Arkansas Letter to Confirm Accounts Receivable is a formal document used by businesses in Arkansas to verify and confirm the outstanding accounts receivable owed to them by their clients or customers. This letter serves as a vital tool for maintaining accurate financial records and ensuring the smooth functioning of business operations. The primary purpose of an Arkansas Letter to Confirm Accounts Receivable is to obtain written confirmation from the customer or client regarding the accuracy and validity of the outstanding invoices. By sending this letter, businesses seek reassurance that the accounts receivable balance mentioned in their financial books matches the customer's records. Key elements included in an Arkansas Letter to Confirm Accounts Receivable may encompass the following: 1. Sender's Information: The letter typically begins with the sender's (business) name, address, and contact details, ensuring clarity and easy identification. 2. Recipient's Information: The letter addresses the customer or client whose accounts receivable balance needs confirmation, stating their name, address, and other relevant contact details. 3. Reference to Invoices: The letter will explicitly reference the outstanding invoices that need validation. This often includes the invoice numbers, dates, and amounts owed. 4. Terms and Conditions: Clarifying the terms and conditions of the agreement is essential. These may include payment due dates, credit limits, interest rates, and penalties for late payments. 5. Request for Confirmation: The central component of the letter is the request for confirmation from the customer to validate the accuracy of the accounts receivable balance. The recipient is usually asked to sign and return the letter within a specified time frame. 6. Contact Information: The letter provides contact details, such as telephone numbers and email addresses, in case the customer needs clarification or has any questions. Types of Arkansas Letters to Confirm Accounts Receivable: a. Initial Confirmation: This type of letter is sent for the first-time confirmation of outstanding accounts receivable. It is typically used to establish a baseline and reconcile the customer's records with those of the business. b. Regular Confirmation: Businesses often send periodic confirmation letters to ensure up-to-date and accurate accounts receivable information. These letters are recurrently sent at predetermined intervals, such as quarterly or annually, to maintain financial accuracy. c. Delinquent Confirmation: When an account becomes delinquent, an Arkansas Letter to Confirm Accounts Receivable can be sent to remind customers of outstanding invoices and request confirmation regarding the outstanding balances. This type of letter may also outline consequences for non-compliance or late payments. d. Final Confirmation: In certain cases, businesses may send a final confirmation letter when terminating their association with a customer or client. This letter serves to verify and settle all outstanding balances before closing the account. In summary, an Arkansas Letter to Confirm Accounts Receivable is a crucial document that allows businesses in Arkansas to maintain accurate financial records and verify outstanding balances owed to them. It helps establish transparency and trust with customers or clients, ensuring the smooth flow of accounts receivable operations.

Arkansas Letter to Confirm Accounts Receivable

Description

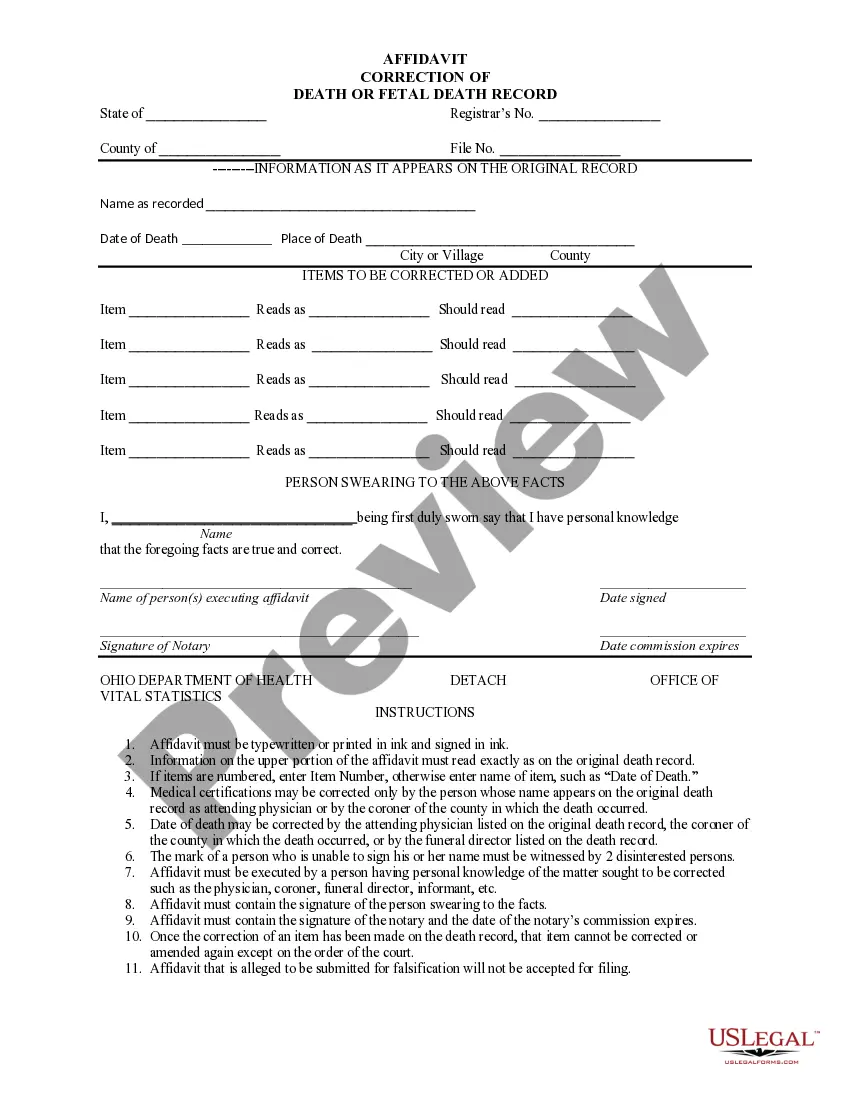

How to fill out Arkansas Letter To Confirm Accounts Receivable?

Are you in a situation where you will need papers for either company or person functions nearly every day time? There are tons of lawful record web templates available on the Internet, but getting versions you can depend on isn`t straightforward. US Legal Forms offers 1000s of kind web templates, like the Arkansas Letter to Confirm Accounts Receivable, which are composed to satisfy state and federal demands.

When you are previously knowledgeable about US Legal Forms site and have a merchant account, just log in. Next, you can obtain the Arkansas Letter to Confirm Accounts Receivable web template.

Unless you have an profile and need to begin to use US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is for that right metropolis/county.

- Use the Review button to analyze the form.

- Browse the information to ensure that you have chosen the correct kind.

- In case the kind isn`t what you`re searching for, make use of the Lookup industry to discover the kind that suits you and demands.

- Once you discover the right kind, just click Acquire now.

- Opt for the prices strategy you need, fill out the necessary information and facts to make your money, and buy an order utilizing your PayPal or bank card.

- Pick a hassle-free document file format and obtain your version.

Locate all of the record web templates you possess purchased in the My Forms food selection. You can aquire a more version of Arkansas Letter to Confirm Accounts Receivable anytime, if required. Just select the essential kind to obtain or produce the record web template.

Use US Legal Forms, by far the most substantial assortment of lawful kinds, to save some time and stay away from errors. The assistance offers appropriately created lawful record web templates that can be used for an array of functions. Produce a merchant account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

The auditor does so with an accounts receivable confirmation. This is a letter signed by a company officer (but mailed by the auditor) to customers selected by the auditors from the company's accounts receivable aging report.

Investigate reconciling items. Test invoices listed in receivable report. Match invoices to shipping log. Confirm accounts receivable.

To test the existence and rights assertions of accounts receivable, auditors will send confirmation requests to the company's customers. These requests typically ask the customer to confirm that it owes the amount of the receivable to the company being audited.

RECEIVABLE CONFIRMATIONS ARE NOT ALWAYS required if accounts receivable are immaterial, the use of confirmations would be ineffective or combined inherent risk and control risk are low and analytics or other substantive tests would detect misstatements.

Is the confirmation of cash and accounts receivable required according to auditing standards? Yes, usually required by auditing standards but auditors can choose not to in certain situations. It then becomes the auditors responsibility to gather evidence which can take much more time.

Balance Confirmation Letter FormatFind out to whom you are writing or addressing the letter.Format the letter (Grammar and spelling check)Salutation/Greetings.Introduce yourself.Write the body of the letter.Close the letter with gratitude.Your's sincerely/faithfully.

7 Tips to Improve Your Accounts Receivable CollectionCreate an A/R Aging Report and Calculate Your ART.Be Proactive in Your Invoicing and Collections Effort.Move Fast on Past-Due Receivables.Consider Offering an Early Payment Discount.Consider Offering a Payment Plan.Diversify Your Client Base.More items...?

What is an Accounts Receivable Confirmation? When an auditor is examining the accounting records of a client company, a primary technique for verifying the existence of accounts receivable is to confirm them with the company's customers. The auditor does so with an accounts receivable confirmation.

Normally, account payable confirmation is used to verify the accuracy and existence of account payable at the end of the accounting period that claims to be existing by the client.

To confirm accounts receivable, you need to reconcile the accounts receivable subsidiary ledger to all the customers that owe the company money to the total amount shown on the balance sheet.