Title: Arkansas Sample Letter for Debt Collection — Letter Offering Opportunity to Pay Debt Introduction: When it comes to debt collection in Arkansas, it is vital to follow the state's laws and guidelines to ensure a fair and legal process. Sending a detailed letter offering an opportunity to pay off a debt serves as an important communication tool between debt collectors and debtors. This article discusses a sample letter template that debt collectors can utilize to initiate an opportunity for debt repayment in Arkansas, while adhering to applicable laws and regulations. Keywords: Arkansas, debt collection, sample letter, opportunity to pay debt I. Basic Information: 1. Reference Number: Each debt collection letter should include a unique reference number for easy identification and tracking. 2. Date: Begin the letter with the current date, indicating when it was sent. II. Recipient Details: 1. Address: Mention the debtor's complete address, including street, city, state, and zip code. 2. Full Name: Use the debtor's full name as recorded in your records. III. Creditor's Information: 1. Company Name: Include the name of your company or organization. 2. Address: Provide the creditor's complete address for correspondence. IV. Debt Details: 1. Outstanding Amount: State the total amount owed by the debtor, including any interest or additional charges. 2. Debt Description: Briefly describe the nature of the debt and the reason it was incurred. 3. Original Creditor: Mention the name of the original creditor or service provider. 4. Account Number: Include the unique account number associated with the debt. V. Offer to Pay: 1. Payment Options: Present various methods of payment available to the debtor, such as online payments, check or money order, or over-the-phone transactions. 2. Payment Plan: Suggest the possibility of a payment plan, outlining the number of installments, frequency, and acceptable payment amounts. 3. Due Date: Specify a due date by which the debtor should make the payment or respond to the letter. VI. Contact Information: 1. Phone Number: Provide a reliable contact number for the debtor to reach out regarding any questions or concerns. 2. Email Address: Mention an email address dedicated to debt collection inquiries. 3. Office Hours: Mention the working hours during which the debtor can reach out for assistance. VII. Legal Disclaimer: 1. Debt Validation Rights: Include a statement informing the debtor about their right to request debt validation within a specific time frame. 2. Legal Consequences: Mention the potential legal consequences of non-payment or failure to respond to the letter. 3. Fair Debt Collection Practices Act: Include a brief summary of the debtor's rights under the federal Fair Debt Collection Practices Act (FD CPA) and the Arkansas Fair Debt Collection Practices Act. Types of Arkansas Sample Letters for Debt Collection: 1. Initial Debt Collection Notice: A letter sent to inform debtors about their outstanding debt and provide an opportunity to pay it off. 2. Follow-up Debt Collection Notice: A subsequent letter sent as a reminder to debtors who have failed to respond to the initial notice. 3. Payment Plan Proposal Letter: A letter offering debtors a structured payment plan to help them repay the debt over a specified period. 4. Final Notice of Debt Collection: A letter serving as a final warning, informing debtors about potential legal actions if payment or response is not received within a specific timeframe. Conclusion: When sending a debt collection letter in Arkansas, it is essential to provide debtors with clear and comprehensive information while ensuring compliance with state and federal laws. By offering an opportunity for debt repayment through a detailed letter, debt collectors establish better communication channels and increase their chances of successfully recovering the debt. Use the sample letter template provided in this article as a starting point to customize letters according to your specific circumstances and the debtor's situation.

Arkansas Sample Letter for Debt Collection - Letter Offering Opportunity to Pay Debt

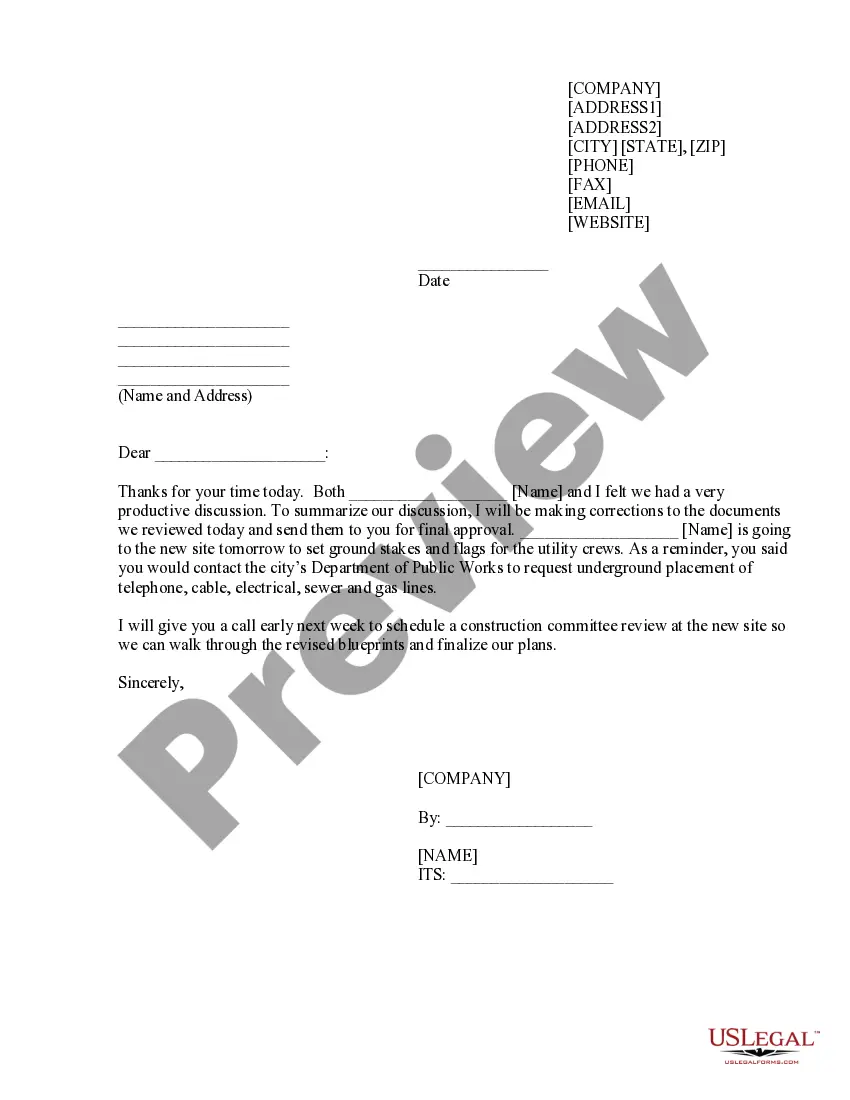

Description

How to fill out Arkansas Sample Letter For Debt Collection - Letter Offering Opportunity To Pay Debt?

Choosing the best legitimate record template can be a have a problem. Naturally, there are tons of templates accessible on the Internet, but how will you obtain the legitimate form you want? Use the US Legal Forms site. The assistance gives a large number of templates, such as the Arkansas Sample Letter for Debt Collection - Letter Offering Opportunity to Pay Debt, that you can use for organization and private requirements. All the varieties are examined by experts and fulfill state and federal specifications.

In case you are presently signed up, log in in your profile and click on the Acquire key to obtain the Arkansas Sample Letter for Debt Collection - Letter Offering Opportunity to Pay Debt. Use your profile to appear from the legitimate varieties you possess purchased in the past. Visit the My Forms tab of the profile and acquire an additional duplicate from the record you want.

In case you are a new end user of US Legal Forms, allow me to share simple guidelines so that you can follow:

- First, make sure you have chosen the right form for the town/region. You can look over the form utilizing the Review key and read the form outline to make certain it will be the best for you.

- In case the form is not going to fulfill your needs, utilize the Seach field to discover the proper form.

- Once you are certain that the form is acceptable, go through the Purchase now key to obtain the form.

- Choose the prices strategy you would like and enter the needed information and facts. Design your profile and pay money for the order with your PayPal profile or Visa or Mastercard.

- Choose the data file formatting and download the legitimate record template in your product.

- Total, revise and print out and signal the attained Arkansas Sample Letter for Debt Collection - Letter Offering Opportunity to Pay Debt.

US Legal Forms is the biggest catalogue of legitimate varieties that you can find numerous record templates. Use the service to download expertly-made papers that follow condition specifications.