Arkansas Sample Letter for Dissolution of Corporation

Description

How to fill out Sample Letter For Dissolution Of Corporation?

You may commit time on the web searching for the legitimate document design that meets the federal and state requirements you will need. US Legal Forms offers 1000s of legitimate forms which can be reviewed by specialists. It is possible to download or printing the Arkansas Sample Letter for Dissolution of Corporation from your service.

If you already possess a US Legal Forms account, you are able to log in and then click the Obtain option. Afterward, you are able to full, edit, printing, or indicator the Arkansas Sample Letter for Dissolution of Corporation. Every legitimate document design you buy is your own eternally. To obtain yet another copy for any obtained kind, go to the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms site initially, stick to the easy recommendations below:

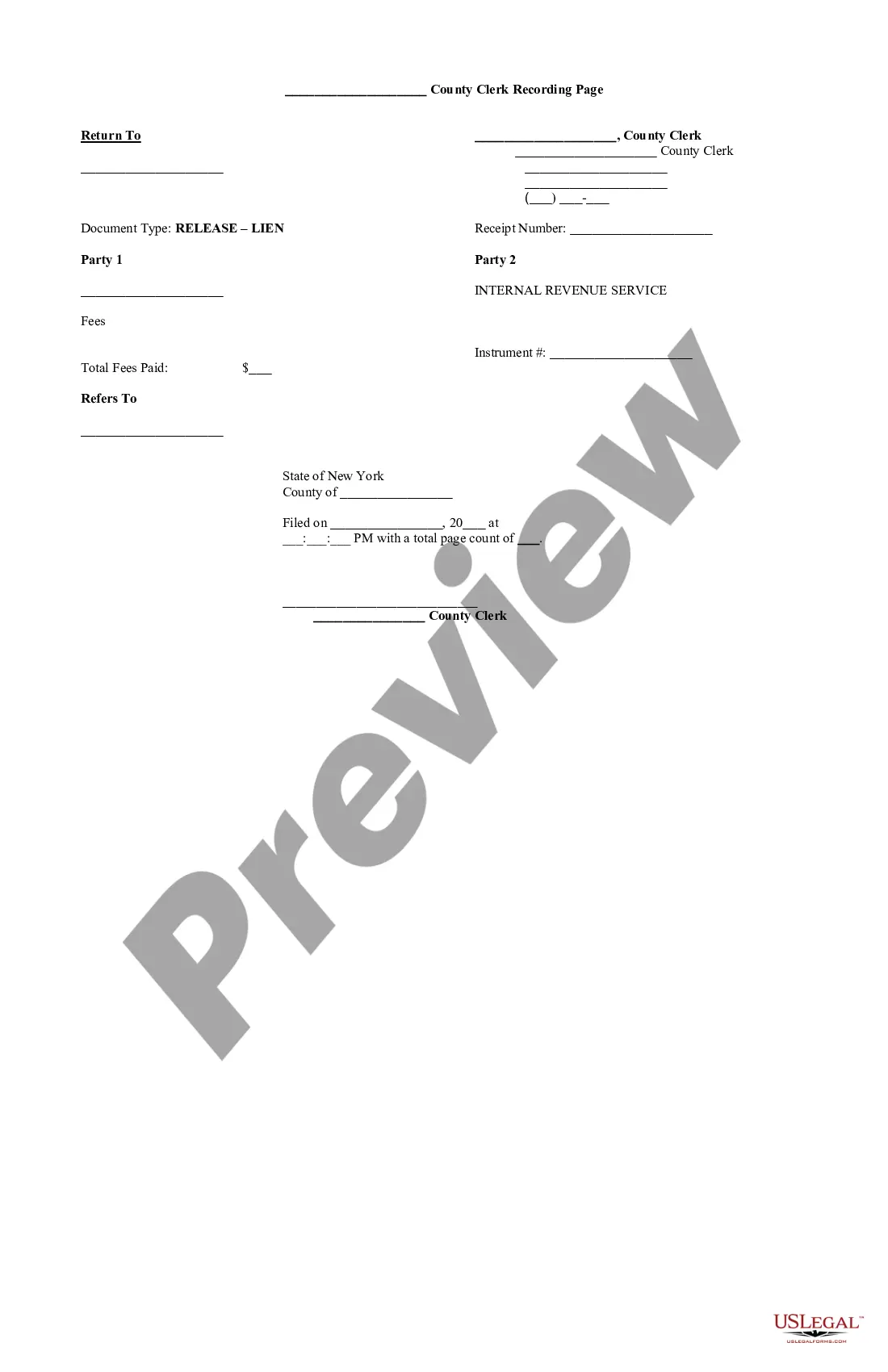

- Initially, be sure that you have selected the best document design for your state/town of your liking. Look at the kind outline to make sure you have picked out the appropriate kind. If readily available, take advantage of the Preview option to appear with the document design as well.

- If you would like get yet another variation from the kind, take advantage of the Look for discipline to discover the design that meets your requirements and requirements.

- Upon having found the design you desire, just click Purchase now to carry on.

- Find the prices prepare you desire, type your accreditations, and register for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your charge card or PayPal account to pay for the legitimate kind.

- Find the structure from the document and download it for your gadget.

- Make changes for your document if needed. You may full, edit and indicator and printing Arkansas Sample Letter for Dissolution of Corporation.

Obtain and printing 1000s of document layouts while using US Legal Forms Internet site, which provides the biggest selection of legitimate forms. Use skilled and condition-specific layouts to take on your small business or individual requires.