Arkansas Partnership Dissolution Agreement

Description

How to fill out Partnership Dissolution Agreement?

Are you currently in a position where you require paperwork for occasional business or personal purposes regularly.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

US Legal Forms offers a vast array of form templates, such as the Arkansas Partnership Dissolution Agreement, designed to comply with state and federal regulations.

Once you find the right form, just click Purchase now.

Select the pricing plan you want, provide the necessary information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Arkansas Partnership Dissolution Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

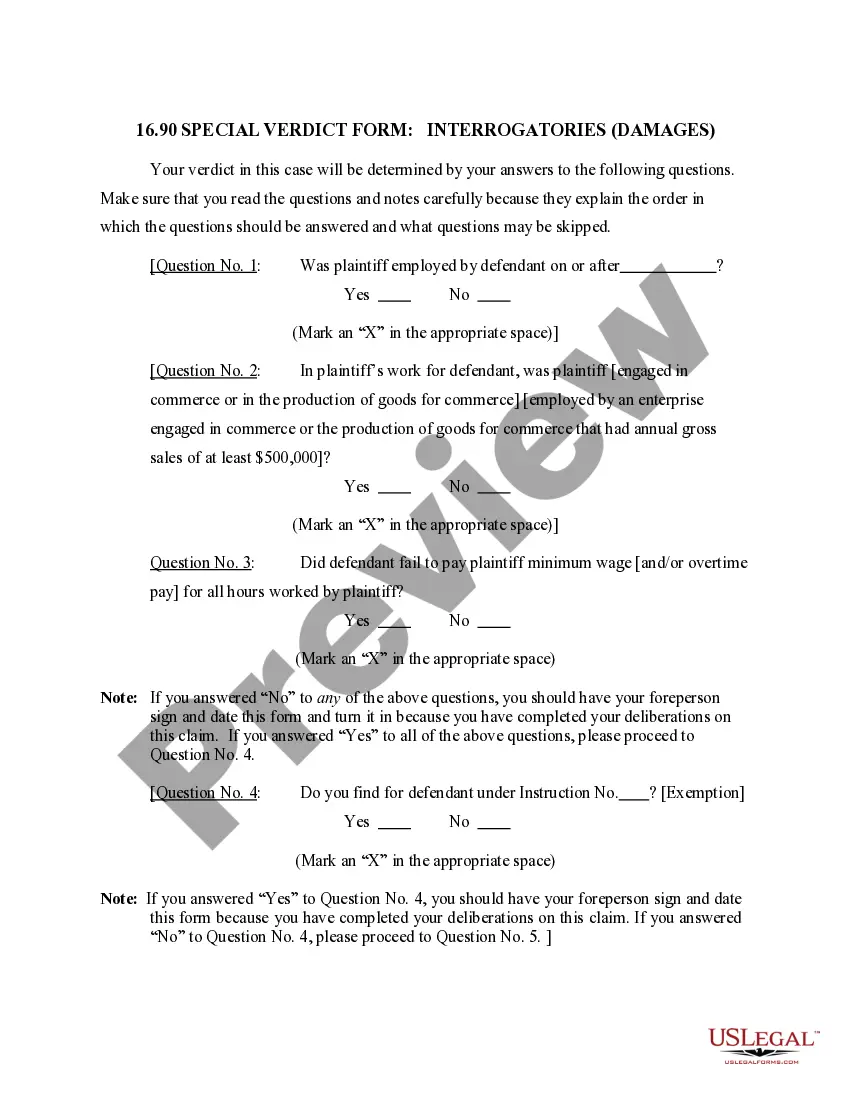

- Use the Preview button to review the form.

- Check the details to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Search area to find the document that suits your needs and requirements.

Form popularity

FAQ

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

It may also refer to the business' various business activities ceasing. There are a number of reasons why a partnership can dissolve. When a partnership dissolves, the partners receive an equal share in terms of profits and gains; however, they also receive an equal distribution of losses as well.

In the dissolution process, any partner may dissolve the partnership at any time by providing a notice of dissolution. The partnership is then required to wind up its business activities and distribute its assets.

Take a Vote or Action to Dissolve In most cases, dissolution provisions in a partnership agreement will state that all or a majority of partners must consent before the partnership can dissolve. In such cases, you should have all partners vote on a resolution to dissolve the partnership.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

It is common for general partnerships to dissolve if any partner withdraws, dies, or becomes otherwise unable to continue their duties as a business partner.

To dissolve your Arkansas LLC, you submit the completed form Articles of Dissolution for Limited Liability Company to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file articles of dissolution online. Make checks payable to Arkansas Secretary of State.

There is no filing fee. Under California law, other people generally are considered to have notice of the partnership's dissolution ninety (90) days after filing the Statement of Dissolution.

To close their business account, partnerships need to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.