates Legal contracts documents drafted regularly updated attorneys lice Legal Templates and Word Templates to Use for Personal Documents and Lease Agreements Free Business Deal Definition Business Deal Document Free Legal Notice for Residential Lease Free Legal Letter for Residential Property Exchange Free Notice Letter for Lease Sale Business Deal Definition Free Legal Notice for Residential Lease Legal Note for Residential Lease Free Legal Notice for Residential Property Exchange Legal Letter for Residential Property Exchange Notice Letter for Lease Sale Free Notice Letter for Lease Sale Legal Note for Lease Sale Notice Letter for Lease Sale Free Legal Letter for Lease Purchase Legal Notice for Residential Lease Legal Letter for Residential Property Exchange Legal Notice Letter for Residential Property Exchange Legal Notice Letter for Lease Purchase Legal Notice Letter for Lease Purchase Legal Note for Lease Purchase Legal Letter for Lease Purchase Notices for Lease Sales