An Arkansas LLC Operating Agreement for a Married Couple is a legally binding agreement that outlines the rights, responsibilities, and duties of a married couple who operate a limited liability company (LLC) together in the state of Arkansas. This agreement is specifically tailored to meet the unique needs and circumstances of a married couple running a business together. The primary purpose of an LLC Operating Agreement is to establish clear guidelines for decision-making, profit distribution, management responsibilities, and dispute resolution within the business. It outlines the roles each spouse will play in the operation of the LLC and contains provisions that protect the couple's personal assets in case the business faces legal or financial challenges. There may be different types or variations of Arkansas LLC Operating Agreements for Married Couples, depending on various factors such as the nature of the business, the couple's individual preferences, and their specific goals. Some of these types may include: 1. Partnership-Style Operating Agreement: This type of agreement outlines a more equal partnership between the spouses, where they both have equal decision-making authority and share profits and losses equally. 2. Manager-Managed Operating Agreement: In this agreement, one spouse assumes the role of the LLC manager, responsible for managing day-to-day operations, while the other spouse takes a less involved role. Profit distribution and decision-making authority may be structured to reflect the differing responsibilities. 3. Silent Partner Operating Agreement: In this arrangement, one spouse plays a more passive role as a silent partner, contributing funds or assets to the business, while the other spouse assumes all management and decision-making responsibilities. Regardless of the type of Arkansas LLC Operating Agreement for a Married Couple, it is important to consider essential elements such as capital contributions, percentage ownership, profit distribution, management structure, voting rights, buyout provisions, and dispute resolution mechanisms. These agreements serve as a crucial tool in protecting the interests of both spouses and maintaining a harmonious business relationship. If you and your spouse are considering forming an LLC in Arkansas, it is highly advisable to consult with a qualified attorney who specializes in business law to ensure that your operating agreement is properly drafted, taking into account both state and federal regulations.

Arkansas LLC Operating Agreement for Married Couple

Description

How to fill out Arkansas LLC Operating Agreement For Married Couple?

It is possible to invest hours online trying to find the authorized file format that suits the federal and state demands you require. US Legal Forms offers thousands of authorized forms that happen to be examined by professionals. You can easily download or printing the Arkansas LLC Operating Agreement for Married Couple from our assistance.

If you currently have a US Legal Forms profile, you are able to log in and then click the Download button. Afterward, you are able to total, modify, printing, or indicator the Arkansas LLC Operating Agreement for Married Couple. Each and every authorized file format you get is the one you have permanently. To get one more version associated with a bought type, check out the My Forms tab and then click the related button.

If you use the US Legal Forms site for the first time, adhere to the easy instructions beneath:

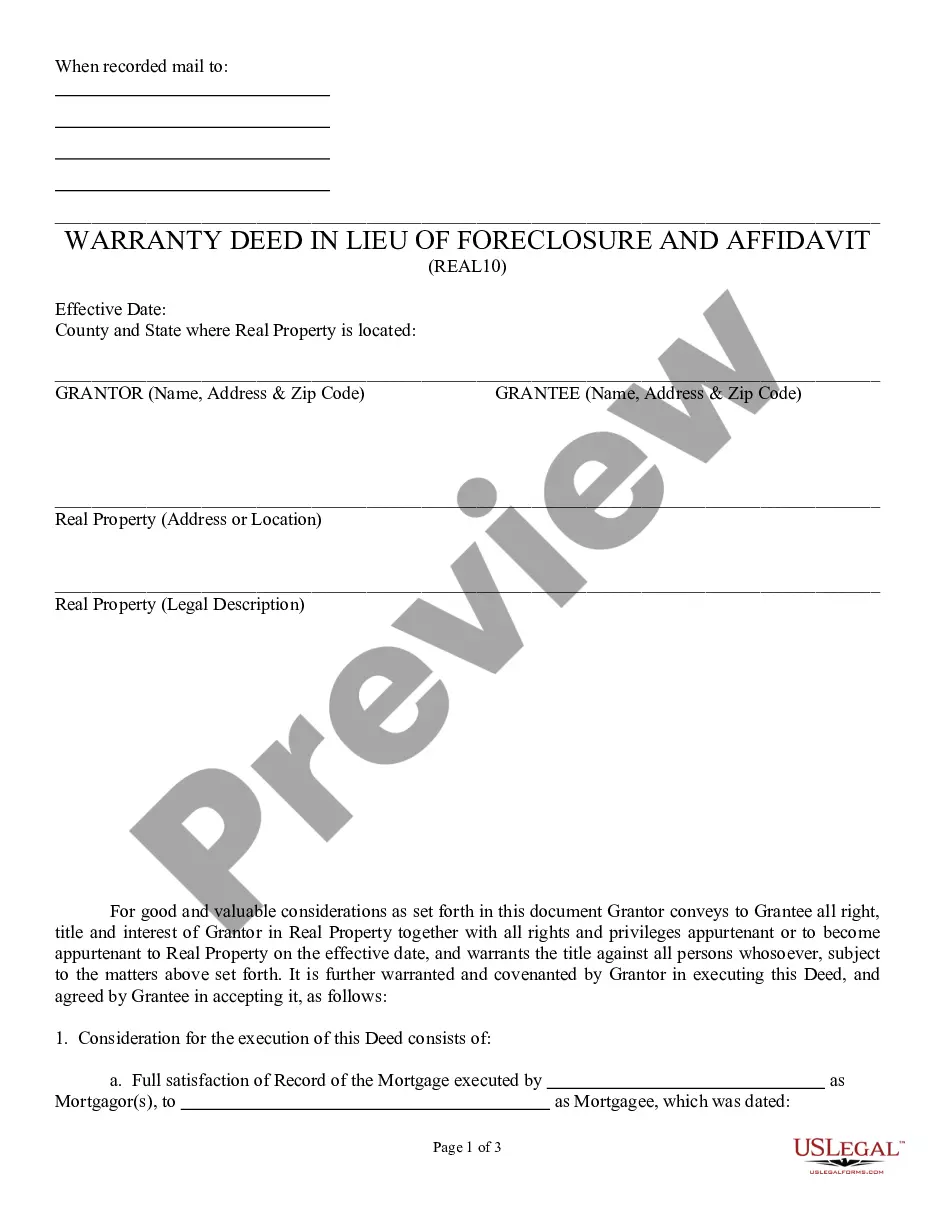

- Very first, make sure that you have chosen the correct file format for that state/area that you pick. Look at the type outline to ensure you have chosen the appropriate type. If available, make use of the Preview button to look through the file format as well.

- If you wish to get one more edition of your type, make use of the Search field to obtain the format that fits your needs and demands.

- When you have discovered the format you would like, click on Get now to proceed.

- Choose the prices strategy you would like, enter your references, and sign up for a free account on US Legal Forms.

- Total the deal. You can utilize your credit card or PayPal profile to fund the authorized type.

- Choose the formatting of your file and download it to the product.

- Make changes to the file if required. It is possible to total, modify and indicator and printing Arkansas LLC Operating Agreement for Married Couple.

Download and printing thousands of file web templates using the US Legal Forms web site, that provides the greatest variety of authorized forms. Use specialist and status-specific web templates to tackle your business or specific demands.