Arkansas Sample Letter for Tax Return for Supplement

Description

How to fill out Sample Letter For Tax Return For Supplement?

Are you presently in the position that you will need files for either company or person functions just about every day? There are tons of authorized document layouts accessible on the Internet, but getting ones you can trust isn`t simple. US Legal Forms gives a huge number of form layouts, like the Arkansas Sample Letter for Tax Return for Supplement, which can be published to fulfill state and federal needs.

If you are already informed about US Legal Forms website and possess a free account, basically log in. Afterward, you can acquire the Arkansas Sample Letter for Tax Return for Supplement design.

If you do not come with an profile and need to begin using US Legal Forms, adopt these measures:

- Obtain the form you want and make sure it is for your correct area/county.

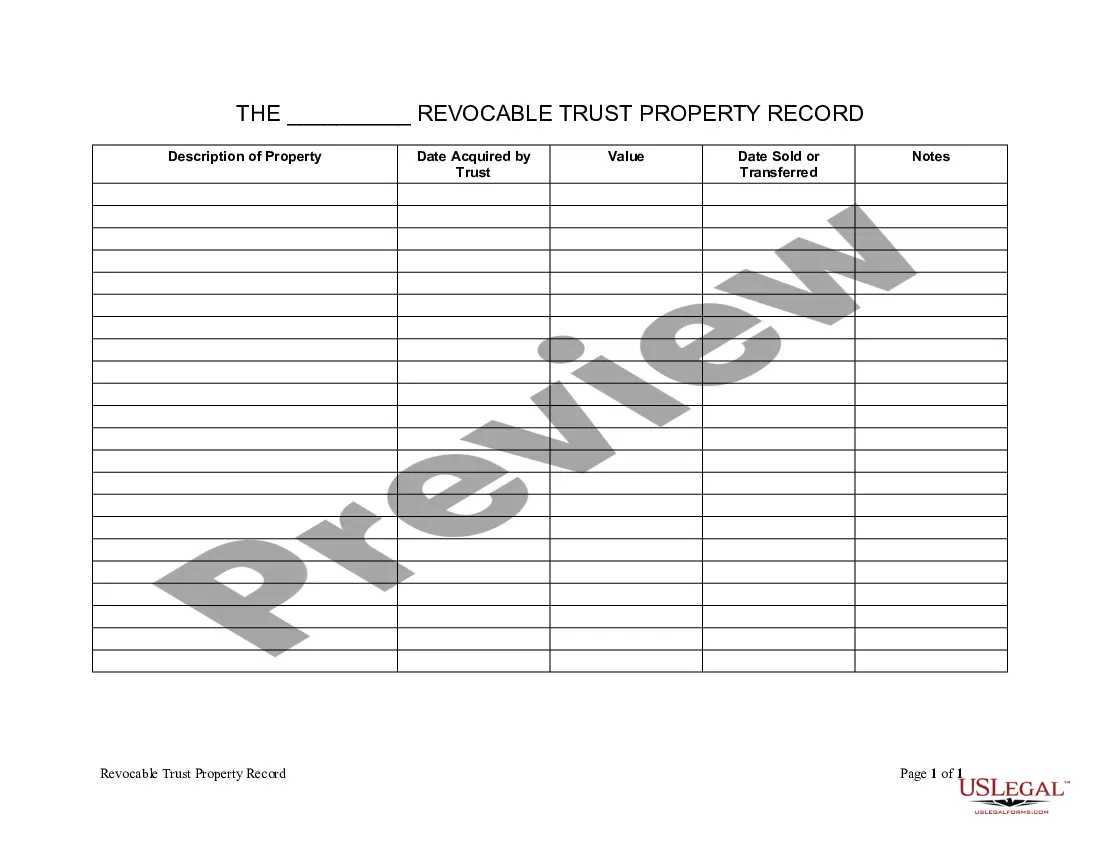

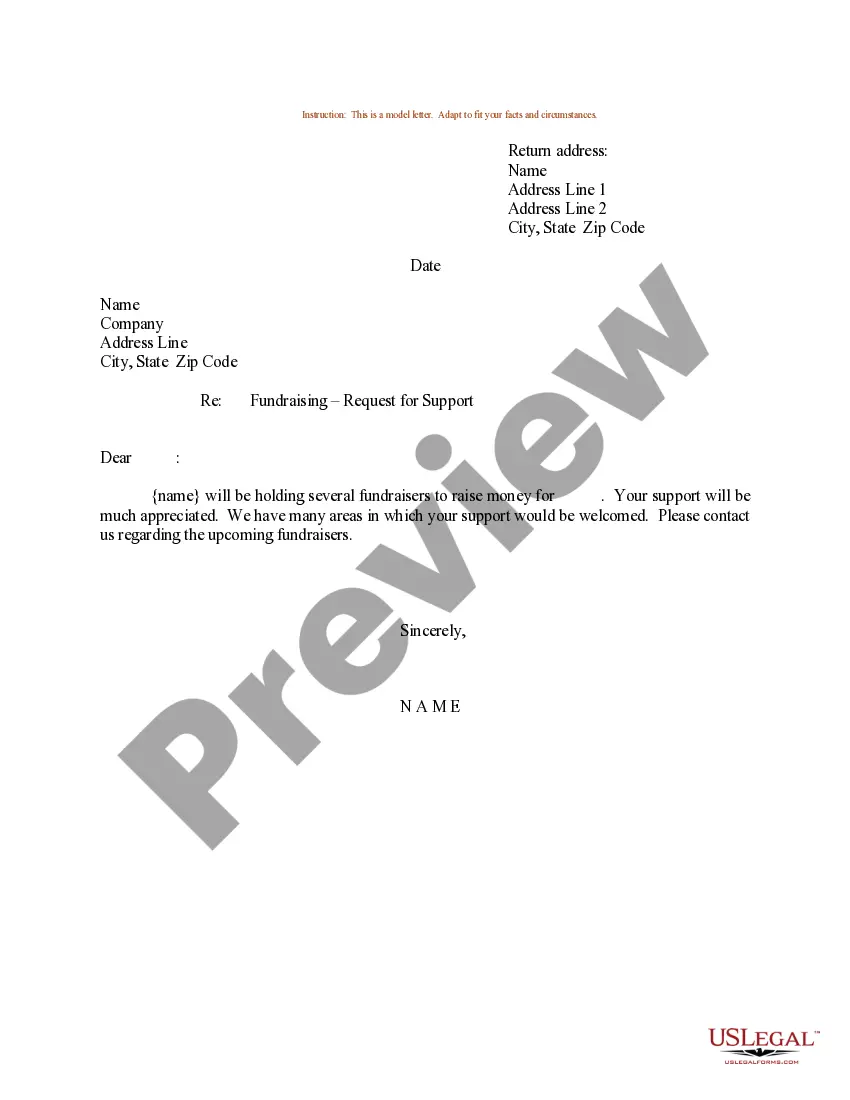

- Utilize the Preview button to review the shape.

- Browse the explanation to actually have selected the correct form.

- In case the form isn`t what you are looking for, utilize the Look for discipline to get the form that meets your needs and needs.

- Whenever you obtain the correct form, click Purchase now.

- Pick the costs prepare you desire, fill out the necessary details to produce your money, and purchase your order with your PayPal or Visa or Mastercard.

- Choose a convenient data file file format and acquire your copy.

Get each of the document layouts you may have purchased in the My Forms menus. You can get a additional copy of Arkansas Sample Letter for Tax Return for Supplement at any time, if possible. Just click on the essential form to acquire or produce the document design.

Use US Legal Forms, by far the most extensive assortment of authorized types, to save time as well as prevent blunders. The services gives expertly produced authorized document layouts which can be used for an array of functions. Make a free account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

Arkansas State Income Tax Forms for the current Tax Year can be e-Filed in conjunction with a IRS Income Tax Return. Details on how to only prepare and print an Arkansas Tax Return. Prior back taxes forms can no longer be e-Filed. You can complete the forms with the help of eFile.com free tax calculators.

Any taxpayer age 65 or over not claiming a retirement income exemption on Line 18 is eligible for an additional $29 (per taxpayer) tax credit. Check the box(es) marked ?65 Special?.

No matter what type of business license or permit you might need, you're going to need a tax ID before you apply for one. Your tax ID is an initial prerequisite before your business can be approved for any of those licenses and permits, so it's a good idea to get it before you begin those application processes.

You can request copies of previously filed Arkansas individual income tax returns by completing form AR4506 and returning it to our office with a check or money order (copies are $2.00 per year). Please allow 4 to 6 weeks to receive your copies.

Employee's State Withholding Exemption Certificate (Form AR4EC)

For REFUND RETURN: Arkansas State Income Tax, P.O. Box 1000, Little Rock, AR 72203-1000; For TAX DUE RETURN: Arkansas State Income Tax, P.O. Box 2144, Little Rock, AR 72203-2144; For NO TAX DUE RETURN: Arkansas State Income Tax, P.O. Box 2144, Little Rock, AR 72203-2144.

The state of Arkansas requires you to pay taxes if you're a resident or nonresident that receives income from an Arkansas source. The state income tax rates range up to 5.9%, and the sales tax rate is 6.5%.

Apply by submitting a copy of the IRS Determination Letter, the first two pages of IRS Form 1023, and a statement declaring exemption under ACA 26-51-303 or ACA 26-51-309. Organizations without an IRS Determination Letter should submit Form AR1023CT, a copy of the articles of incorporation, and a copy of the bylaws.