A buy-sell agreement is a legally binding contract between shareholders of a closely held corporation that outlines the terms and conditions for the buying and selling of shares within the company. In Arkansas, specific laws and regulations govern these agreements to protect the rights and interests of all parties involved. The Arkansas Buy-Sell Agreement between Shareholders of Closely Held Corporation is designed to provide a fair and orderly process for the transfer of shares in the corporation, whether due to retirement, death, disability, or other triggering events. It ensures that the remaining shareholders have the opportunity to purchase the shares of the exiting shareholder before seeking outside buyers. Types of Arkansas Buy-Sell Agreements between Shareholders of Closely Held Corporation: 1. Cross-Purchase Agreement: This type of agreement allows the remaining shareholders to individually purchase the shares of the departing shareholder. Each shareholder has the option to buy a portion of the shares proportional to their ownership percentage in the company. This agreement is often chosen when there are only a few shareholders and simpler ownership structures. 2. Entity-Purchase Agreement: In this type of agreement, the corporation itself is responsible for purchasing the shares of the departing shareholder. The corporation becomes the buyer and effectively retires the shares, redistributing them among the remaining shareholders. This option is common when there are numerous shareholders or complex ownership structures in place. 3. Hybrid Agreement: A hybrid agreement combines elements of both cross-purchase and entity-purchase agreements. The choice of purchasing the departing shareholder's shares can be made by either the individual shareholders or the corporation, depending on specific circumstances or triggering events. Key elements typically included in an Arkansas Buy-Sell Agreement between Shareholders of Closely Held Corporation may include: — Shareholder Definitions: Clearly defining who is considered a shareholder and their respective ownership percentages to establish the parties involved in the agreement. — Triggering Events: Identifying events such as death, disability, retirement, divorce, bankruptcy, or voluntary departure that will activate the buy-sell provisions. — Valuation Method: Specifying how the value of the shares will be determined. Common methods include appraisals, book value, or using a pre-determined formula within the agreement to establish a fair market price. — Purchase Terms: Outlining the terms and conditions for the purchase, including payment structures, any financing arrangements, and potential rights of first refusal for existing shareholders. — Dispute Resolution: Establishing procedures to resolve any disputes that may arise during the buy-sell process, such as mediation or arbitration. — Governing Law: Specifying that the agreement is governed by the laws of Arkansas, ensuring compliance with state regulations. — Confidentiality: Including provisions to maintain confidentiality regarding the terms of the agreement and any financial details. It is essential for shareholders of a closely held corporation in Arkansas to carefully draft and execute a buy-sell agreement tailored to their specific needs and goals. Consulting with legal professionals familiar with state laws can ensure the agreement conforms to all legal requirements and provides the necessary protections for all parties involved.

Arkansas Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

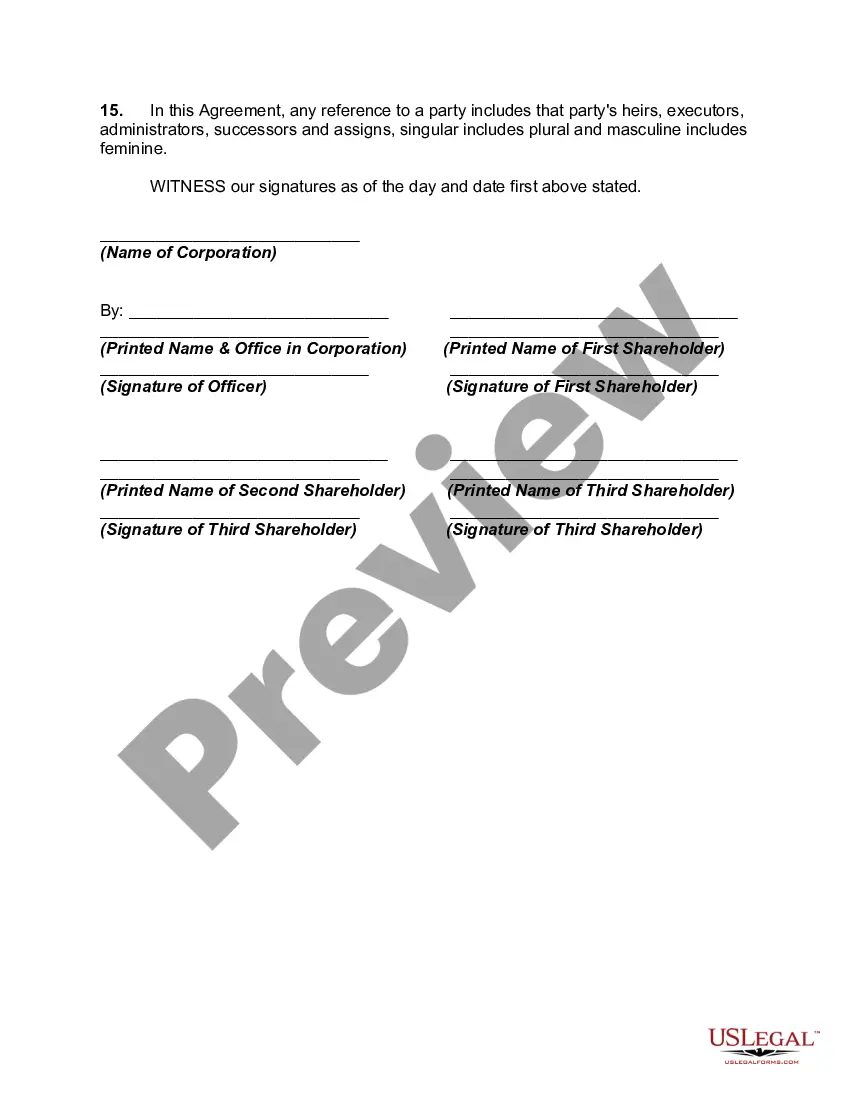

How to fill out Arkansas Buy-Sell Agreement Between Shareholders Of Closely Held Corporation?

Choosing the best legitimate document design could be a battle. Naturally, there are a lot of layouts accessible on the Internet, but how do you obtain the legitimate form you will need? Make use of the US Legal Forms website. The service delivers 1000s of layouts, like the Arkansas Buy-Sell Agreement between Shareholders of Closely Held Corporation, that can be used for enterprise and personal requires. All of the kinds are checked by pros and fulfill federal and state requirements.

Should you be already authorized, log in for your profile and click on the Acquire switch to find the Arkansas Buy-Sell Agreement between Shareholders of Closely Held Corporation. Make use of your profile to check from the legitimate kinds you might have purchased formerly. Go to the My Forms tab of your respective profile and have another backup of the document you will need.

Should you be a fresh customer of US Legal Forms, listed here are basic directions for you to follow:

- Very first, ensure you have selected the correct form for the town/area. You are able to examine the form utilizing the Preview switch and look at the form explanation to ensure this is basically the right one for you.

- If the form is not going to fulfill your preferences, make use of the Seach discipline to obtain the correct form.

- Once you are certain that the form is suitable, go through the Buy now switch to find the form.

- Pick the prices strategy you desire and enter in the essential information. Build your profile and pay for an order utilizing your PayPal profile or bank card.

- Opt for the submit formatting and obtain the legitimate document design for your product.

- Comprehensive, edit and print out and sign the obtained Arkansas Buy-Sell Agreement between Shareholders of Closely Held Corporation.

US Legal Forms is the most significant local library of legitimate kinds for which you will find various document layouts. Make use of the service to obtain skillfully-made documents that follow state requirements.