Arkansas Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

It is feasible to spend hours online attempting to locate the legal documents template that meets the state and federal requirements you need.

US Legal Forms offers a wide variety of legal forms that have been verified by professionals.

You can download or print the Arkansas Receipt and Withdrawal from Partnership from the service.

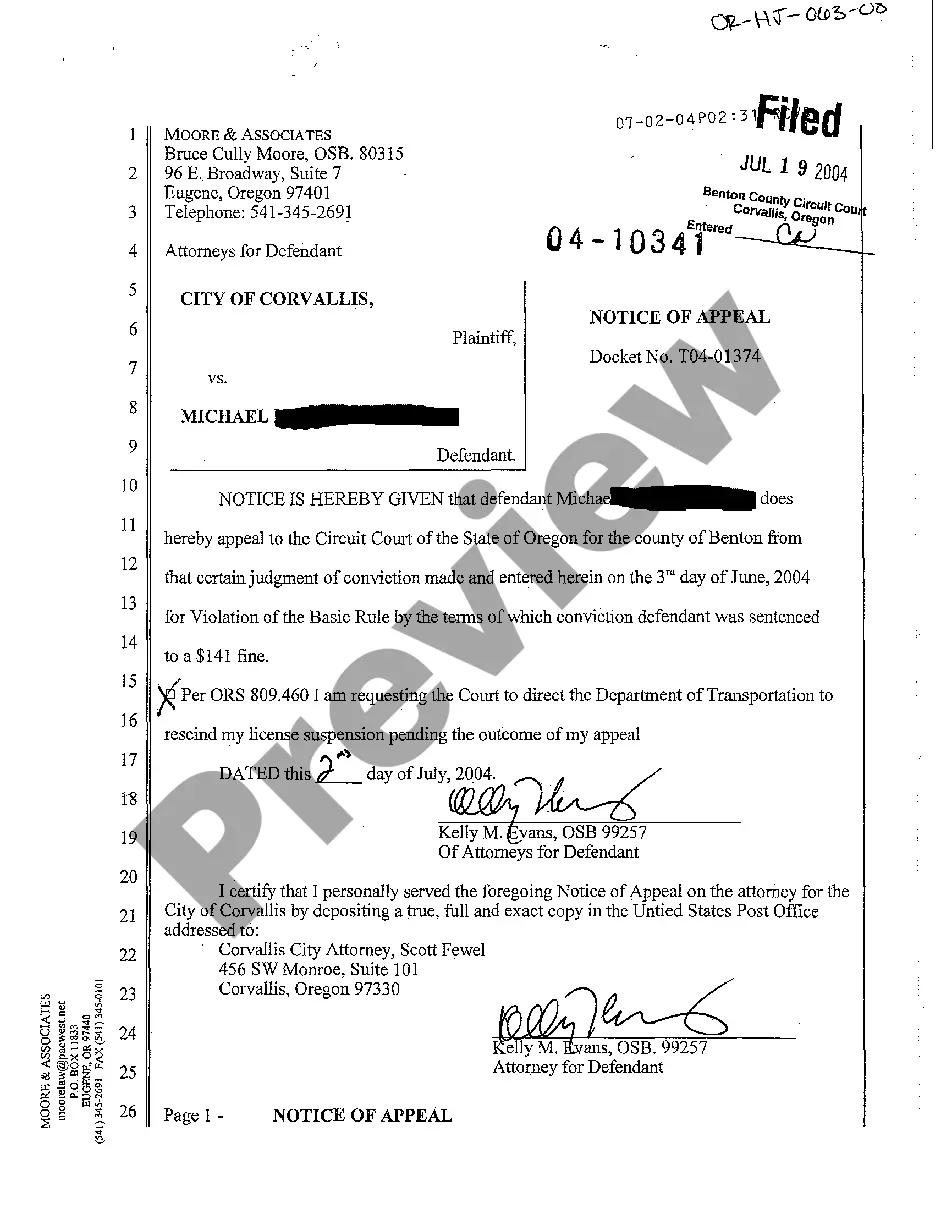

If available, utilize the Review button to examine the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you may fill out, edit, print, or sign the Arkansas Receipt and Withdrawal from Partnership.

- Each legal document template you obtain is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure that you have selected the correct document template for your chosen state/city.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

Form 1065 is the tax return that partnerships must file to report their income, deductions, and credits to the IRS. It allows the partnership to report its total income while allocating the earnings to each partner through K-1 forms. This form is critical for proper tax reporting, especially when partners process an Arkansas Receipt and Withdrawal from Partnership. Understanding its components can help you avoid common pitfalls.

Partners report their shares of income, whether or not it's actually been distributed. Schedule K-1 reports each partner's share of income. A partner uses this information to complete Schedule E Part II of Form 1040.

Unlike regular corporations, partnerships aren't subject to income tax. Instead, each partner is taxed on the partnership's earnings whether or not they're distributed. Similarly, if a partnership has a loss, the loss is passed through to the partners.

Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership representative where no partnership representative is in effect.

Where Are Partnership Distributions Reported 1040? Schedule K and K-1 of the partnership return includes their details. On Schedule E (Form 1040), partners report guaranteed payments as ordinary income in addition to other ordinary income distributed equally among themselves.

To close their business account, partnerships need to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

A partnership distribution is not taken into account in determining the partner's distributive share of partnership income or loss. If any gain or loss from the distribution is recognized by the partner, it must be reported on their return for the tax year in which the distribution is received.

Are Partnership Distributions Reported On 1099? If your partnership received more than $600 from your clients in 2017, it will receive 1099 forms. The total income received by the partnership from all of its 1099s results in, according to you, the most of all the income that the partnership earned during taxes.

AR1000F Full Year Resident Individual Income Tax Return. 01/10/2017. AR1000NR Part Year or Non-Resident Individual Income Tax Return. 01/10/2017.

File a Form With the State Filing a Statement of Dissolution will help make clear that your partnership has ended and limit your liability. You cannot file a Statement of Dissolution unless you have first filed a Statement of Partnership Authority. You can file the Statement of Dissolution online or on paper.