Arkansas Sample Basic Partnership Agreement

Description

How to fill out Sample Basic Partnership Agreement?

You can devote hours online searching for the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by professionals.

You can easily download or print the Arkansas Sample Basic Partnership Agreement from our service.

If available, use the Preview option to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, modify, print, or sign the Arkansas Sample Basic Partnership Agreement.

- Each legal document template you download is yours for an indefinite period.

- To obtain an additional copy of any downloaded form, navigate to the My documents section and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your county/city of choice.

- Review the form description to confirm you have chosen the right one.

Form popularity

FAQ

Three common examples of partnerships include general partnerships, limited partnerships, and limited liability partnerships. In a general partnership, all partners share responsibilities and liabilities equally. A limited partnership has at least one general partner and one limited partner who is usually an investor. Lastly, a limited liability partnership protects partners from personal liability, similar to a corporation. Each example highlights the diversity of partnership structures, and an Arkansas Sample Basic Partnership Agreement can cater to various needs.

An Arkansas LLC operating agreement is a legal document that outlines the internal operations of a company and protects individual members' stake. The document also offers tax advantages to the business and its contributing members.

A partnership agreement is the legal document that dictates the way a business is run and details the relationship between each partner.

A partnership operating agreement is a document that outlines the roles, responsibilities, and rights of the owners and managers of a partnership. It states the rules and regulations governing many aspects of the organization, ranging from voting powers to profit and loss distribution.

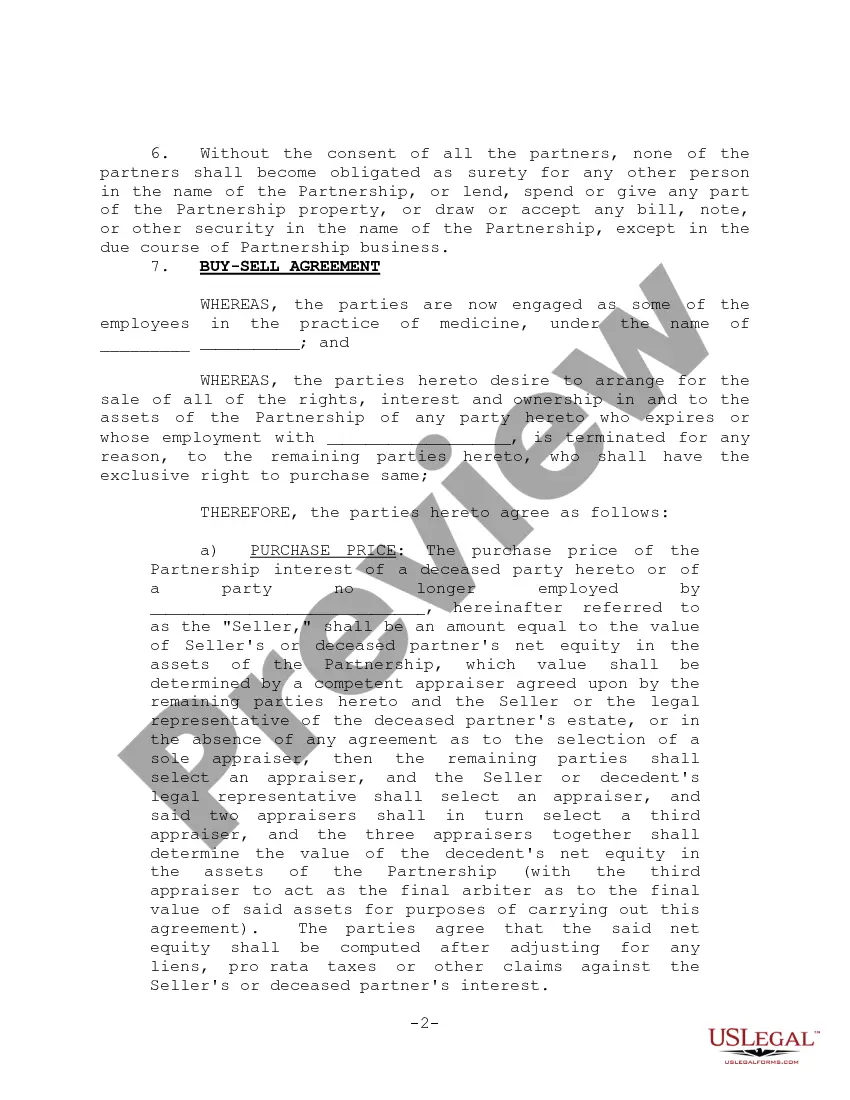

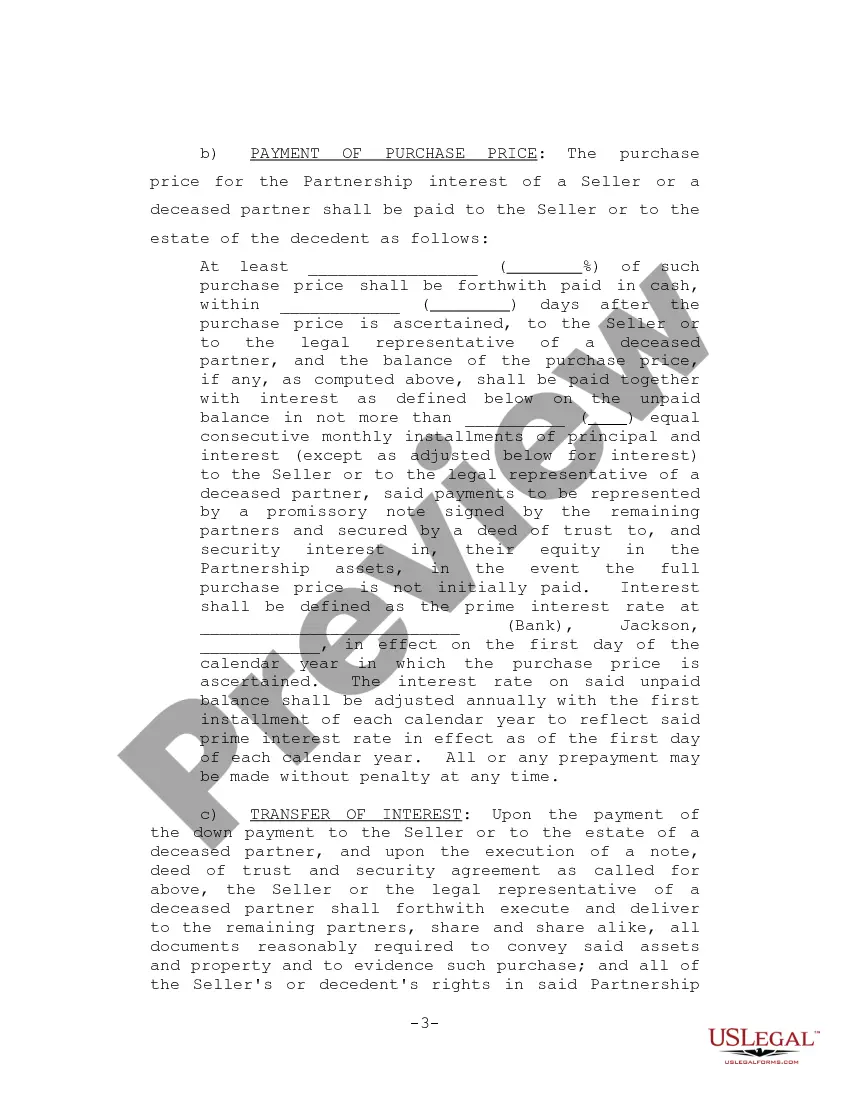

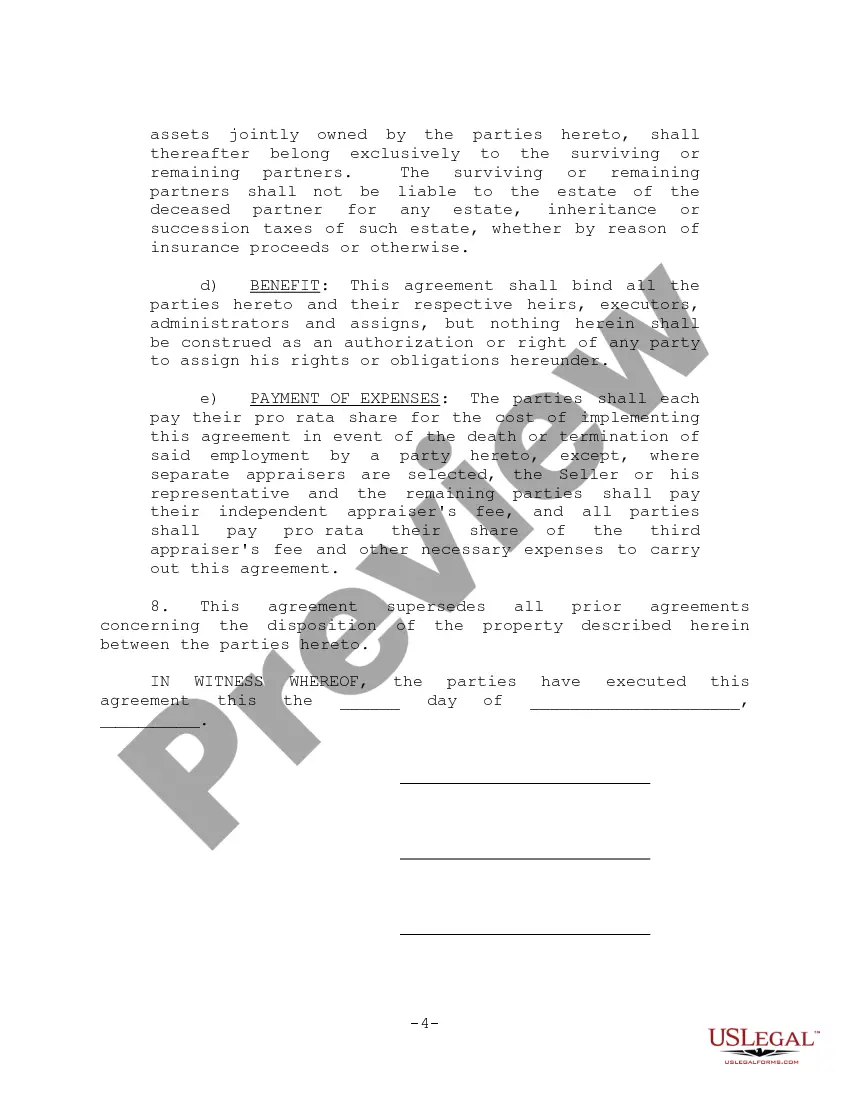

What to include in your partnership agreementName of the partnership.Contributions to the partnership.Allocation of profits, losses, and draws.Partners' authority.Partnership decision-making.Management duties.Admitting new partners.Withdrawal or death of a partner.More items...

It's ultimately up to you and the partners to decide how to create the partnership agreement. It's a legal contract, so it should be worded as such, and signed by all parties. You can choose an online template, create one yourself or speak to an attorney to draw up the contract.

Company name, status, and duration.Liability of the partners.Number of owners/control of the business.Capital.Management, decision-making and binding the partnership.Dissolution.Death and disability.Transfer of partnership interests.More items...?

Every Arkansas LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?