Arkansas Covenant Not to Sue by Widow of Deceased Stockholder

Category:

State:

Multi-State

Control #:

US-0624BG

Format:

Word;

Rich Text

Instant download

Description

A covenant not to sue is an agreement entered into by a person who has a legal claim against another but agrees not to pursue the claim. Such a covenant does not extinguish a cause of action and does not release other joint tortfeasors even if it does not

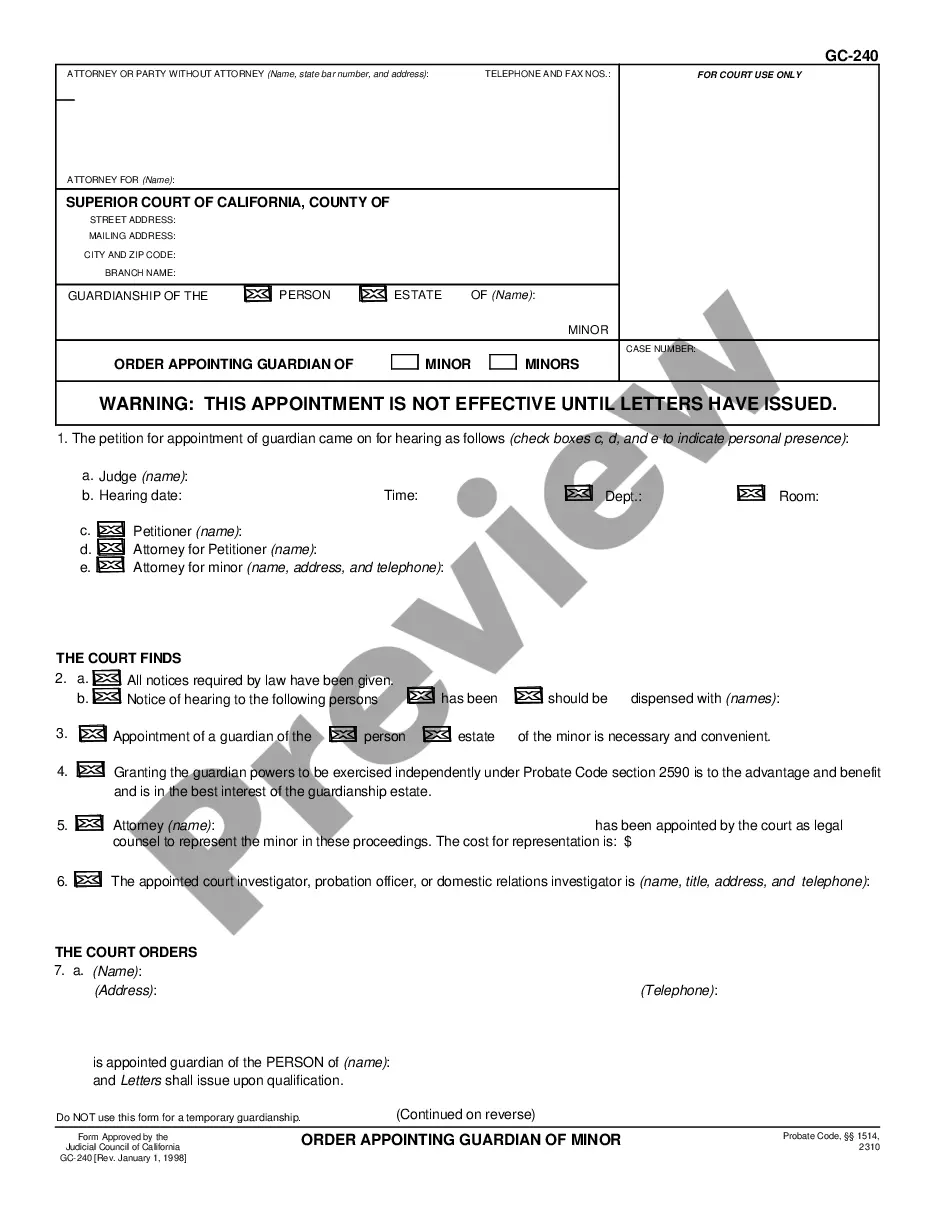

Free preview

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

You may invest numerous hours online attempting to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

You can readily obtain or print the Arkansas Covenant Not to Sue by Widow of Deceased Stockholder from your account.

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Arkansas Covenant Not to Sue by Widow of Deceased Stockholder.

- Every legal document template you purchase is yours to keep permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region area of your choice.

- Review the document description to confirm you have chosen the right document.