Arkansas Business Deductions Checklist is a comprehensive tool designed to assist business owners and entrepreneurs in identifying and maximizing their tax deductions in the state of Arkansas. By utilizing this checklist, businesses can ensure they are taking advantage of all available deductions, ultimately reducing their overall tax liability and increasing their bottom line. This versatile checklist covers a wide range of key deductions that businesses operating in Arkansas may be eligible for. It includes both common deductions and those specific to Arkansas tax laws, ensuring all potential tax savings are considered. By adhering to this checklist, businesses can ensure they are in compliance with the state's tax regulations while maximizing their deductions. Some prominent deductions covered in the Arkansas Business Deductions Checklist include: 1. Startup Costs: This section outlines the deduction opportunities available for qualifying startup expenses. It covers costs like market research, advertising, legal fees, and other expenses involved in setting up the business. 2. Employee Expenses: This section emphasizes deductions related to employee compensation and benefits, including wages, salaries, bonuses, and benefits such as health insurance and retirement plans. 3. Rent and Lease Expenses: This category covers deductions associated with renting or leasing business properties, including office spaces, storefronts, warehouses, and equipment rentals. 4. Travel and Entertainment Expenses: This portion outlines the deductions available for business-related travel expenses, including transportation, lodging, meals, and entertainment costs incurred during business trips. 5. Business Equipment: This section focuses on deductions related to the purchase and depreciation of business equipment and machinery used in daily operations. 6. Home Office Deductions: This category caters to businesses that operate from a home office and provides a breakdown of deductions for home office expenses like utilities, mortgage interest, and maintenance costs. 7. Advertising and Marketing Expenses: This section highlights deductions for various advertising and marketing expenses, such as website development, online advertising, print media, and promotional materials. 8. State Taxes and Licenses: This part includes deductions associated with state taxes, licenses, permits, and registration fees required for operating a business in Arkansas. 9. Professional Services: This category covers deductions for fees paid to professionals such as accountants, lawyers, consultants, marketing agencies, and other professional services necessary for business operations. By utilizing the Arkansas Business Deductions Checklist, businesses can ensure they are utilizing all eligible deductions, minimizing tax liabilities, and maximizing their financial success. It is important to note that specific types of businesses, such as corporations, partnerships, and sole proprietorship, may have unique deductions tailored to their specific structure and industry.

Arkansas Business Deductions Checklist

Description

How to fill out Arkansas Business Deductions Checklist?

If you need to comprehensive, download, or print out authorized file templates, use US Legal Forms, the most important variety of authorized kinds, which can be found online. Take advantage of the site`s easy and handy look for to find the paperwork you need. A variety of templates for organization and person purposes are sorted by types and says, or keywords. Use US Legal Forms to find the Arkansas Business Deductions Checklist in just a few click throughs.

If you are currently a US Legal Forms buyer, log in to your profile and then click the Obtain key to get the Arkansas Business Deductions Checklist. You can also accessibility kinds you earlier delivered electronically within the My Forms tab of the profile.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for your appropriate city/nation.

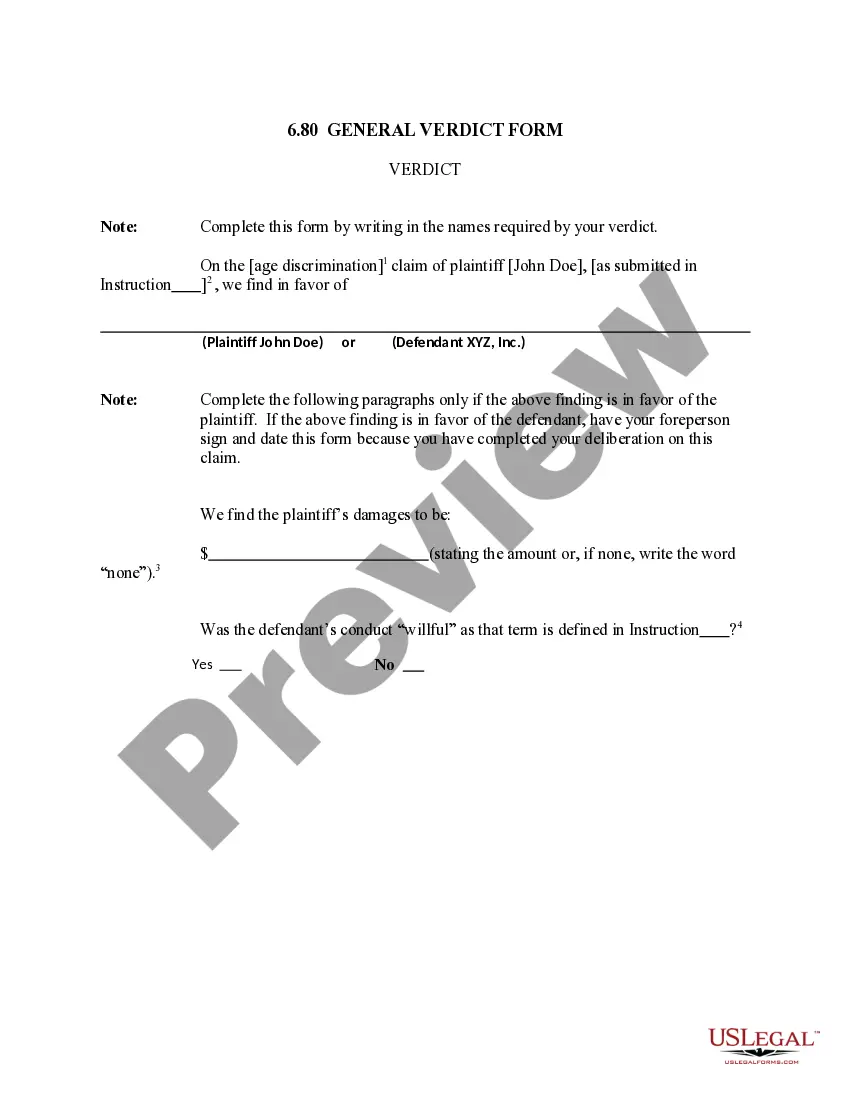

- Step 2. Utilize the Review method to look over the form`s articles. Don`t neglect to learn the information.

- Step 3. If you are not satisfied with all the develop, utilize the Research area towards the top of the display screen to find other types in the authorized develop format.

- Step 4. After you have discovered the shape you need, click on the Purchase now key. Choose the rates prepare you prefer and add your references to sign up for an profile.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal profile to complete the transaction.

- Step 6. Pick the formatting in the authorized develop and download it on your device.

- Step 7. Full, modify and print out or indicator the Arkansas Business Deductions Checklist.

Each and every authorized file format you acquire is the one you have eternally. You possess acces to every single develop you delivered electronically with your acccount. Click the My Forms area and select a develop to print out or download again.

Be competitive and download, and print out the Arkansas Business Deductions Checklist with US Legal Forms. There are many professional and status-distinct kinds you may use for the organization or person needs.