This form is a type of asset-financing arrangement in which a company uses its receivables (money owed by customers) as collateral in a financing agreement. The company receives an amount that is equal to a reduced value of the receivables pledged. The age of the receivables have a large effect on the amount a company will receive. The older the receivables, the less the company can expect.

This type of financing helps companies free up capital that is stuck in accounts receivables. Accounts receivable financing transfers the default risk associated with the accounts receivables to the financing company. This transfer of risk can help the company using the financing to shift focus from trying to collect receivables to current business activities.

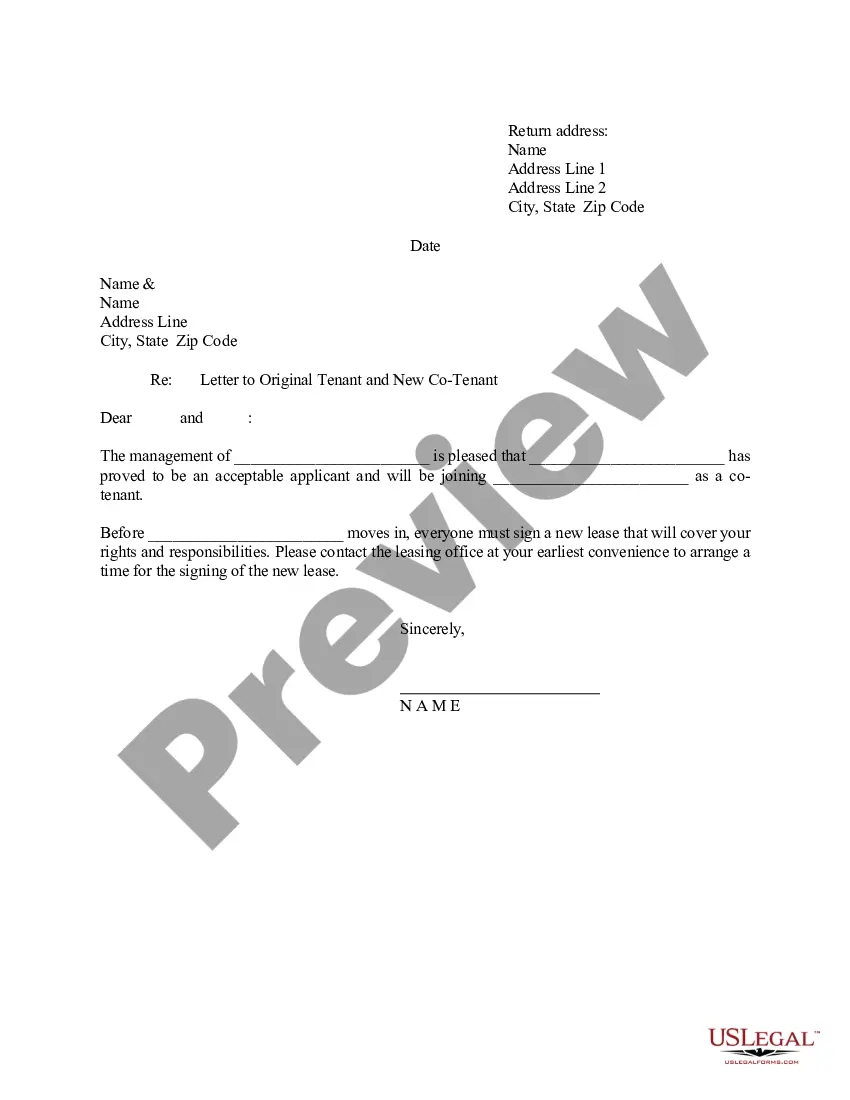

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

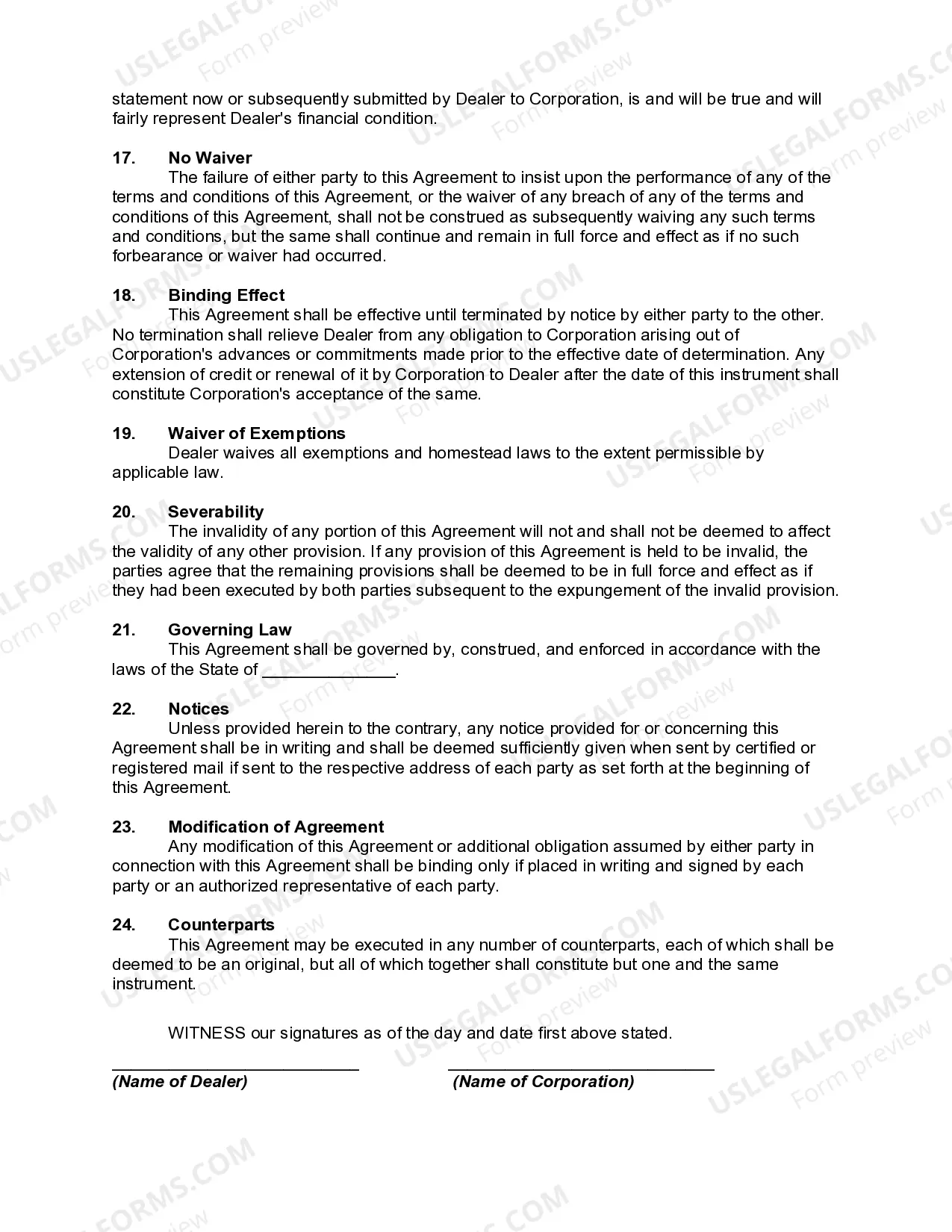

An Arkansas Financing Agreement between a dealer and a credit corporation for wholesale financing with a security interest in accounts and general intangibles is a legal document that outlines the terms and conditions of a financial arrangement between a dealer and a credit corporation in Arkansas. This agreement enables the dealer to obtain wholesale financing from the credit corporation to support their business operations. The purpose of this agreement is to establish a mutually beneficial relationship where the credit corporation provides funds to the dealer to purchase inventory, manage cash flow, and meet other financial obligations. In return, the dealer grants a security interest in their accounts and general intangibles to secure the repayment of the financing. The key terms and provisions of this financing agreement may vary depending on the specific requirements of the dealer and the credit corporation. However, they typically cover important elements such as: 1. Parties involved: The agreement identifies the dealer and the credit corporation as the parties entering into the financing arrangement. It also includes their contact information and legal details. 2. Financing terms: This section outlines the terms related to the wholesale financing, including the maximum amount of funds available, the interest rate charged, repayment schedule, and any fees or penalties associated with late payment or defaults. 3. Security interest: The agreement specifies that the dealer grants a security interest in their accounts and general intangibles as collateral for the financing. This ensures that the credit corporation has a legal claim over these assets in case of default. 4. Representation and warranties: Both the dealer and the credit corporation provide representations and warranties regarding their legal status, authority to enter into the agreement, and the accuracy of the information provided. 5. Default and remedies: This section explains the actions that can be taken by the credit corporation in case of default by the dealer. It may include the right to accelerate the payment, repossess the collateral, or initiate legal proceedings to recover the outstanding amounts. 6. Governing law: The agreement specifies that it is governed by the laws of the state of Arkansas, ensuring that any disputes or legal issues are resolved in accordance with the state's jurisdiction. It should be noted that there may be different types or variations of financing agreements between dealers and credit corporations in Arkansas. Some of these may include variations in terms of the duration of the agreement, the scope of the security interest, the inclusion of additional collateral, or specific provisions tailored to the unique needs of the parties involved. Overall, an Arkansas Financing Agreement between a dealer and a credit corporation for wholesale financing with a security interest in accounts and general intangibles is a vital legal document that protects the interests of both parties involved. By clearly outlining the terms and conditions of the financial arrangement, it promotes transparency, facilitates smooth operations, and ensures the repayment of funds in accordance with the agreed-upon terms.