Arkansas Receiving Order, also known as an Arkansas RO, is a legal process initiated by a court to collect unpaid debts owed by a debtor to a creditor. This order authorizes the creditor to seize and sell the debtor's non-exempt property to satisfy the outstanding debt. The Arkansas Receiving Order is applicable to various types of debt, including credit card bills, personal loans, mortgages, medical bills, and other unsecured debts. This order is typically issued after a creditor has exhausted other collection efforts, such as sending payment reminders, issuing demand letters, or even attempting negotiations with the debtor. Once the Arkansas Receiving Order is granted, a sheriff or court-appointed receiver is assigned to oversee the enforcement process. The receiver takes possession of the debtor's non-exempt assets, including real estate, vehicles, electronics, jewelry, and other valuable possessions, with the intention to sell them to repay the debt. It is important to note that certain types of property are exempt from seizure under Arkansas law, such as a primary residence, certain personal items, and retirement accounts. There are no specific variations or types of Arkansas Receiving Orders as they are primarily governed by Arkansas state laws. However, the procedures and requirements for obtaining an Arkansas RO may slightly vary depending on the court where the case is filed. It is crucial for both creditors and debtors to consult with an attorney familiar with Arkansas debt collection laws to ensure compliance and protect their rights throughout the process. In summary, an Arkansas Receiving Order is a legal tool used by creditors in Arkansas to collect outstanding debts. It enables the creditor to seize and sell the debtor's non-exempt assets, with the intention to repay the debt. This process is initiated after other collection efforts have been exhausted, and it is crucial for both parties involved to seek legal advice to navigate the complexities of an Arkansas Receiving Order.

Arkansas Receiving Order

Description

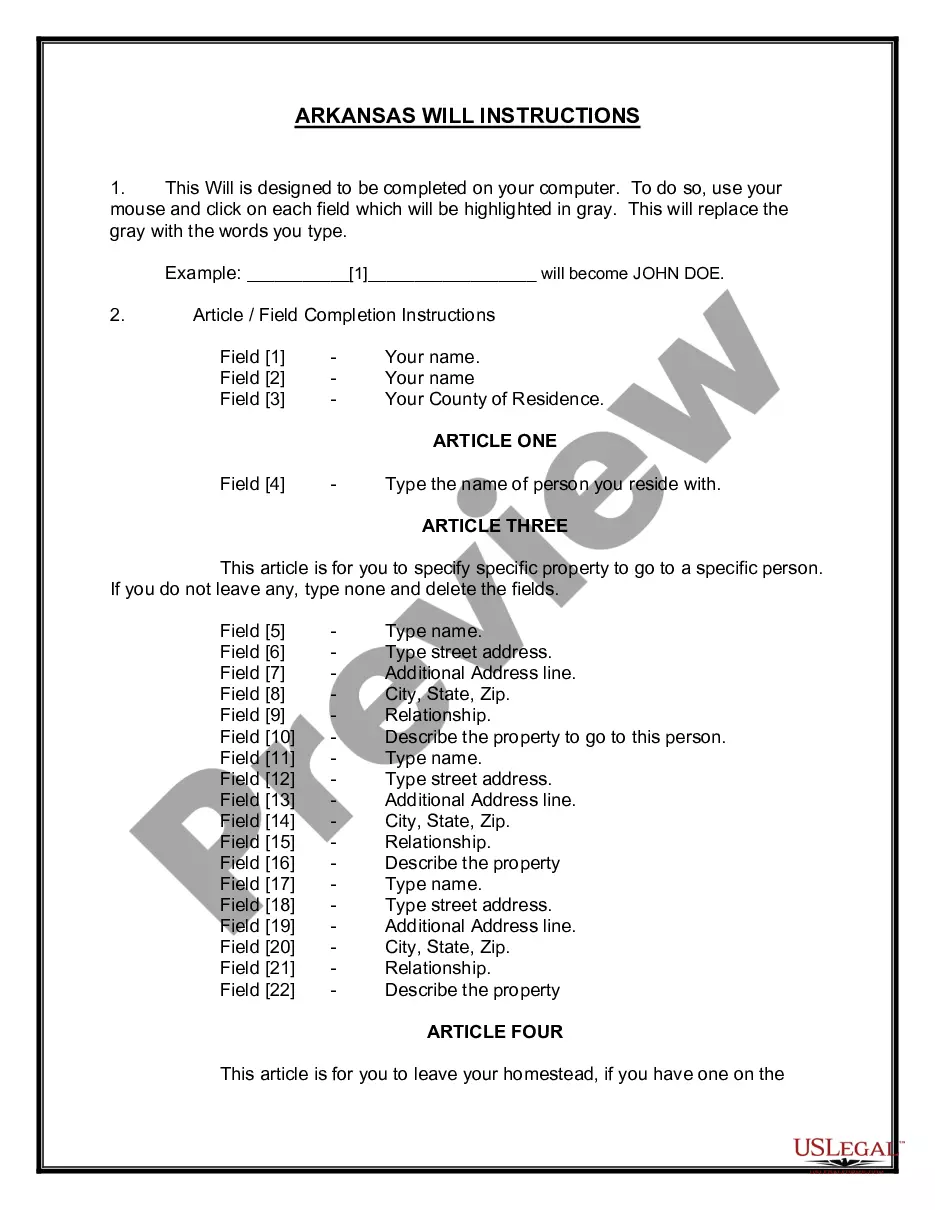

How to fill out Arkansas Receiving Order?

If you have to full, download, or produce lawful document themes, use US Legal Forms, the greatest collection of lawful forms, which can be found on-line. Take advantage of the site`s basic and practical lookup to obtain the paperwork you require. Numerous themes for business and specific reasons are sorted by categories and claims, or key phrases. Use US Legal Forms to obtain the Arkansas Receiving Order in a couple of mouse clicks.

In case you are previously a US Legal Forms consumer, log in to the account and click the Acquire button to get the Arkansas Receiving Order. You may also gain access to forms you formerly saved in the My Forms tab of your own account.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the form for that right metropolis/land.

- Step 2. Use the Review method to examine the form`s content. Never forget to learn the outline.

- Step 3. In case you are unhappy using the kind, make use of the Look for field on top of the screen to get other variations of your lawful kind design.

- Step 4. When you have located the form you require, click on the Acquire now button. Pick the rates prepare you favor and add your references to sign up to have an account.

- Step 5. Procedure the financial transaction. You should use your bank card or PayPal account to complete the financial transaction.

- Step 6. Choose the formatting of your lawful kind and download it on the system.

- Step 7. Comprehensive, revise and produce or signal the Arkansas Receiving Order.

Each lawful document design you purchase is your own forever. You might have acces to each kind you saved in your acccount. Select the My Forms section and select a kind to produce or download again.

Remain competitive and download, and produce the Arkansas Receiving Order with US Legal Forms. There are thousands of expert and status-specific forms you can utilize for your business or specific demands.

Form popularity

FAQ

Any person who violates any provision of the Order of Protection has committed a crime, specifically a Class A Misdemeanor, the punishment for which is up to a $1,000 fine and/or up to one (1) year in jail. The Judge issuing the Order can also punish for Contempt of Court.

A protection order aims at preventing the reoccurrence of domestic violence or sexual harassment by stating what conduct the alleged offender must refrain from doing. As long as he/she complies with the protection order, the complainant will be safe.

Violating an order can be a Class A misdemeanor, which carries a maximum penalty of one year in the county jail, a fine of up to $1,000, or both.

An order of protection: 2022 keeps the abuser away from you at your home, job, church, school, your child's school or daycare, or any. other address where you want protection. 2022 makes your abuser move out of the house if you are. living together.

To help prevent a person causing harm or annoyance to another person, a court can issue a protective order. They put different restrictions on a person depending on the severity of the case. The most common orders are non-molestation orders, occupation orders and restraining orders.

To file for an order of protection in Arkansas, go to the county courthouse in the county where you live, where the abuse took place, or where the abuser may be served (given paperwork related to the case). Find the civil clerk of court and ask for a petition for an order of protection.

The court may have regard to any evidence it may have heard during a criminal trial in determining whether a restraining order is required. However, further evidence may be required especially where the defendant has been acquitted (either after trial or following the offering of no evidence by the prosecution).

In order to get the judge to lift the No Contact Order you have to file a motion. That motion should have notarized statements from the victim and the defendant. The statement will most likely not be enough, and the judge will require the victim to appear before the court and request the No Contact Order be lifted.

(a) As used in this section, a "no contact order" is an order issued by a court to a defendant at or after arraignment on charges that prohibits the defendant from contacting directly or indirectly a person in any manner or from being within a certain distance of the person's home or place of employment.

If you believe the protection order was granted improperly or that it is no longer needed, you can file a motion asking the court to dissolve (terminate or cancel) the protection order. After you file the motion, the court will decide whether or not to schedule a hearing.