Title: Arkansas Sample Letter regarding Articles of Incorporation — Election of Sub-S Status: A Comprehensive Guide Keywords: Arkansas, sample letter, Articles of Incorporation, Election of Sub-S Status, types of Arkansas sample letters Introduction: In the state of Arkansas, when incorporating a company, business owners may choose to elect for Sub-S status, also known as a Subchapter S Corporation. This election allows the business to be treated as a pass-through entity for tax purposes, providing potential benefits for small businesses. This article provides a detailed description of what an Arkansas sample letter regarding Articles of Incorporation — Election of Sub-S Status should include, along with various types of letters that can be used. 1. Purpose of the Arkansas Sample Letter: The purpose of an Arkansas Sample Letter regarding Articles of Incorporation — Election of Sub-S Status is to formally inform the Arkansas Secretary of State that a corporation wishes to elect for Sub-S status. 2. Contents of the Arkansas Sample Letter: — Company Information: Include full legal name, registered address, and contact details of the corporation. — Statement of Intent: Clearly state the corporation's desire to elect Sub-S status, providing a concise and straightforward explanation for doing so. — Effective Date: Specify the desired effective date for the Sub-S election, keeping in mind IRS regulations and legal timelines. — Attachments: Include any necessary attachments, such as a copy of the corporation's Articles of Incorporation. 3. Types of Arkansas Sample Letters regarding Articles of Incorporation — Election of Sub-S Status: a) Basic Arkansas Sample Letter: This type of letter covers the minimum requirements mentioned in point 2 above, providing a simple yet complete submission. b) Detailed Arkansas Sample Letter: This letter includes additional details, such as a statement of how the corporation qualifies for Sub-S status, providing extra supporting documentation if available. c) Resubmission Arkansas Sample Letter: This letter is used when a previous submission was rejected or returned due to missing or incorrect information. It helps rectify the issues and ensure successful processing. Conclusion: When considering Sub-S status for a corporation in Arkansas, the use of a well-crafted sample letter is essential to streamline the process. Businesses should carefully customize their letter based on their unique circumstances and adhere to all relevant regulations. By electing Sub-S status correctly, corporations can potentially enjoy tax benefits and legal advantages in Arkansas.

Arkansas Sample Letter regarding Articles of Incorporation - Election of Sub-S Status

Description

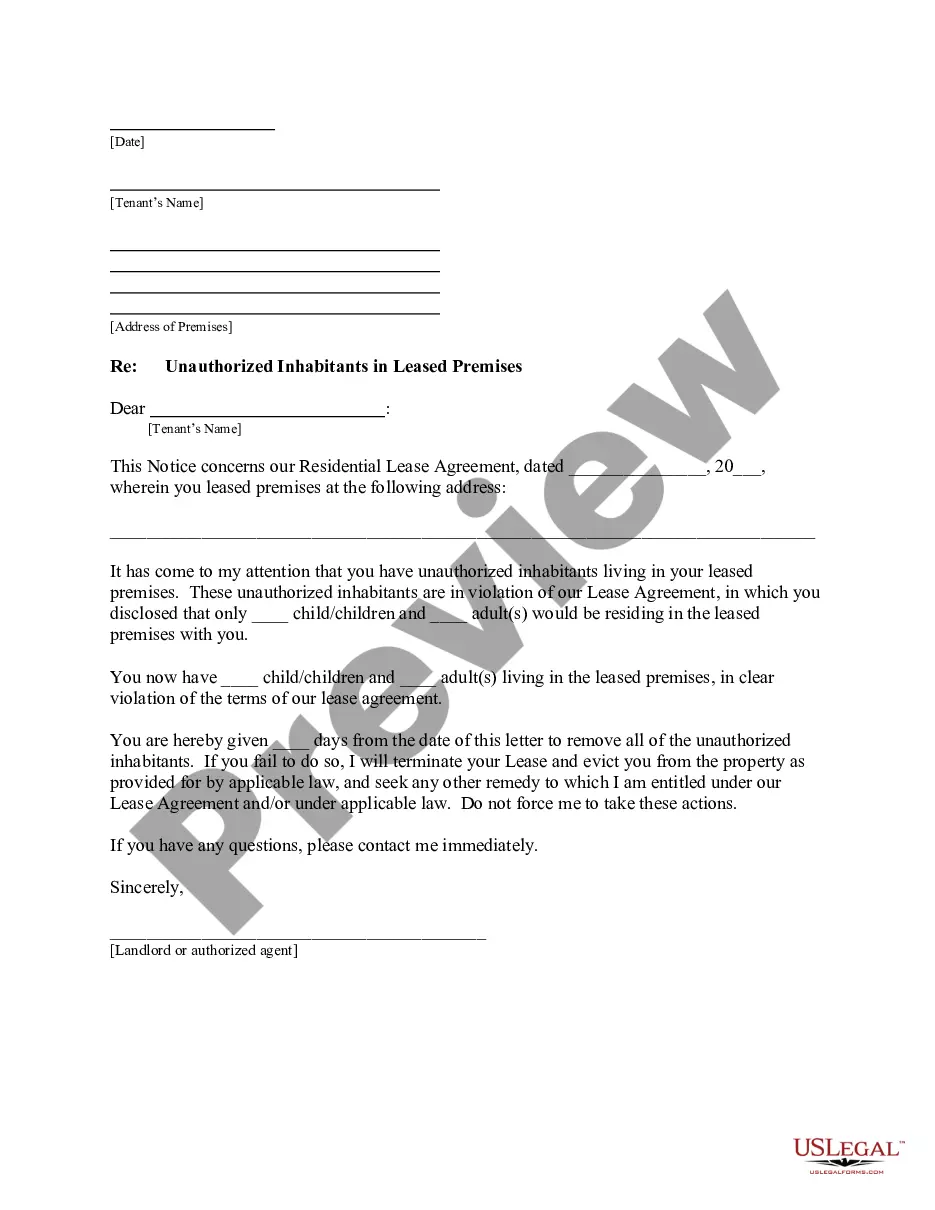

How to fill out Arkansas Sample Letter Regarding Articles Of Incorporation - Election Of Sub-S Status?

If you need to comprehensive, obtain, or print out lawful papers themes, use US Legal Forms, the largest variety of lawful types, that can be found on-line. Make use of the site`s easy and practical search to find the papers you will need. A variety of themes for company and personal purposes are sorted by categories and says, or search phrases. Use US Legal Forms to find the Arkansas Sample Letter regarding Articles of Incorporation - Election of Sub-S Status with a number of mouse clicks.

In case you are previously a US Legal Forms client, log in for your accounts and click the Obtain button to find the Arkansas Sample Letter regarding Articles of Incorporation - Election of Sub-S Status. Also you can gain access to types you in the past delivered electronically from the My Forms tab of the accounts.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the form for the correct area/land.

- Step 2. Use the Preview option to examine the form`s content. Don`t forget about to read the explanation.

- Step 3. In case you are unsatisfied using the form, make use of the Lookup industry near the top of the screen to locate other types of your lawful form template.

- Step 4. When you have found the form you will need, go through the Buy now button. Pick the costs program you favor and put your qualifications to sign up to have an accounts.

- Step 5. Approach the purchase. You may use your credit card or PayPal accounts to finish the purchase.

- Step 6. Select the format of your lawful form and obtain it on your own system.

- Step 7. Full, revise and print out or indication the Arkansas Sample Letter regarding Articles of Incorporation - Election of Sub-S Status.

Each and every lawful papers template you buy is the one you have for a long time. You might have acces to every form you delivered electronically with your acccount. Select the My Forms section and pick a form to print out or obtain once again.

Be competitive and obtain, and print out the Arkansas Sample Letter regarding Articles of Incorporation - Election of Sub-S Status with US Legal Forms. There are many specialist and condition-distinct types you can utilize to your company or personal needs.

Form popularity

FAQ

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.

File Your Business Taxes Businesses that operate within Arkansas are required to register for one or more tax-specific identification numbers, licenses or permits, including income tax withholding, sales and use tax (seller's permit), and unemployment insurance tax.

Limited Liability Company Must file Articles of Organization with the Arkansas Secretary of State. Allow members to manage a company themselves or to elect managers.

Arkansas S Corporation Taxation To qualify as an S corporation in Arkansas, an IRS Form 2553 must be filed with the Internal Revenue Service. In very few states, you will also be required to file a separate state election, as specified by that state, in order to qualify as a Sub S Corporation.

The Division completes most filings such as articles of incorporation, amendments, mergers or dissolutions within two business days of receipt.

In Arkansas, you can establish a sole proprietorship without filing any legal documents with the Arkansas state government. Though no action is required to legally create a sole proprietorship, you should follow four simple steps to start your business: Choose a business name.

Arkansas does not legally require LLC owners to submit an operating agreement to the Secretary of State when filing the Articles of Organization (the formal paperwork needed to form an LLC officially).