A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Arkansas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

If you require to complete, download, or create legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Leverage the site's user-friendly and convenient search feature to locate the documents you need.

Numerous templates for business and personal use are organized by categories and jurisdictions, or keywords. Use US Legal Forms to obtain the Arkansas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you acquired in your account. Click on the My documents section and select a form to print or download again.

Complete and download, and print the Arkansas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to receive the Arkansas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation.

- Additionally, you can access forms you have previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

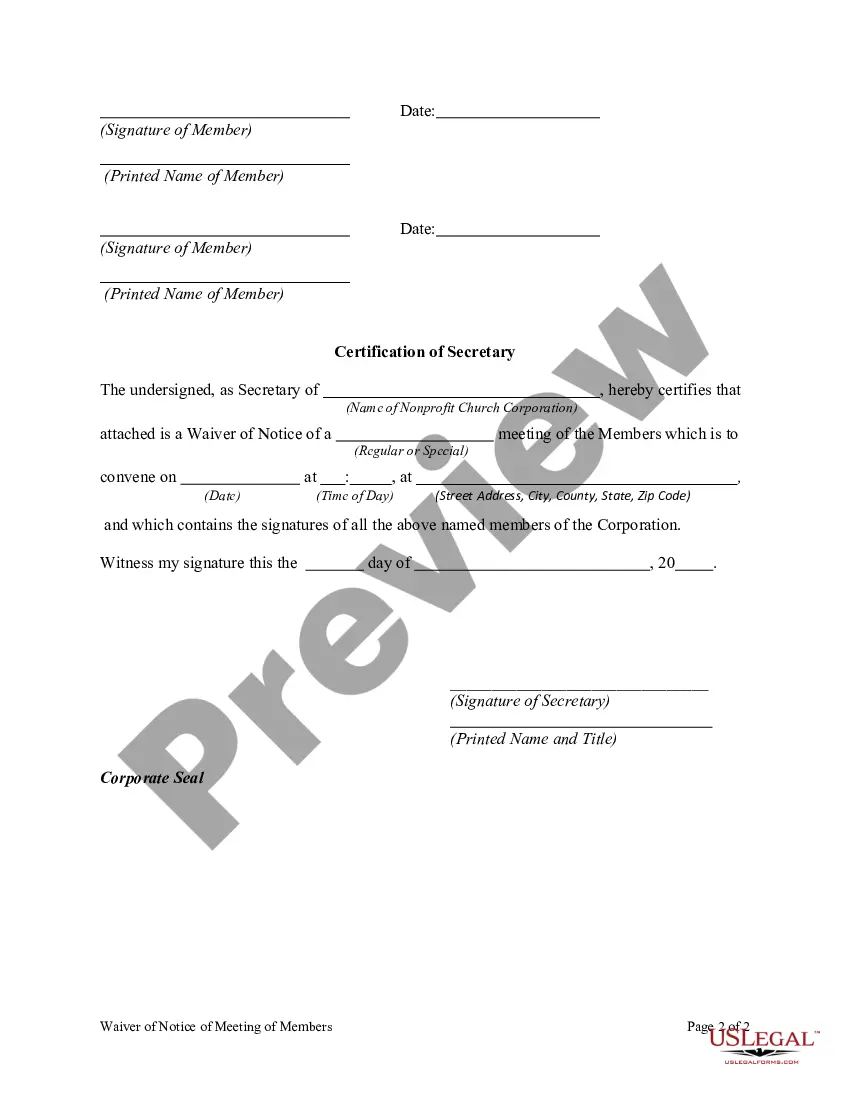

- Step 2. Use the Preview option to review the contents of the form. Be sure to read through the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Buy now button. Choose your preferred payment plan and add your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Arkansas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation.

Form popularity

FAQ

When we say 'notice of presentation waived', it means that the members of a Nonprofit Church Corporation agree to forego the formal notification typically required before a meeting. This agreement allows for more flexibility in scheduling meetings, fostering quicker decision-making. It essentially ensures that all members are on the same page and can participate without delays caused by notice periods.

SocietyDecide to dissolve. If a society has stopped operating and does not have any debts, the members can vote to dissolve the society or they can apply to the Court for an order to dissolve the society.Sell all property and pay all debts.Fill out the form.Send the form to Corporate Registry.

How to Start a Nonprofit in ArkansasName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

Steps to Dissolving a NonprofitFile a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.

If the leadership of the organization decides that winding down is the best option, the organization will need a plan of dissolution. A plan of dissolution is essentially a written description of how the nonprofit intends to distribute its remaining assets and address its remaining liabilities.

Consent refers to the provision of approval or assent, particularly and especially after thoughtful consideration. Consent can be either express or implied. A waiver of consent relieves a person or organization required to obtain consent from actually getting that consent.

What is a Waiver of Notice? A waiver of notice is an agreement that allows people to conduct certain legal procedures without giving formal notification that he or she is going to do so.

With the resolution and plan in hand, Arkansas law provides for voluntary dissolution as follows:if your nonprofit does not have members, by a vote of the directors; or.if your nonprofit does have members, by action of the directors followed by a vote or other consent of the members.

Once the decision has been made to dissolve, the nonprofit must stop transacting business, except to wind down its activities. The assets of a charitable nonprofit can only be used for exempt purposes. 6feff This means that assets may not go to staff or board members.

A waiver of notice is a legal document that states a board member agrees to waive the formal notice, and it must be signed by the board member. Organizations will have different rules based on the type of meeting, such as the first meeting, special meetings, emergency meetings, and executive sessions.