Arkansas Pledge of Personal Property as Collateral Security

Description

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

How to fill out Pledge Of Personal Property As Collateral Security?

Are you presently at the location where you might require documents for potentially business or particular objectives virtually every day.

There are numerous legitimate document templates accessible online, but obtaining forms you can trust isn't straightforward.

US Legal Forms offers thousands of template forms, such as the Arkansas Pledge of Personal Property as Collateral Security, which are designed to comply with state and federal regulations.

When you locate the correct form, click on Purchase now.

Select the pricing plan you want, provide the necessary information to process your payment, and purchase your order using your PayPal or credit card. Choose a convenient document format and download your copy. Find all the document templates you have purchased in the My documents list. You can obtain another copy of the Arkansas Pledge of Personal Property as Collateral Security whenever needed; just access the required form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arkansas Pledge of Personal Property as Collateral Security template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

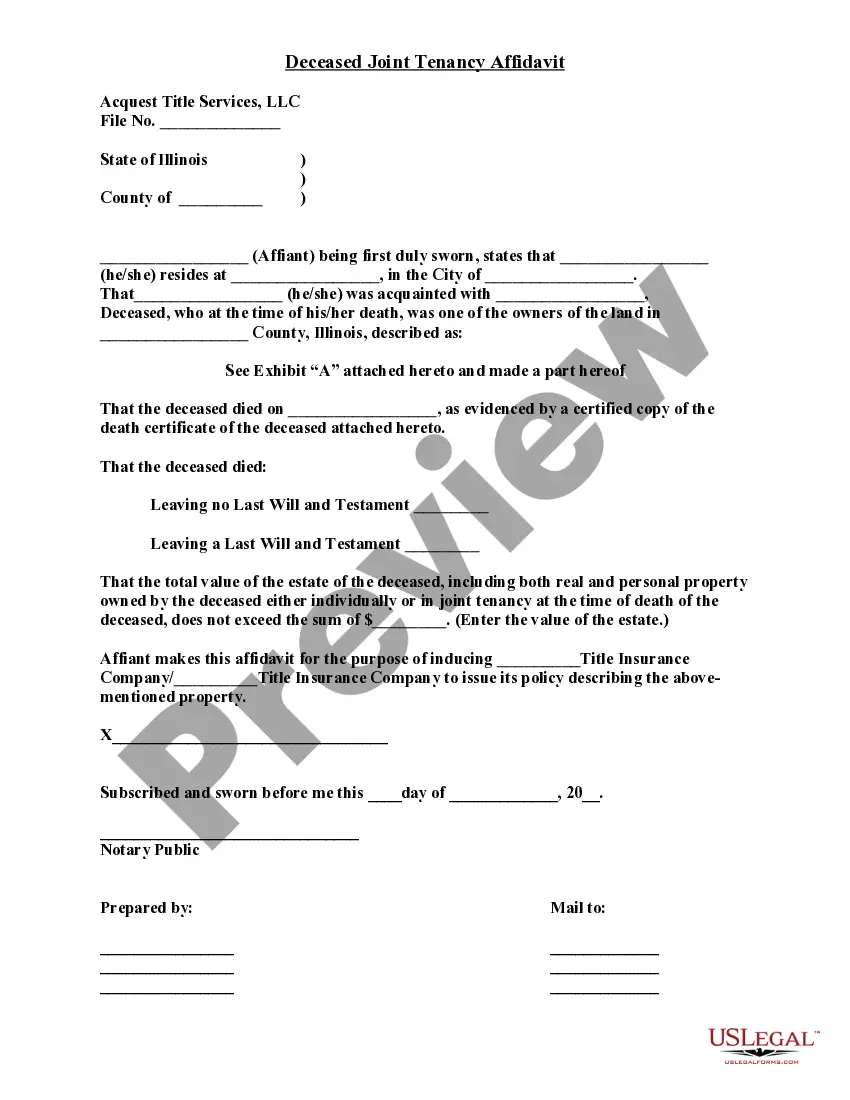

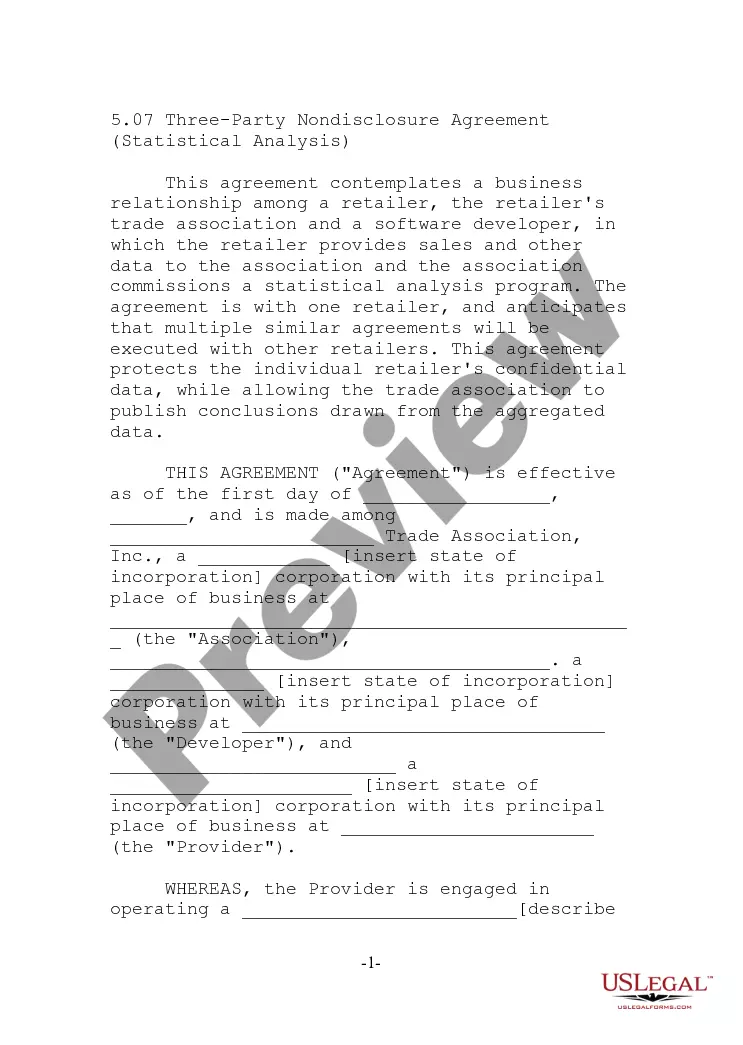

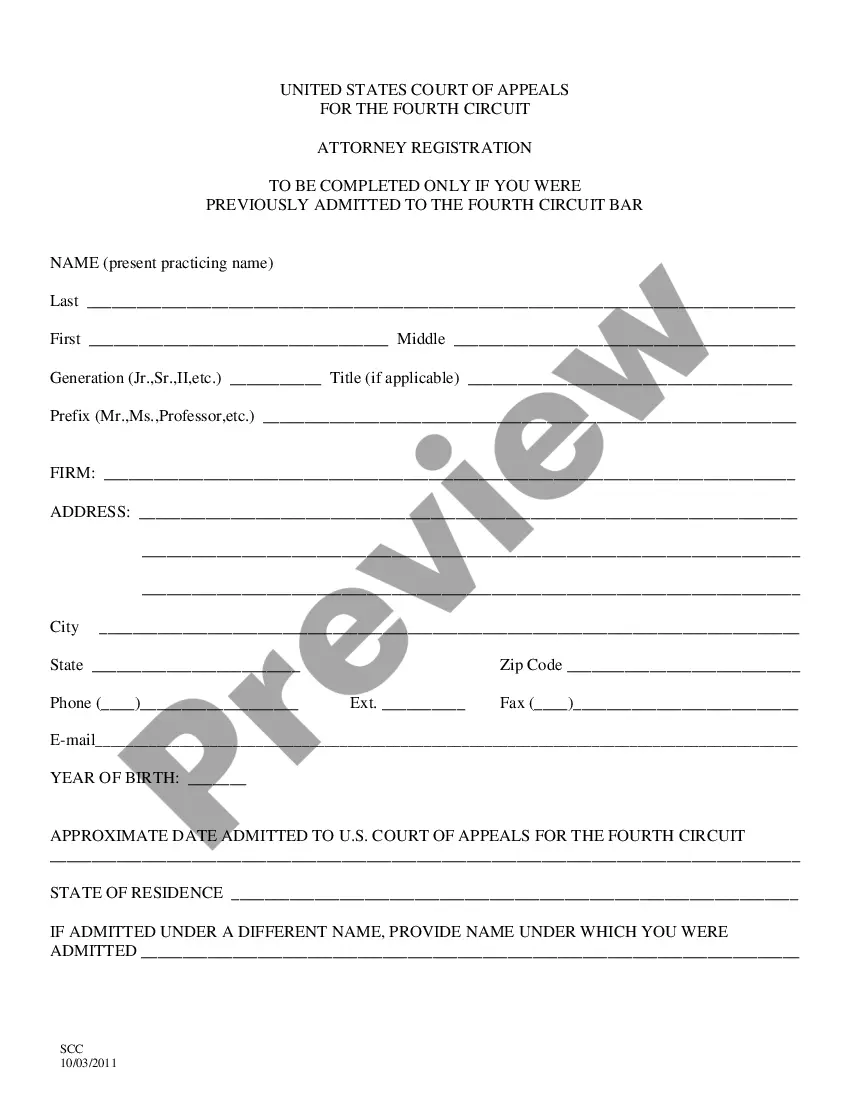

- Use the Preview button to review the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you're looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

Pledging real estate as collateral without giving up possession is known as a 'secured transaction' or 'mortgage'. This allows the borrower to maintain control of their property while still providing security for the lender. The concept is integral to various financial agreements in the context of the Arkansas Pledge of Personal Property as Collateral Security. Effectively, it balances the interests of both parties involved.

A pledge of property to secure a debt is an agreement where a borrower uses personal property as collateral to obtain financing. In this arrangement, the lender holds the property until the borrower repays the debt. If the borrower fails to fulfill their obligation, the lender can claim the property. This is a key aspect of the Arkansas Pledge of Personal Property as Collateral Security.

Personal property includes any movable items that you own, excluding real estate. Examples are cars, furniture, electronics, and collectibles. These items can be leveraged for loans, particularly under the Arkansas Pledge of Personal Property as Collateral Security framework. Understanding what constitutes personal property helps you make informed decisions when seeking financial support.

The document that pledges designated property as security for a debt is often referred to as a lien. Specifically, in cases involving the Arkansas Pledge of Personal Property as Collateral Security, a lien establishes the lender's rights to the property in question. This arrangement is beneficial for both parties, as it formalizes the agreement and helps protect the lender's interests. Proper documentation is essential to maintain clarity and uphold legal standards.

A legal document that pledges real property to the lender as security is typically known as a mortgage. In the context of the Arkansas Pledge of Personal Property as Collateral Security, this document serves to ensure that the lender has a claim on the property if the borrower defaults on their debt. This arrangement allows the lender to take possession of the property as a way to recoup their losses. Utilizing this type of pledge enhances trust in financial transactions.

A pledged asset is a valuable asset that is transferred to a lender to secure a debt or loan. Pledged assets can reduce the down payment that is typically required for a loan. The asset may also provide a better interest rate or repayment terms for the loan.

Pledged collateral refers to assets that are used to secure a loan. The borrower pledges assets or property to the lender to guarantee or secure the loan.

To pledge assets as collateral (or Pledging) is the act of offering assets as collateral to secure loans. Assets pledged can be in the form of security holdings and act as assurance for recovering the borrowed amount should a borrower fail to pay up.

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).