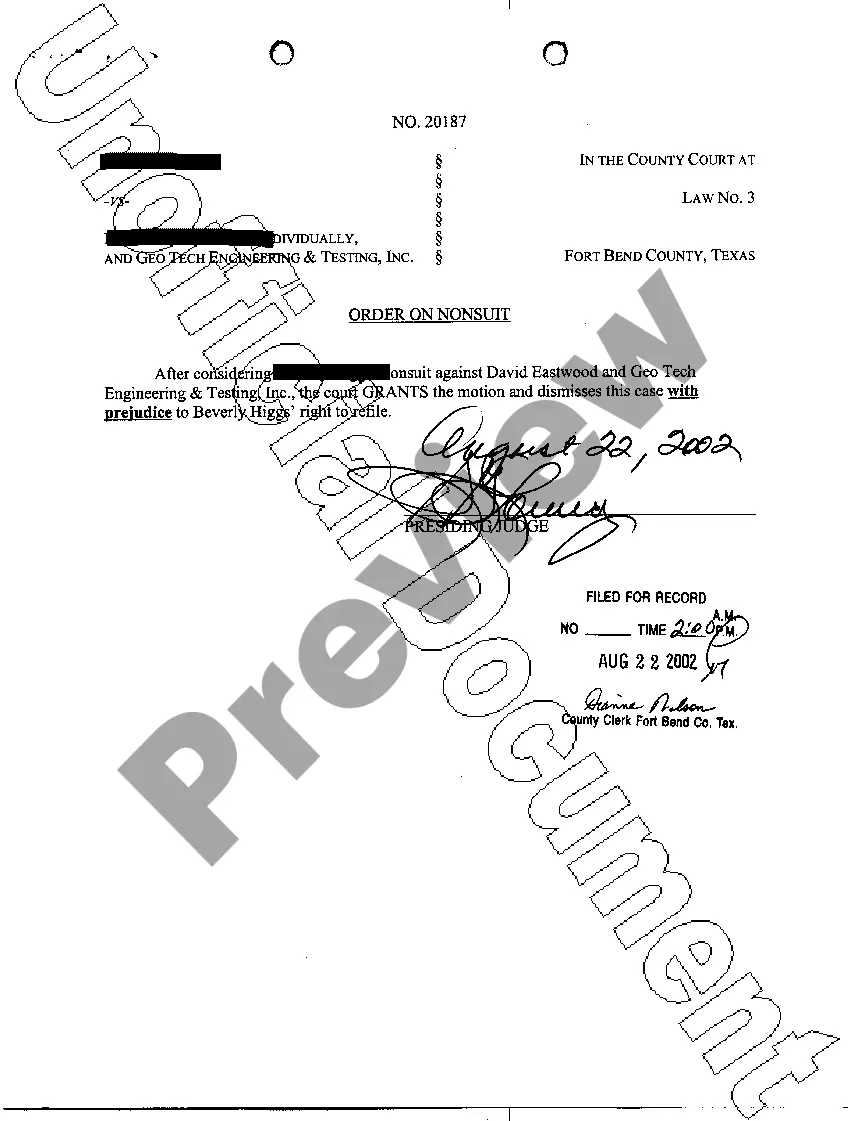

Arkansas Sample Letter for Attempt to Collect Debt before Acceleration

Description

How to fill out Sample Letter For Attempt To Collect Debt Before Acceleration?

US Legal Forms - one of many most significant libraries of lawful forms in the States - gives a wide range of lawful papers themes you are able to down load or produce. Utilizing the website, you may get a large number of forms for business and person purposes, categorized by classes, says, or keywords and phrases.You can find the newest versions of forms much like the Arkansas Sample Letter for Attempt to Collect Debt before Acceleration in seconds.

If you have a registration, log in and down load Arkansas Sample Letter for Attempt to Collect Debt before Acceleration in the US Legal Forms collection. The Acquire switch will show up on each type you look at. You have accessibility to all formerly downloaded forms inside the My Forms tab of your respective bank account.

If you would like use US Legal Forms initially, here are basic directions to help you started off:

- Be sure you have chosen the proper type for your town/area. Select the Preview switch to check the form`s content. Look at the type explanation to actually have chosen the appropriate type.

- If the type does not fit your specifications, take advantage of the Look for industry on top of the monitor to discover the one that does.

- Should you be happy with the form, verify your option by clicking the Acquire now switch. Then, choose the rates strategy you want and supply your qualifications to register on an bank account.

- Approach the financial transaction. Use your bank card or PayPal bank account to accomplish the financial transaction.

- Find the format and down load the form on your system.

- Make adjustments. Complete, change and produce and indicator the downloaded Arkansas Sample Letter for Attempt to Collect Debt before Acceleration.

Each and every design you included with your account lacks an expiration time and is your own property forever. So, in order to down load or produce yet another copy, just proceed to the My Forms portion and click on in the type you need.

Obtain access to the Arkansas Sample Letter for Attempt to Collect Debt before Acceleration with US Legal Forms, one of the most extensive collection of lawful papers themes. Use a large number of expert and state-particular themes that meet your organization or person needs and specifications.

Form popularity

FAQ

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

Hi [Contact Point's Name], We hope this email finds you well. This is a friendly reminder from [Name of Your Business] that your payment of [invoice amount] for Invoice [number] is due today. If you have any questions or concerns regarding your payment, do let us know.

A collection letter is a written notification to inform a consumer of his due payments. It is an official message to a borrower. A collection letter may include reminders, inquiries, warnings or notification of possible legal actions.

Frequently Asked Questions (FAQ) Type your letter. ... Concisely review the main facts. ... Be polite. ... Write with your goal in mind. ... Ask for exactly what you want. ... Set a deadline. ... End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

Dear [Client name], We're sending you this letter as a friendly reminder that your account in the amount of [amount due to you] is past due. Your invoice was due on [month, day and year their payment was originally due as stated in their invoice]. This payment is now [number of days since the due date] past due.

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

The third collection letter should include the following information: Mention of all previous attempts to collect. Invoice number and amount. Original invoice due date. Current days past due. Instructions on what they should do next. A warning of the impending consequences.