Arkansas Sample Letter for Finalization of Accounting

Description

How to fill out Sample Letter For Finalization Of Accounting?

Are you presently within a position that you require paperwork for both enterprise or personal reasons just about every working day? There are plenty of legitimate file themes accessible on the Internet, but finding versions you can rely on is not easy. US Legal Forms provides thousands of kind themes, much like the Arkansas Sample Letter for Finalization of Accounting, that happen to be written to fulfill federal and state specifications.

If you are previously informed about US Legal Forms site and get an account, simply log in. After that, you may down load the Arkansas Sample Letter for Finalization of Accounting template.

Unless you provide an account and would like to begin using US Legal Forms, adopt these measures:

- Obtain the kind you want and ensure it is for that appropriate town/region.

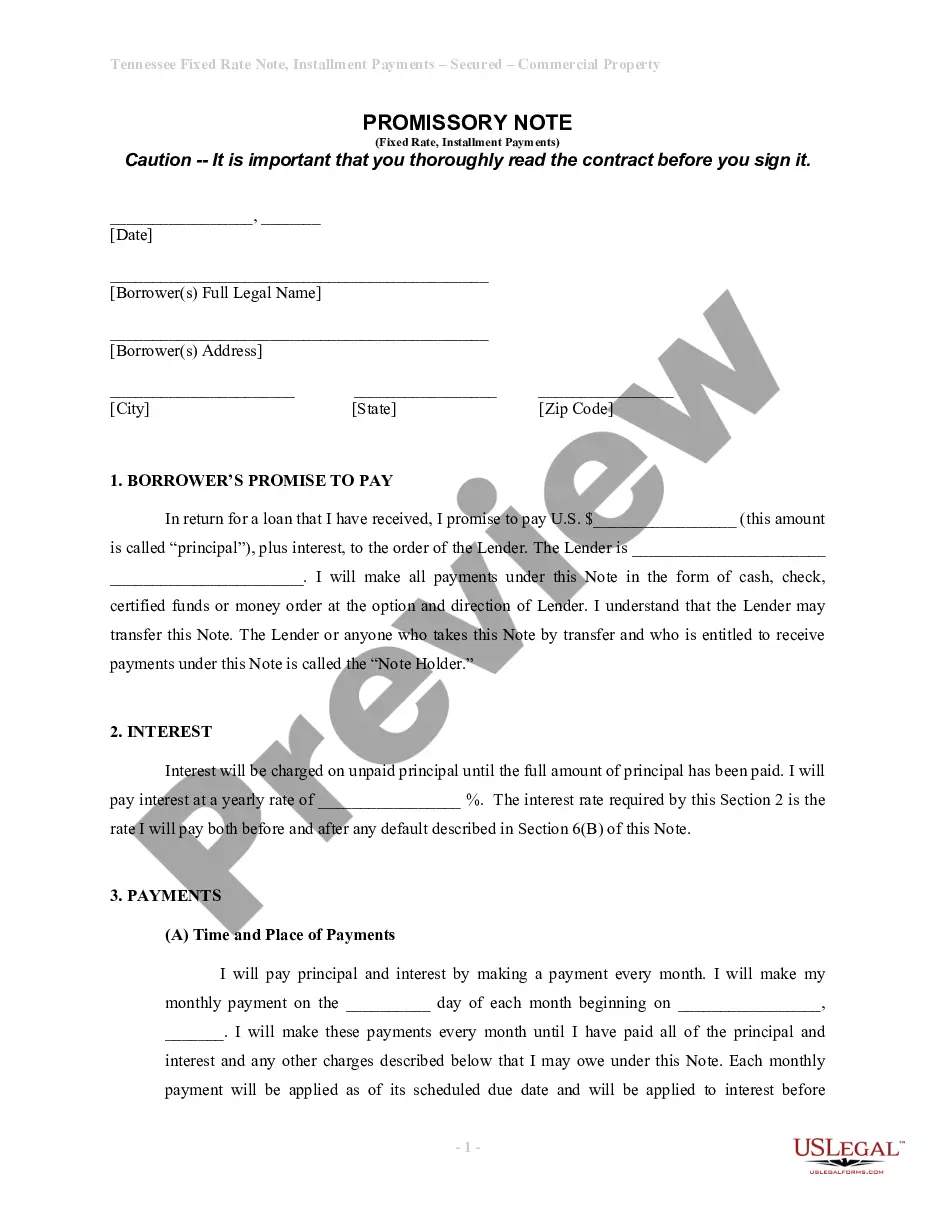

- Make use of the Preview key to check the form.

- Look at the explanation to ensure that you have selected the right kind.

- When the kind is not what you are trying to find, utilize the Search area to find the kind that meets your requirements and specifications.

- Whenever you discover the appropriate kind, click on Purchase now.

- Choose the prices strategy you want, fill out the required information to produce your money, and pay money for the order using your PayPal or Visa or Mastercard.

- Pick a hassle-free paper structure and down load your backup.

Locate every one of the file themes you have bought in the My Forms menus. You can obtain a more backup of Arkansas Sample Letter for Finalization of Accounting anytime, if necessary. Just go through the required kind to down load or print the file template.

Use US Legal Forms, by far the most extensive assortment of legitimate forms, to save efforts and stay away from errors. The assistance provides skillfully created legitimate file themes that you can use for a variety of reasons. Make an account on US Legal Forms and start producing your life easier.