Generally, the members of a nonprofit corporation must exercise their control of corporate policies at regularly called meetings of the members. A corporation has a duty to keep a record of the meetings of its members, showing the dates such meetings were held and listing the members present or showing the number of voting shares represented at the meeting in person or by proxy. It is the duty of the secretary to prepare and enter the minutes of such meetings in the corporate records.

Arkansas Minutes of Annual Meeting of a Non-Profit Corporation

Description

How to fill out Minutes Of Annual Meeting Of A Non-Profit Corporation?

If you need to entirely retrieve, download, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states or keywords.

Every legal document template you acquire is yours permanently. You have access to every form you purchased in your account. Click the My documents section and choose a form to print or download again.

Complete and download, and print the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to acquire the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to find the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review feature to examine the form's content. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation.

Form popularity

FAQ

Yes, there is a legal distinction between nonprofit and not-for-profit organizations. Nonprofits typically focus on charitable purposes and can receive tax-exempt status, while not-for-profits may operate for mutual benefit without the same obligations. Understanding these definitions is essential when documenting activities such as the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation to reflect the organization's true nature.

The Arkansas nonprofit corporation Act provides the legal framework for forming and operating nonprofit organizations in the state. This act sets forth the rules regarding management, compliance, and reporting. When executing the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation, you make sure that your organization adheres to the statutes set out in this act.

It is recommended that a nonprofit organization hold at least two to four board meetings each year to maintain effective governance. Regular meetings facilitate communication and prompt decision-making among board members. Recording these discussions in the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation helps ensure that all decisions are clearly documented.

Yes, Arkansas law requires nonprofits to hold an annual meeting to discuss the organization's performance and future plans. This meeting is vital for engaging with members and making collective decisions. Properly documenting the meeting through the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation is essential for legal compliance.

The nonprofit integrity act aims to promote accountability and transparency within nonprofit organizations in Arkansas. It involves specific regulations related to board governance and financial practices. Compliance with these standards will also involve recording decisions in the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation.

In Arkansas, a nonprofit corporation must have at least three directors on its board, all of whom should be at least 18 years old. This structure promotes balanced decision-making and accountability. Proper documentation, such as the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation, is crucial for maintaining records of board member actions and decisions.

The Arkansas nonprofit Act governs the formation and operation of nonprofit organizations within the state. This law outlines the requirements for organizing a nonprofit, including the need for bylaws and the process for holding meetings. When you document the Arkansas Minutes of Annual Meeting of a Non-Profit Corporation, you ensure compliance with these legal obligations.

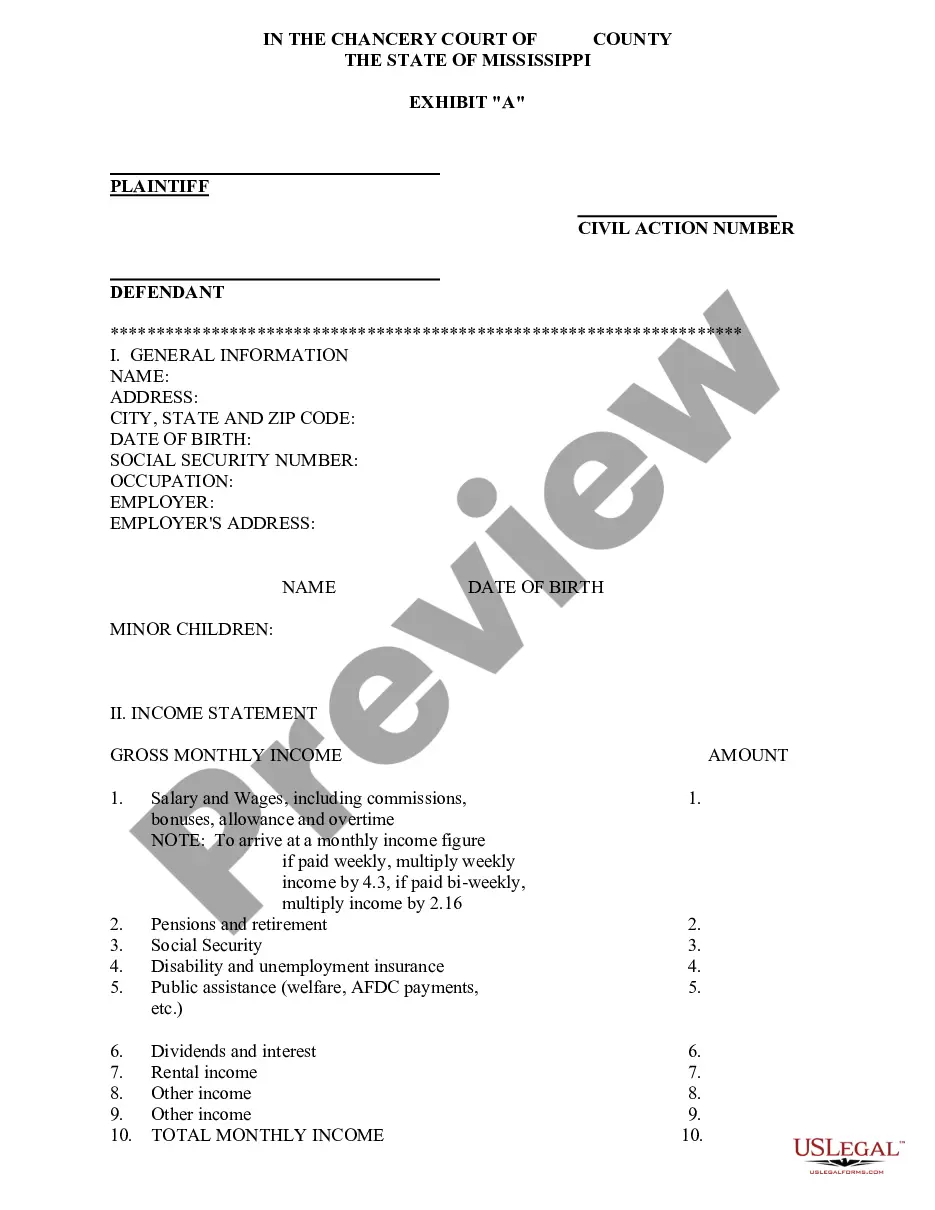

Writing annual meeting minutes involves recording key details such as the date, time, and venue, alongside a list of those who attended. Document the essential discussions, decisions made, and any motions passed. This practice ensures clarity and accountability for all actions taken. If you're looking for specialized assistance, US Legal Forms offers valuable resources for crafting Arkansas Minutes of Annual Meeting of a Non-Profit Corporation.

To write meeting minutes for a nonprofit, document the basic meeting information followed by a list of attendees. It is important to capture each agenda item's discussions, decisions, and assigned tasks. Keeping the minutes clear and objective will assist in maintaining a professional record. Templates tailored for Arkansas Minutes of Annual Meeting of a Non-Profit Corporation, available through US Legal Forms, can provide further assistance.

When writing minutes for an annual meeting, begin with the essential facts like date, time, and location, followed by a list of attendees. Capture the main discussions, decisions made, and any motions that were passed clearly and concisely. This organized approach not only reflects the meeting accurately but also serves as a formal record for the nonprofit. For Arkansas Minutes of Annual Meeting of a Non-Profit Corporation, consider using established templates.