Title: Arkansas Notice of Public Sale of Collateral (Consumer Goods) on Default — A Comprehensive Guide Introduction: The Arkansas Notice of Public Sale of Collateral (Consumer Goods) on Default is a crucial legal document used when a borrower defaults on a loan secured by consumer goods in Arkansas. This notice is provided by the lender to inform the borrower and other interested parties about the upcoming public sale of the collateral to recover the outstanding debt. In Arkansas, there are primarily two types of notices related to the public sale of collateral. 1. Arkansas Conditional Sales Contract Law Notice: When goods are sold under a conditional sales contract in Arkansas, the lender exercises its right to repossess and sell the collateral upon default. The lender is required to send a written notice to the borrower to inform them of the default and the intention to sell the collateral publicly. This notice must include specific details about the goods, the amount owed, the borrower's right to cure the default, and the date, time, and location of the public sale. 2. Arkansas Uniform Commercial Code (UCC) Notice: The UCC notice of public sale of collateral applies to other types of secured loans, where the lender has a security interest in the consumer goods. In the event of default, the lender has the right to sell the collateral publicly to recover the outstanding debt. Similar to the conditional sales contract notice, the UCC notice must contain specific information such as a description of the goods, the amount owed, the right to cure, and the details of the upcoming public sale. Key Elements of an Arkansas Notice of Public Sale of Collateral (Consumer Goods) on Default: 1. Identification of the parties: Clearly state the names and addresses of the borrower, lender, and any other parties with an interest in the collateral. 2. Description of the collateral: Provide a detailed description of the consumer goods being sold, including any distinguishing features or identifying numbers, such as serial or VIN numbers. 3. Amount owed and default: State the specific amount owed by the borrower and outline the default event that triggers the lender's right to sell the collateral. 4. Right to cure: Inform the borrower of their right to cure the default by paying the outstanding amount within a specified time period. 5. Public sale details: Include the date, time, and location of the public sale, ensuring it adheres to Arkansas laws regarding notice period and methods of advertising. 6. Redemption rights: If applicable, mention any redemption rights the borrower may have to regain possession of the collateral before the public sale. 7. Other relevant information: Provide any additional information required by Arkansas laws, such as the lender's obligation to dispose of the collateral in a commercially reasonable manner. Conclusion: The Arkansas Notice of Public Sale of Collateral (Consumer Goods) on Default serves as a formal communication to inform the borrower and other interested parties about the upcoming public sale of collateral due to default on a loan secured by consumer goods. It is crucial to understand the specific requirements outlined by Arkansas laws when drafting and serving these notices to ensure compliance and protect the rights of all parties involved.

Arkansas Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

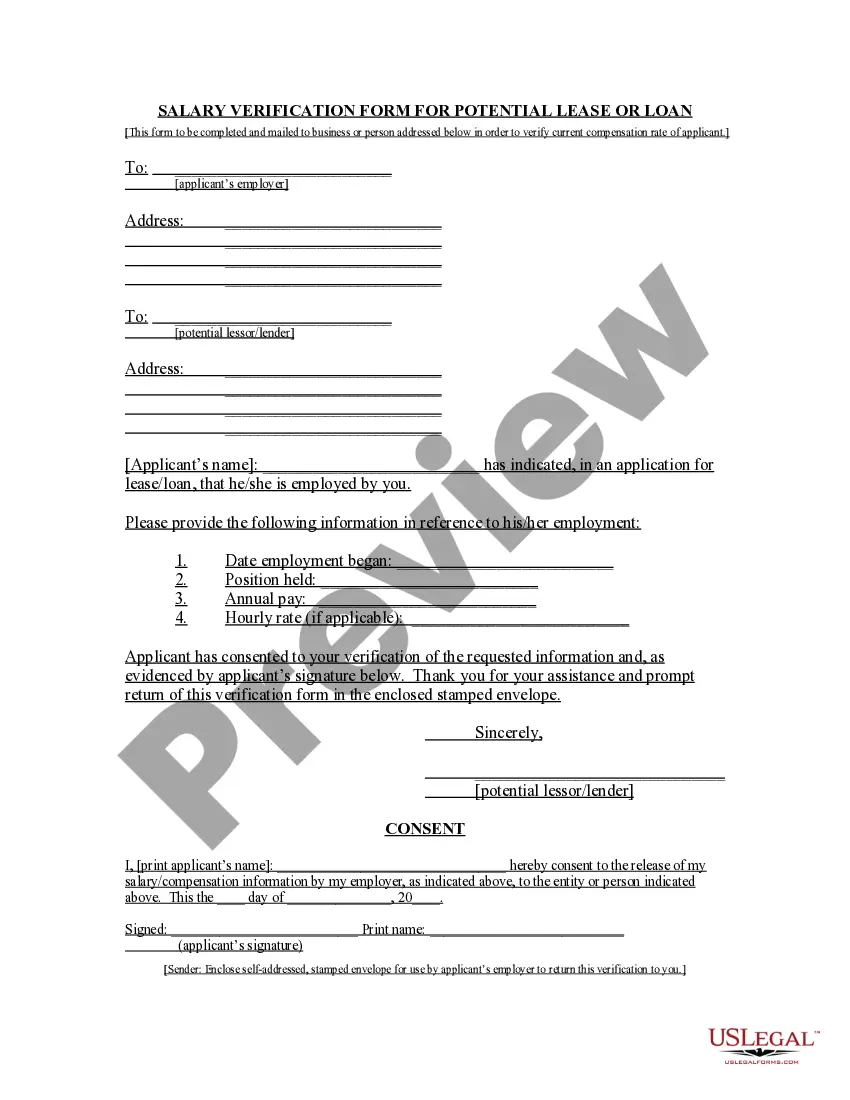

How to fill out Arkansas Notice Of Public Sale Of Collateral (Consumer Goods) On Default?

Choosing the right authorized papers template can be quite a have a problem. Naturally, there are plenty of themes accessible on the Internet, but how would you obtain the authorized type you will need? Make use of the US Legal Forms site. The service gives a large number of themes, for example the Arkansas Notice of Public Sale of Collateral (Consumer Goods) on Default, that you can use for organization and private demands. Every one of the forms are checked out by pros and meet up with federal and state demands.

If you are currently registered, log in to your bank account and then click the Obtain option to obtain the Arkansas Notice of Public Sale of Collateral (Consumer Goods) on Default. Make use of your bank account to check throughout the authorized forms you possess ordered earlier. Check out the My Forms tab of your respective bank account and get an additional duplicate from the papers you will need.

If you are a brand new customer of US Legal Forms, allow me to share easy recommendations that you can follow:

- First, make certain you have chosen the appropriate type for your area/region. You can look over the shape utilizing the Review option and read the shape outline to guarantee this is the right one for you.

- In the event the type is not going to meet up with your expectations, utilize the Seach field to discover the right type.

- Once you are positive that the shape is acceptable, go through the Get now option to obtain the type.

- Choose the pricing plan you need and enter in the required details. Design your bank account and buy an order using your PayPal bank account or Visa or Mastercard.

- Opt for the submit structure and down load the authorized papers template to your gadget.

- Complete, edit and print out and sign the attained Arkansas Notice of Public Sale of Collateral (Consumer Goods) on Default.

US Legal Forms will be the most significant library of authorized forms that you can find numerous papers themes. Make use of the company to down load appropriately-made papers that follow express demands.

Form popularity

FAQ

If the debtor defaults under its obligation, the secured creditor may proceed to sell the assets representing the collateral under the secured party's Credit Agreement.

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

Section 9-609 of the Uniform Commercial Code (UCC) permits the secured party to take possession of the collateral on default (unless the agreement specifies otherwise):

If the debtor defaults and does not repay the loan, generally the secured party can foreclose and recover the collateral. A person who has an ownership or other interest in the collateral and owes payment of a secured obligation Revised UCC 9-102(a)(28).

When a borrower applies for a loan, most lenders require the borrower to pledge an asset as security for the repayment of the loan, i.e. collateral. In the event the borrower defaults, usually by failing to make loan payments, a secured creditor has a right to take possession of the collateral. § 679.609, Fla.

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase

Revised Article 9 of the Uniform Commercial Code placed greater responsibility on secured parties to use the correct debtor name when preparing financing statements. RA9 provides that a financing statement is effective only if recorded under the correct name of the debtor.

Either way, if you or the business can't pay back the debt, a secured creditor can repossess or foreclose on the secured property, or order it to be sold, to satisfy the debt.

If a borrower defaults on a secured credit product, the secured creditor has a legal right to the secured asset used as collateral. The secured asset may be seized by the secured creditor and sold to pay off any remaining obligations.

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.