Arkansas Sample Letter for Collection - Referral of Account to Collection Agency

Description

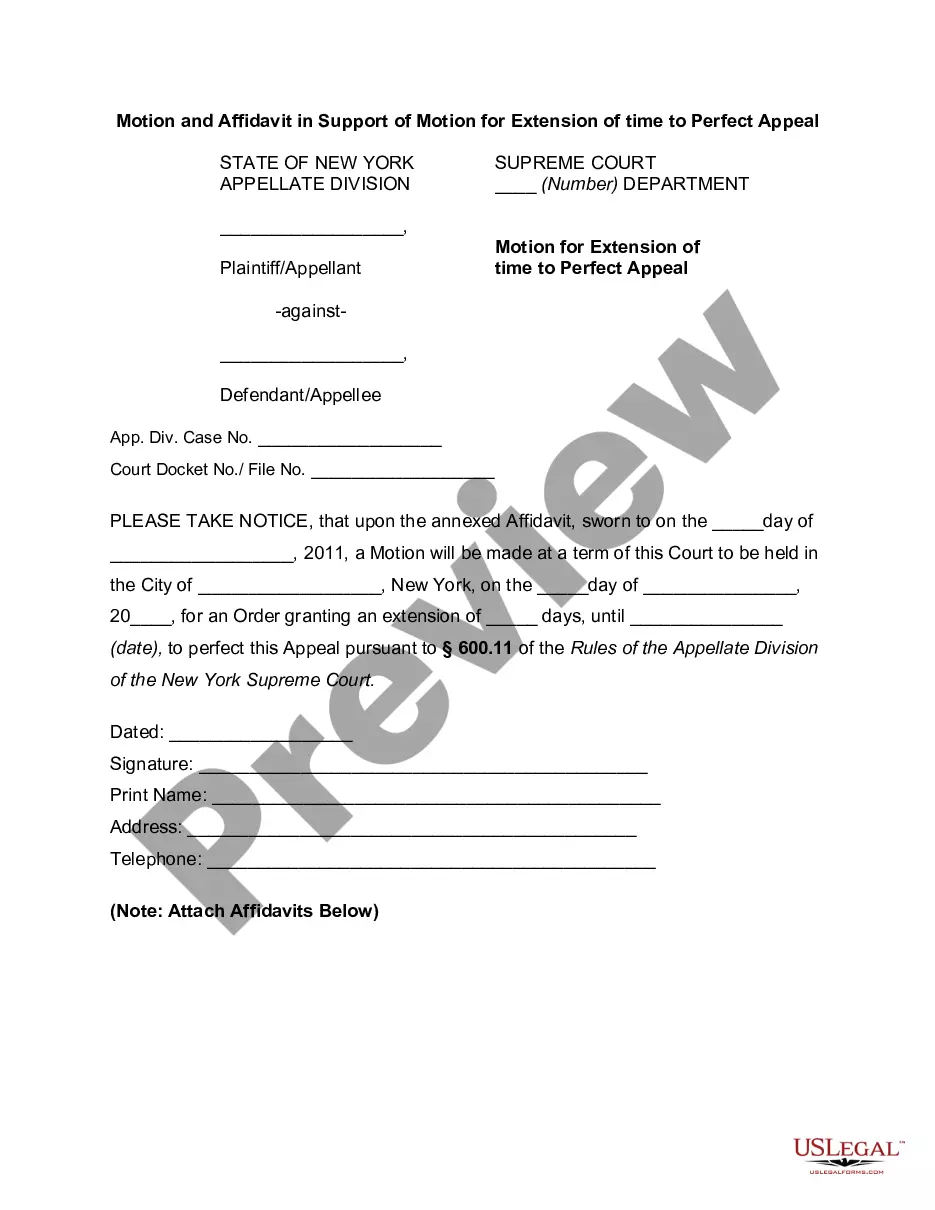

How to fill out Sample Letter For Collection - Referral Of Account To Collection Agency?

If you wish to be thorough, obtain, or print valid document templates, utilize US Legal Forms, the principal repository of valid forms, accessible online.

Utilize the site’s easy and convenient search to locate the documents required.

Various templates for business and personal purposes are categorized by types and titles, or keywords.

Step 4. After locating the form you need, click the Buy now button. Select the pricing plan you prefer and enter your information to create an account.

Step 5. Process the transaction. You can use your Мisa or Ьank card, or PayPal account to complete the purchase.

- Employ US Legal Forms to find the Arkansas Sample Letter for Collection - Referral of Account to Collection Agency in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to procure the Arkansas Sample Letter for Collection - Referral of Account to Collection Agency.

- You can also access forms you previously acquired within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Review option to examine the form's details. Do not forget to read through the description.

- Step 3. If you are unhappy with the form, use the Search field at the top of the screen to find other forms in the legal format.

Form popularity

FAQ

A collection letter should include the amount owed, the contact information of both the debtor and creditor, and specific instructions on how to make payments or dispute the debt. It is equally important to explain the consequences of ignoring the letter. By referencing the Arkansas Sample Letter for Collection - Referral of Account to Collection Agency, you can incorporate these essential elements effectively.

A properly written collection letter must clearly state the amount owed and include the creditor's contact information. Furthermore, it should notify the debtor of their rights regarding the debt, such as their ability to dispute the amount. Crafting such a letter can be efficiently done using the Arkansas Sample Letter for Collection - Referral of Account to Collection Agency template, ensuring compliance and clarity.

A referral to a collections agency occurs when a creditor decides to hand over a delinquent account to a third-party agency for collection efforts. This process aims to recover the debt after initial attempts have failed. Through this referral, the collection agency utilizes its resources and expertise, making the Arkansas Sample Letter for Collection - Referral of Account to Collection Agency a useful tool for notification.

A collection letter should be clear, professional, and direct to convey the seriousness of the debt. It needs to outline the details of the owed amount, any pertinent deadlines, and the next steps the debtor can take. By following an Arkansas Sample Letter for Collection - Referral of Account to Collection Agency, you can ensure that your letter is effective and legally compliant.

A debt collector's written notice must include key information to inform the debtor about their situation. Specifically, it should state the amount owed, the name of the creditor, and the rights of the debtor. Additionally, it must provide instructions on how to respond or dispute the debt. The Arkansas Sample Letter for Collection - Referral of Account to Collection Agency can serve as a helpful template for creating this notice.

When you are referred to debt collection, the agency will begin attempts to recover the unpaid debt on behalf of the creditor. This may involve phone calls, letters, and potentially even legal action if the debt remains unpaid. Understanding this process can be easier with resources like the Arkansas Sample Letter for Collection - Referral of Account to Collection Agency, which can guide you on how to communicate effectively with the agency or contest the debt if needed.

A debt collection letter must include specific language that communicates the nature of the debt, the amount owed, and the rights of the debtor. It typically includes statements about the consequences of non-payment and how the debt can be resolved. For a polished example, look at the Arkansas Sample Letter for Collection - Referral of Account to Collection Agency, which highlights the essential elements to include while maintaining clarity and professionalism.

When an account is referred to collections, it means that the creditor has handed over the responsibility of collecting the debt to a specialized agency. This process often signifies that the account has been overdue for a significant period. By utilizing an Arkansas Sample Letter for Collection - Referral of Account to Collection Agency, you can better understand the terms and conditions that pertain to this situation and respond accordingly.

The best sample for a debt validation letter should clearly request proof of the debt, including details like the amount owed and the original creditor's information. It's essential to maintain a professional tone while also being assertive in your request. You can refer to our Arkansas Sample Letter for Collection - Referral of Account to Collection Agency for guidance on structuring your letter effectively and ensuring you receive the necessary validation.

A referral to a collection agency occurs when a creditor decides to send your unpaid account to a third-party agency for collection. This step usually happens after several unsuccessful attempts to collect the debt directly. Utilizing an Arkansas Sample Letter for Collection - Referral of Account to Collection Agency can help ensure that all the necessary information is included and professional in tone, making the transition smoother.