Subject: Arkansas Sample Letter for Estate — Correspondence from Attorney Dear [Recipient's Name], I hope this letter finds you well. As an attorney specializing in estate planning and administration, I am writing to provide you with a detailed description of Arkansas Sample Letters for Estate — Correspondence. These letters play a crucial role in legal proceedings related to a deceased person's estate and aim to communicate important information, requests, or updates between the attorney and the involved parties. Arkansas Sample Letters for Estate — Correspondence from Attorney may vary in type and purpose. Let's look at a few common types: 1. Letter of Appointment: This letter is typically sent by the attorney representing the estate to inform the appointed executor or administrator of their designated role. It includes essential details, such as the court's approval of their appointment, their responsibilities, and the need to engage in further legal processes. 2. Beneficiary Notification: When someone is named as a beneficiary in a deceased individual's will or estate plan, this letter informs them of their entitlement. It may include details about the deceased, the nature of their inheritance, and instructions on how the beneficiary should proceed. 3. Debt Collection: In situations where the deceased owed outstanding debts, the attorney may send letters to creditors, lenders, or debt collection agencies. These letters typically request a comprehensive statement of all debts and provide instructions regarding the legal procedures for collecting and resolving outstanding amounts. 4. Notice to Creditors: This letter is sent by the attorney to creditors with claims against the estate. It serves to notify them of the individual's passing and provides a deadline within which they must submit their claims. The letter may outline the necessary documentation or forms that creditors should complete to ensure consideration. 5. Estate Account Administration: Estate administration involves managing the assets and finances of the deceased individual. Attorneys may correspond with financial institutions, such as banks or brokerage firms, to update account ownership details, transfer assets, or request necessary forms to facilitate the estate's management and distribution. Please note that the content and legal requirements of each Arkansas Estate letter can vary depending on specific circumstances and local regulations. It is advisable to consult with an attorney to ensure compliance. If you have any questions about the contents of this letter or any aspect related to the probate process in Arkansas, please feel free to reach out to our office. We are here to provide you with the necessary guidance and legal support. Sincerely, [Your Name] [Your Title/Position] [Attorney's Office Name] [Address] [Phone Number] [Email Address]

Arkansas Sample Letter for Estate - Correspondence from Attorney

Description

How to fill out Arkansas Sample Letter For Estate - Correspondence From Attorney?

If you need to comprehensive, download, or printing legal papers templates, use US Legal Forms, the greatest variety of legal types, that can be found online. Take advantage of the site`s easy and handy search to discover the papers you require. Numerous templates for enterprise and specific functions are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Arkansas Sample Letter for Estate - Correspondence from Attorney with a handful of clicks.

When you are presently a US Legal Forms client, log in for your accounts and click on the Down load button to obtain the Arkansas Sample Letter for Estate - Correspondence from Attorney. You can also accessibility types you previously saved inside the My Forms tab of your own accounts.

If you use US Legal Forms the first time, follow the instructions beneath:

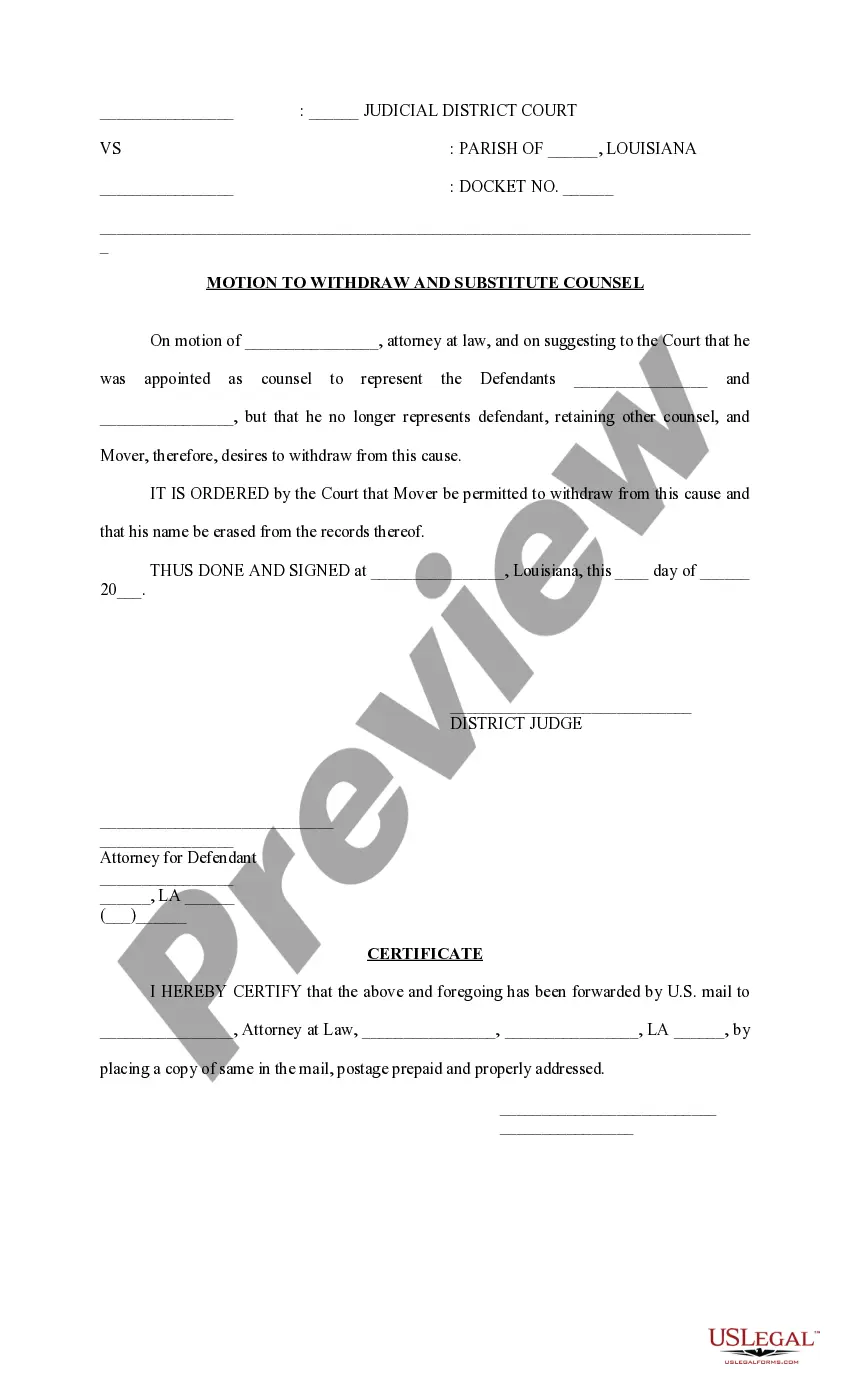

- Step 1. Be sure you have chosen the shape for your correct area/country.

- Step 2. Make use of the Review option to examine the form`s articles. Don`t neglect to learn the explanation.

- Step 3. When you are not satisfied using the form, utilize the Look for discipline near the top of the monitor to find other models from the legal form design.

- Step 4. After you have discovered the shape you require, go through the Buy now button. Select the pricing plan you like and add your references to sign up on an accounts.

- Step 5. Method the financial transaction. You can utilize your credit card or PayPal accounts to accomplish the financial transaction.

- Step 6. Pick the formatting from the legal form and download it on the product.

- Step 7. Full, edit and printing or indicator the Arkansas Sample Letter for Estate - Correspondence from Attorney.

Each legal papers design you get is your own forever. You might have acces to each form you saved inside your acccount. Select the My Forms area and pick a form to printing or download again.

Contend and download, and printing the Arkansas Sample Letter for Estate - Correspondence from Attorney with US Legal Forms. There are millions of professional and status-distinct types you may use for your enterprise or specific needs.