Arkansas Authorization to Release Credit Information

Description

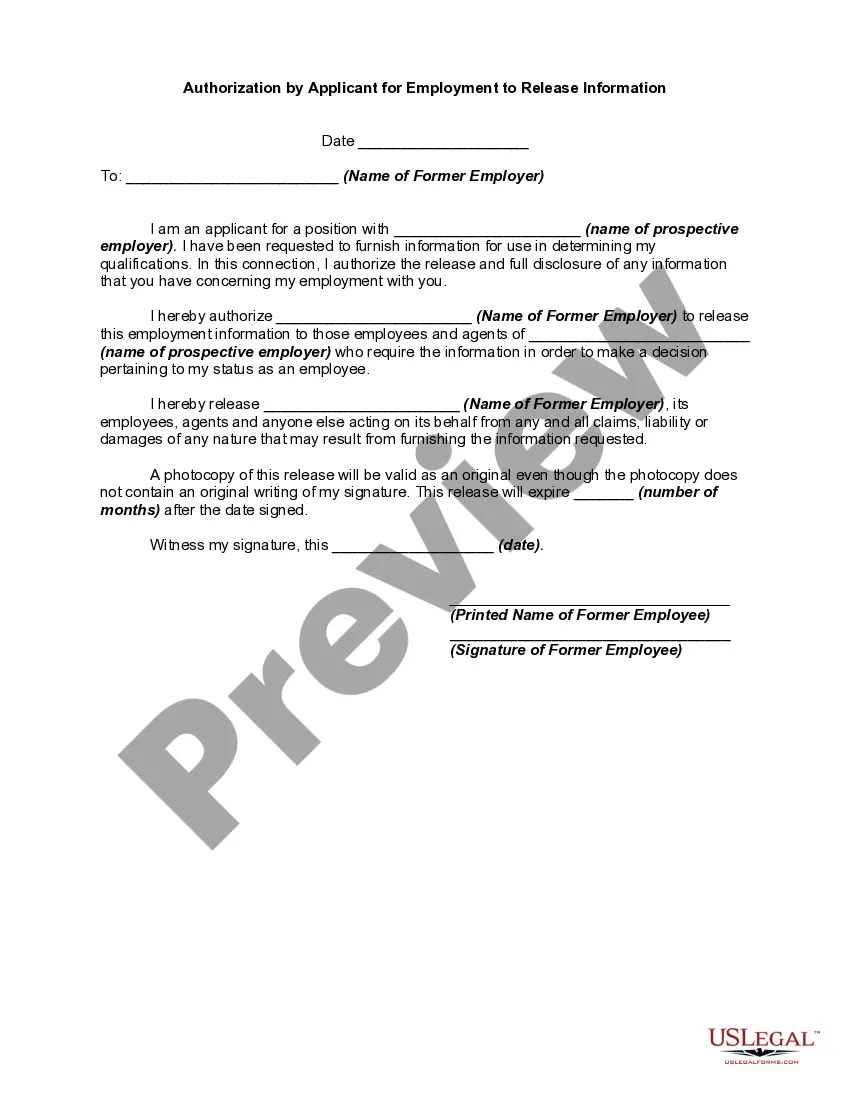

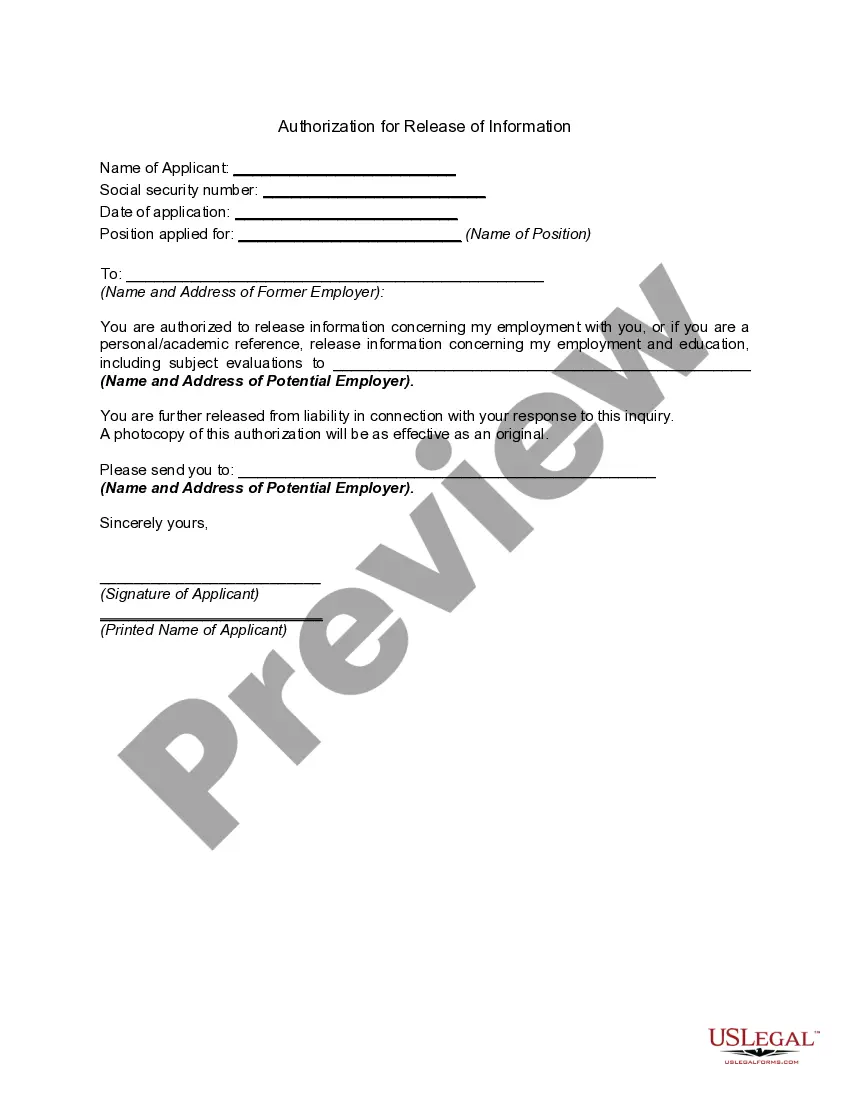

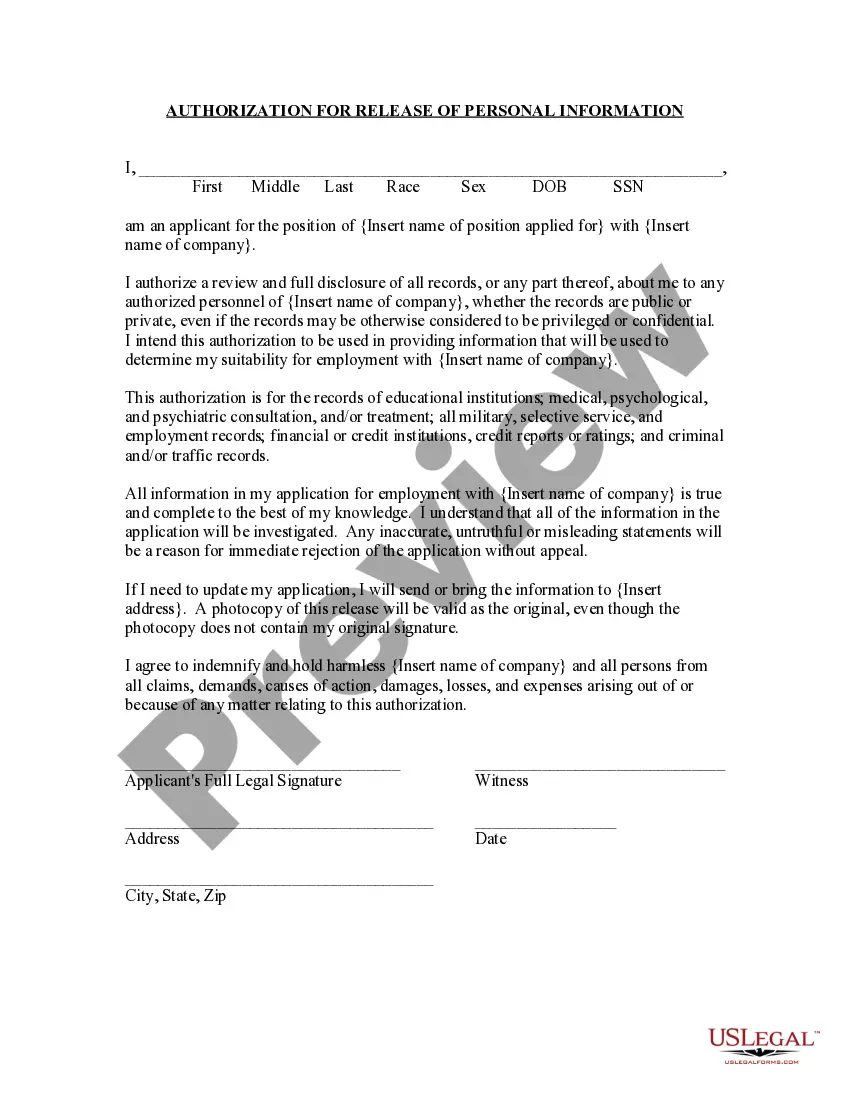

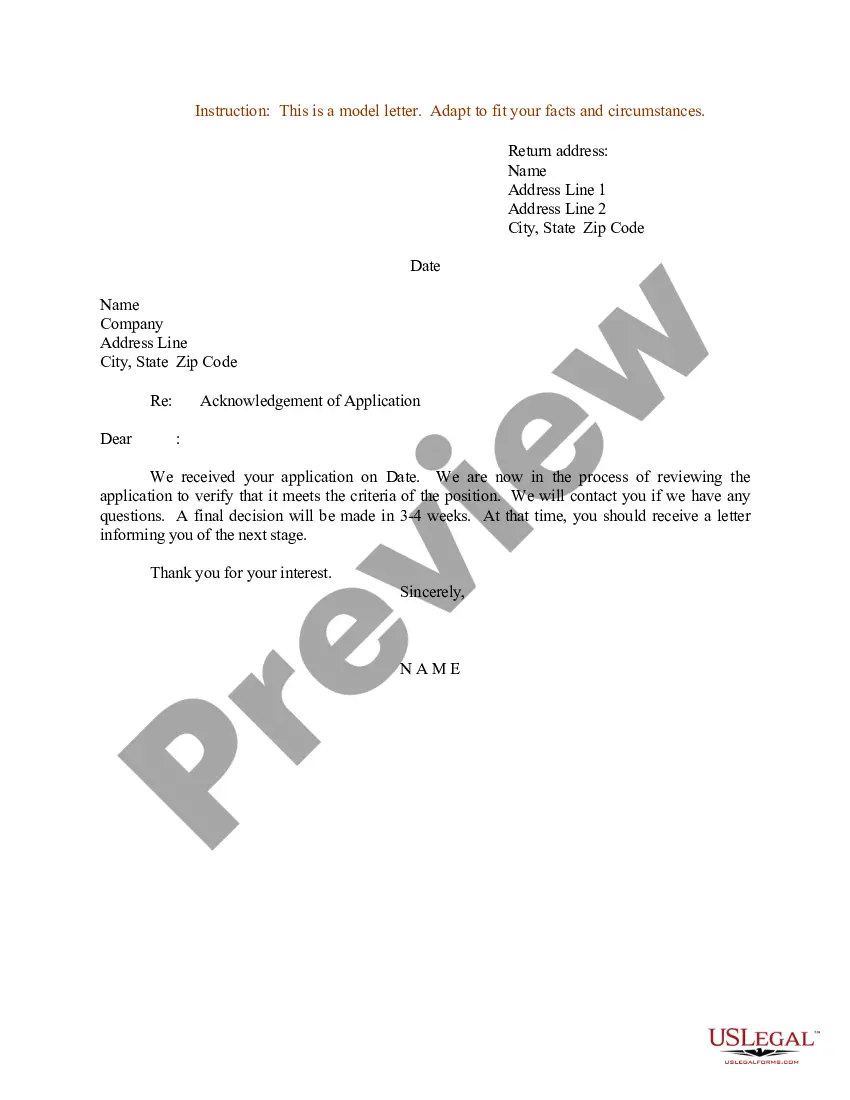

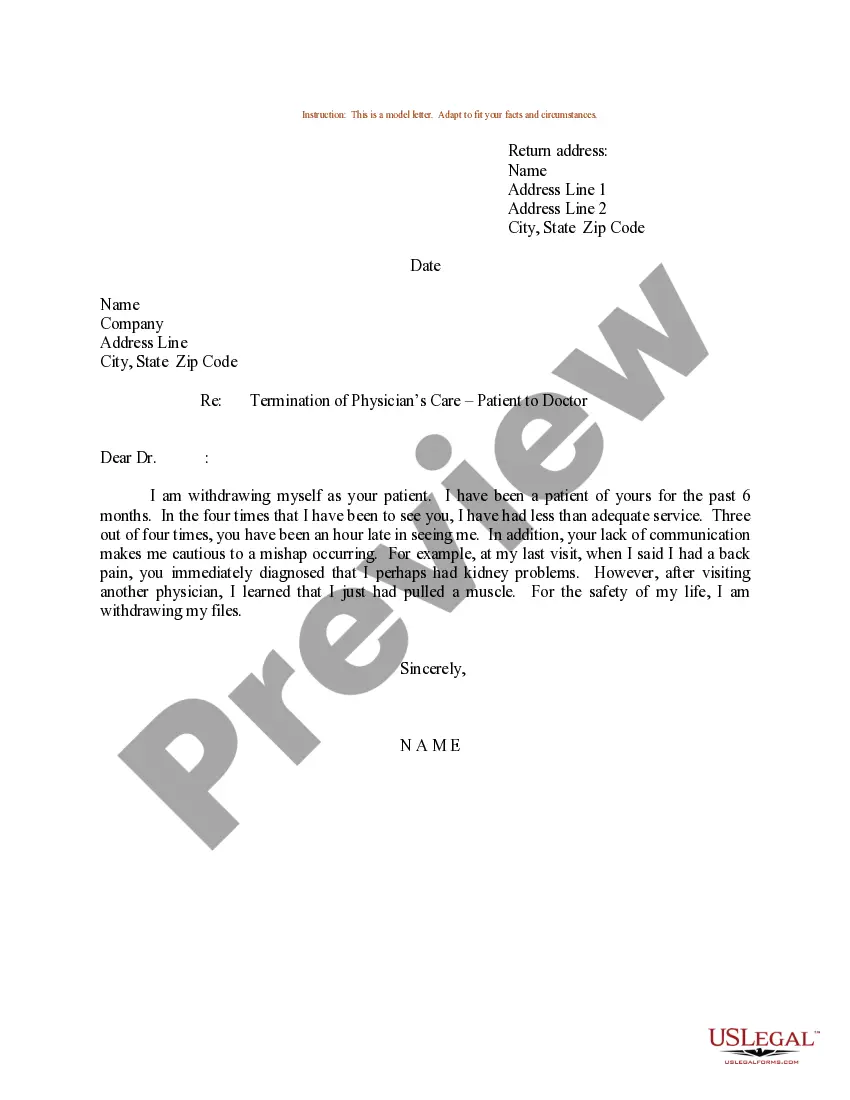

How to fill out Authorization To Release Credit Information?

Discovering the right legal document format can be a struggle. Naturally, there are tons of themes available online, but how do you discover the legal develop you need? Utilize the US Legal Forms site. The services delivers a huge number of themes, for example the Arkansas Authorization to Release Credit Information, that can be used for enterprise and personal demands. All the forms are examined by experts and meet federal and state specifications.

Should you be previously authorized, log in for your account and click the Obtain switch to obtain the Arkansas Authorization to Release Credit Information. Use your account to look from the legal forms you possess ordered formerly. Go to the My Forms tab of the account and get another backup from the document you need.

Should you be a new end user of US Legal Forms, listed here are simple recommendations that you can stick to:

- Initially, ensure you have selected the proper develop for your personal city/area. You are able to examine the shape utilizing the Preview switch and study the shape outline to guarantee it is the right one for you.

- In the event the develop will not meet your requirements, utilize the Seach industry to get the right develop.

- When you are positive that the shape is acceptable, select the Buy now switch to obtain the develop.

- Choose the rates strategy you need and enter the essential information. Make your account and purchase the transaction with your PayPal account or charge card.

- Choose the file file format and acquire the legal document format for your gadget.

- Full, revise and produce and sign the obtained Arkansas Authorization to Release Credit Information.

US Legal Forms is definitely the largest catalogue of legal forms where you can see different document themes. Utilize the service to acquire professionally-produced papers that stick to express specifications.

Form popularity

FAQ

Sanders on Sept. 14 further reduces the state's top income tax rate from 4.7% to 4.4%, (This rate was previously reduced from 4.9% in April 2023.) The new 4.4% tax rate won't take effect until 2024, so taxpayers whose incomes fall into the top bracket are subject to the previously reduced rate of 4.7% for 2023.

Included in the sale are clothing and footwear less than $100, clothing accessories and equipment less than $50, and most school supplies and electronic devices used to study. Cosmetics and jewelry are on the list. Online orders count, but they have to be shipped to an Arkansas address.

The temporary income tax credit is called "an inflationary relief income tax credit" in Act 6. Taxpayers will claim the up to $150 income tax credit when they file in 2024 for tax year 2023 and filing should begin in late January, said Scott Hardin, a spokesman for the state Department of Finance and Administration.

The Additional Child Tax Credit allows you to receive up to $1,500 of the $2,000 CTC per child as a refund for 2023.

In addition, it provides a one-time non-refundable income tax credit of $150 to taxpayers making less than $89,600 a year. Married couples filing jointly with an income of less than $179,200 a year will receive a $300 non-refundable tax credit. The credit will be retroactive to January 1, 2023.

$150 tax credit in Arkansas Unlike the income tax cuts, the Arkansas tax credit of up to $150 ($300 for joint filers) is retroactive to tax year 2023. That means eligible residents can claim the credit when they file their 2023 Arkansas state tax return.

If you e-filed, your refund should be issued within twenty-one business days after acknowledgment of the receipt of the return. The average processing time for a complete paper tax return is up to 10 weeks from the time you mailed it. Please allow 10 weeks from the date you filed before calling.