Arkansas Notice of Default on Promissory Note Installment is a legal document utilized in Arkansas when a borrower fails to make timely payments towards a promissory note installment. This notice serves as a formal notification to the borrower that they are in default and must take immediate action to fulfill their payment obligations. Keywords: Arkansas, Notice of Default, Promissory Note, Installment, borrower, payments, default, legal, notification, obligations. In Arkansas, there are two types of Notice of Default on Promissory Note Installment that may be issued: 1. Preliminary Notice of Default: This type of notice is generally the initial step in the collection process. It is sent to the borrower after they miss a payment deadline. The preliminary notice of default informs the borrower about their delinquency and advises them to rectify the situation promptly in order to avoid further legal actions. Keywords: Preliminary Notice of Default, collection process, delinquency, legal actions. 2. Formal Notice of Default: If the borrower fails to address their delinquency after receiving the preliminary notice, a formal notice of default is issued. This notice is more severe and indicates that the lender is prepared to take legal action against the borrower to recover the remaining balance on the promissory note. It typically includes a specific date by which the borrower must bring their payments up to date to avoid further consequences. Keywords: Formal Notice of Default, legal action, remaining balance, consequences. Arkansas Notice of Default on Promissory Note Installment serves as an essential legal instrument to protect the rights of lenders and ensure borrowers fulfill their financial responsibilities. It is crucial for lenders to adhere to the proper legal procedures and timelines when issuing such notices to avoid any complications during the collection process.

Arkansas Notice of Default on Promissory Note Installment

Description

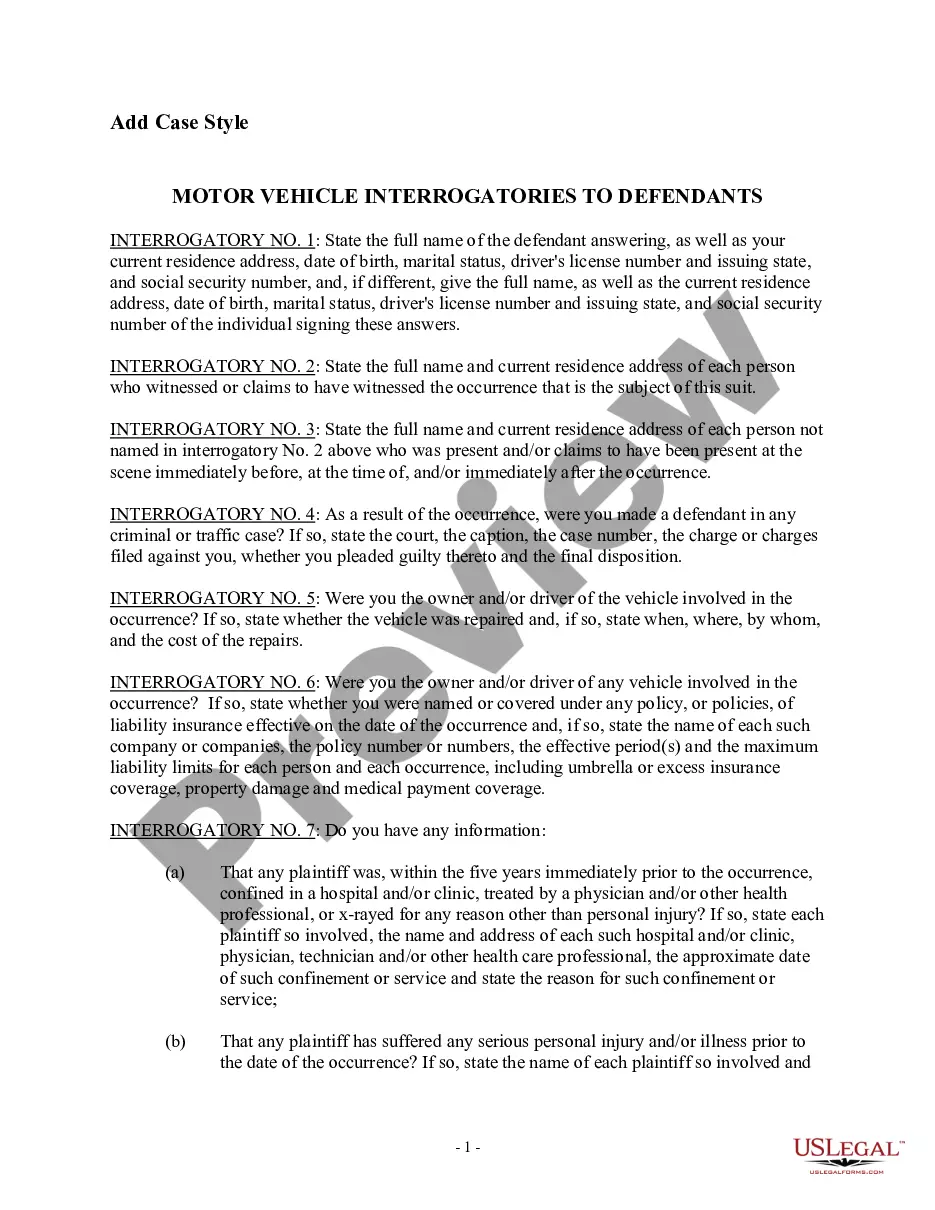

How to fill out Arkansas Notice Of Default On Promissory Note Installment?

If you need to comprehensive, download, or print out lawful file templates, use US Legal Forms, the largest variety of lawful types, that can be found on the Internet. Take advantage of the site`s simple and easy hassle-free lookup to find the paperwork you want. Different templates for company and person reasons are sorted by types and says, or keywords. Use US Legal Forms to find the Arkansas Notice of Default on Promissory Note Installment with a couple of clicks.

Should you be presently a US Legal Forms buyer, log in to the bank account and click the Download switch to have the Arkansas Notice of Default on Promissory Note Installment. You may also accessibility types you previously saved inside the My Forms tab of your respective bank account.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for your correct town/land.

- Step 2. Utilize the Review choice to look over the form`s content material. Don`t forget about to read through the description.

- Step 3. Should you be unhappy using the kind, take advantage of the Research industry near the top of the display to locate other variations of the lawful kind template.

- Step 4. Once you have found the shape you want, select the Get now switch. Pick the costs strategy you like and add your references to register on an bank account.

- Step 5. Process the financial transaction. You should use your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Choose the formatting of the lawful kind and download it in your gadget.

- Step 7. Full, change and print out or sign the Arkansas Notice of Default on Promissory Note Installment.

Each lawful file template you buy is yours permanently. You possess acces to each and every kind you saved inside your acccount. Select the My Forms area and pick a kind to print out or download once more.

Contend and download, and print out the Arkansas Notice of Default on Promissory Note Installment with US Legal Forms. There are thousands of specialist and express-certain types you can use for your personal company or person demands.

Form popularity

FAQ

Prepayment. Maker may prepay all or any part of the principal balance of this Promissory Note at any time without premium or penalty. Amounts prepaid may not be reborrowed.

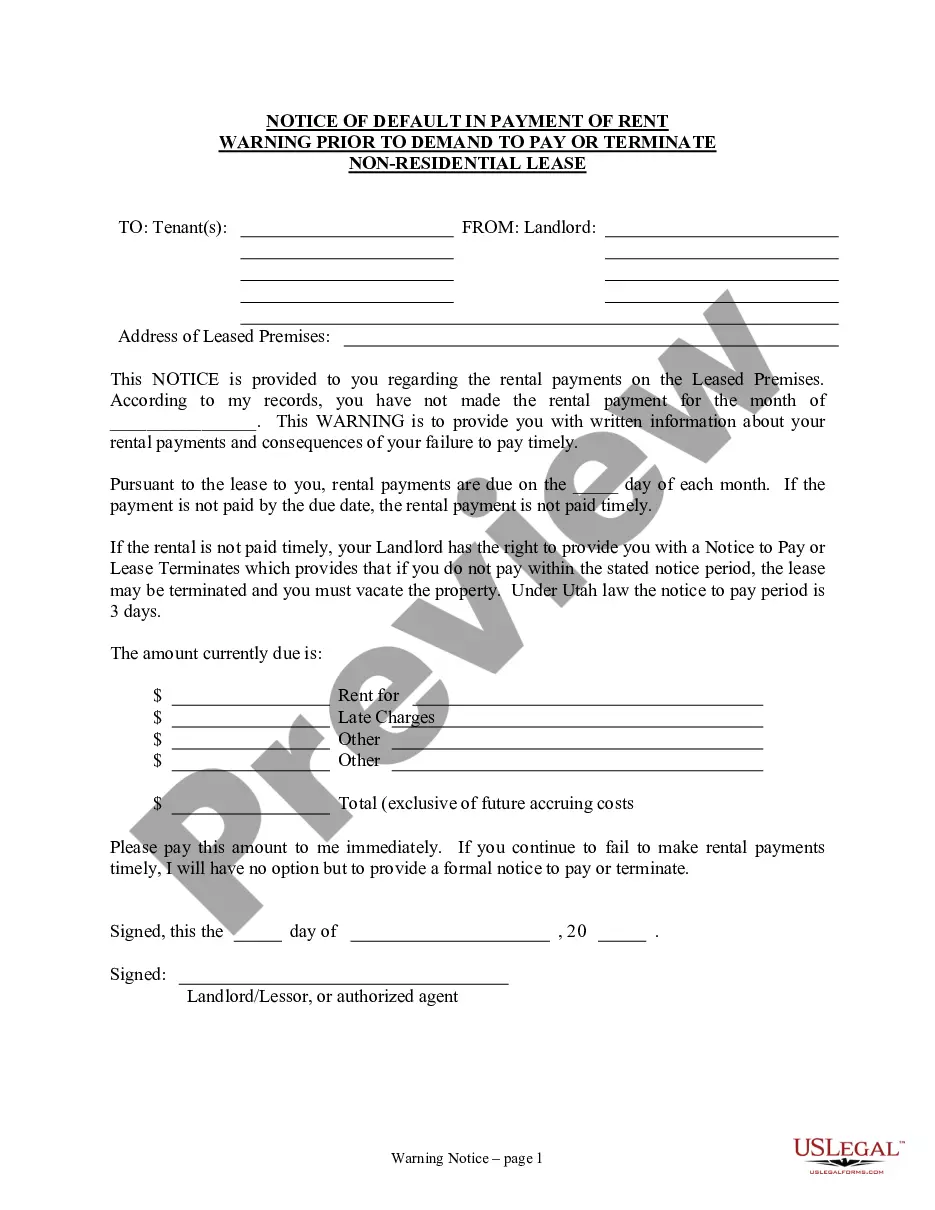

A default on a loan happens when the borrower fails to make the scheduled payments in full. Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note. The promissory note itself should set out what constitutes default, so that both the lender and the borrower are clear on the terms.