Title: Arkansas Renunciation of Legacy in Favor of Other Family Members: A Comprehensive Guide Introduction: The Arkansas Renunciation of Legacy in Favor of Other Family Members is a legal process through which an individual willingly relinquishes their right to inherit property or assets from a deceased family member's estate, allowing these assets to be passed on to other designated beneficiaries. In this article, we will explore the various aspects of this legal procedure, types of renunciations, and the associated considerations. Key Points: 1. Understanding Renunciation of Legacy: — Renunciation of Legacy is a legal concept that allows individuals to refuse or disclaim their entitlement to inherit assets from a deceased person's estate. — This renunciation is typically in favor of other family members, ensuring they receive a larger share or a more substantial inheritance. — The renunciation process in Arkansas is governed by specific laws and regulations to ensure a fair distribution of assets. 2. Reasons for Renunciation: — Dissatisfaction with the inherited amount: Family members might renounce their legacy if they believe the share assigned to them is inadequate compared to other beneficiaries. — Favoring specific family members: Renunciation allows individuals to redirect their inheritance to other family members they believe deserve a greater share or are in greater need. — Preventing conflict and maintaining family unity: Renouncing a legacy can help avoid potential disputes among family members regarding the distribution of assets, promoting harmony within the family. 3. Types of Arkansas Renunciation of Legacy: a. Full Renunciation: — In this type, the individual renounces their entire inheritance from the deceased's estate. — All assets and properties are bequeathed to alternative beneficiaries identified within the renunciation document. b. Partial Renunciation: — This form involves renouncing a specific portion or identified assets from the inherited estate, leaving the remaining assets to other beneficiaries. — Threluctantnt can indicate the precise assets they wish to disclaim or specify a percentage of the inheritance to renounce. 4. The Renunciation Process: a. Consultation with an attorney: — Seek legal counsel to understand the legal implications, potential tax consequences, and specific requirements for renouncing an inheritance in Arkansas. b. Drafting a renunciation document: — Prepare a written statement of renunciation specifying the reluctant's details, the deceased's estate to be renounced, and the intended alternative beneficiaries. c. Filing the renunciation: — Submit the renunciation document to the appropriate court in Arkansas within a specified timeframe following the decease of the testator. d. Legalities and consequences: — Understand the legal effect of renouncing an inheritance, potential impacts on taxes, and subsequent distribution of the renounced assets. Conclusion: The Arkansas Renunciation of Legacy in Favor of Other Family Members provides individuals with the legal means to relinquish their right to inherit assets from a deceased family member's estate and redirect the inheritance to other deserving beneficiaries. By understanding the types of renunciations, reasons, and the procedural aspects involved, interested parties can navigate this process effectively while ensuring a fair distribution of assets and maintaining family harmony. Seeking guidance from legal professionals is crucial to ensure compliance with applicable laws and to make informed decisions throughout the renunciation process.

Arkansas Renunciation of Legacy in Favor of Other Family Members

Description

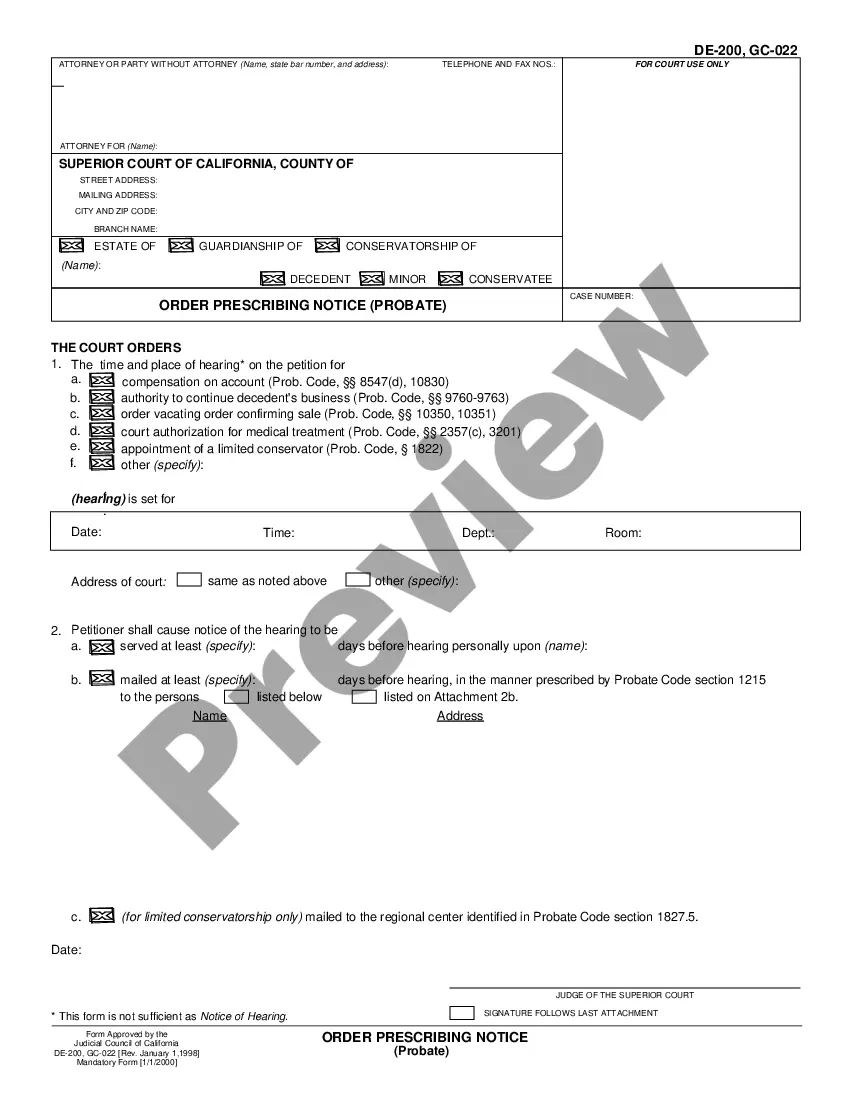

How to fill out Arkansas Renunciation Of Legacy In Favor Of Other Family Members?

Are you currently in a placement where you will need papers for sometimes enterprise or personal functions almost every working day? There are a lot of authorized document layouts available on the Internet, but getting ones you can rely is not simple. US Legal Forms offers a huge number of develop layouts, much like the Arkansas Renunciation of Legacy in Favor of Other Family Members, that are published to fulfill federal and state specifications.

Should you be presently familiar with US Legal Forms web site and get an account, simply log in. After that, you are able to download the Arkansas Renunciation of Legacy in Favor of Other Family Members design.

If you do not offer an bank account and need to begin to use US Legal Forms, abide by these steps:

- Obtain the develop you want and make sure it is to the appropriate area/area.

- Take advantage of the Review option to examine the shape.

- Browse the information to actually have selected the correct develop.

- If the develop is not what you are looking for, make use of the Research industry to find the develop that suits you and specifications.

- Once you find the appropriate develop, just click Purchase now.

- Pick the pricing plan you need, submit the required information and facts to produce your account, and pay for an order utilizing your PayPal or bank card.

- Decide on a practical paper structure and download your version.

Find each of the document layouts you possess bought in the My Forms food selection. You can aquire a additional version of Arkansas Renunciation of Legacy in Favor of Other Family Members at any time, if possible. Just click on the required develop to download or print out the document design.

Use US Legal Forms, one of the most extensive assortment of authorized forms, to save some time and avoid errors. The service offers skillfully manufactured authorized document layouts which can be used for an array of functions. Generate an account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

(a) A trustee shall keep the qualified beneficiaries of the trust reasonably informed about the administration of the trust and of the material facts necessary for them to protect their interests.

What if All Owners Don't Agree to Sell in Arkansas? In such cases, the majority of inheritors can go ahead with the sale. You can start by filing a lawsuit known as a partition action in the Arkansas probate court.

If you don't have a Will, the default order of descent goes like this: (1) full blood and adopted children of the decedent, subject to any dower, curtesy, and homestead interest of a spouse; (2) if no full blood or adopted children, then everything to a spouse of greater than three years or half of everything plus ...

At your death, the real estate goes automatically to the person you named to inherit it (your "grantee" or "beneficiary"), without the need for probate court proceedings. (Ark. Code Ann. § 18-12-608.)

If you later change your mind about who you want to inherit the property, you are not locked in. You have two options: (1) sign and record a revocation or (2) record another beneficiary deed, leaving the property to someone else. You cannot use your will to revoke or override a beneficiary deed.

It provides that insurance and annuity proceeds payable to a slayer as the beneficiary or an assignee of the policy shall be forfeited by the slayer, The funds would instead be paid to the the decedent's estate. The Arkansas definition of a "slayer" in section 18- 4- 202 of the Akansas code.

The Heir Property Act balances the rights of family members who want to retain their land with the rights of family members who want to sell. This became Arkansas law in February of 2015 and took effect January 1, 2016.