Arkansas Breakdown of Savings for Budget and Emergency Fund: In Arkansas, understanding the importance of financial planning and building a robust savings strategy is crucial. One integral aspect of financial planning is creating a breakdown of savings for both budgeting and emergency fund purposes. By allocating specific amounts to different categories, individuals and families in Arkansas can ensure they are prepared for unexpected expenses while also staying on track with their monthly budget. The breakdown of savings typically includes various categories to cover a range of financial needs. These categories may differ based on individual circumstances, but some common ones include: 1. Emergency Fund: An emergency fund serves as a safety net for unforeseen circumstances such as medical emergencies, car repairs, or sudden unemployment. Experts recommend setting aside three to six months' worth of living expenses in this fund. This ensures that Arkansas residents can handle unexpected events without resorting to high-interest loans or credit card debt. 2. Monthly Living Expenses: Another important category is allocating savings for monthly living expenses. This includes budgeting for groceries, utilities, rent or mortgage payments, transportation costs, and any other recurring bills. By having a separate savings account dedicated to covering these expenses, Arkansans can avoid dipping into their emergency fund unnecessarily. 3. Long-Term Goals: Savings for long-term goals is crucial to achieving financial stability. This may include saving for a down payment on a house, education expenses, retirement, or any other significant expenses. Setting aside a portion of the overall savings to invest in future plans can greatly benefit individuals and families in Arkansas. 4. Debt Repayment: For those dealing with existing debts, it's important to allocate a portion of savings to debt repayment. This could include credit card debt, student loans, or any other outstanding balances. Prioritizing debt repayment through savings can help improve credit scores and free up more funds for future financial goals. 5. Fun and Leisure: It is equally important to set aside a portion of savings for leisure activities or unexpected expenses that bring joy and relaxation to Arkansans. This category can be tailored to personal preferences and may include activities like vacations, hobbies, or dining out. By breaking down savings into these different categories, Arkansas residents can create a more comprehensive and manageable financial plan. It ensures they are prepared for emergencies while also actively working towards their long-term financial goals. It is important to review and adjust this breakdown periodically to adapt to changing circumstances and financial needs.

Arkansas Breakdown of Savings for Budget and Emergency Fund

Description

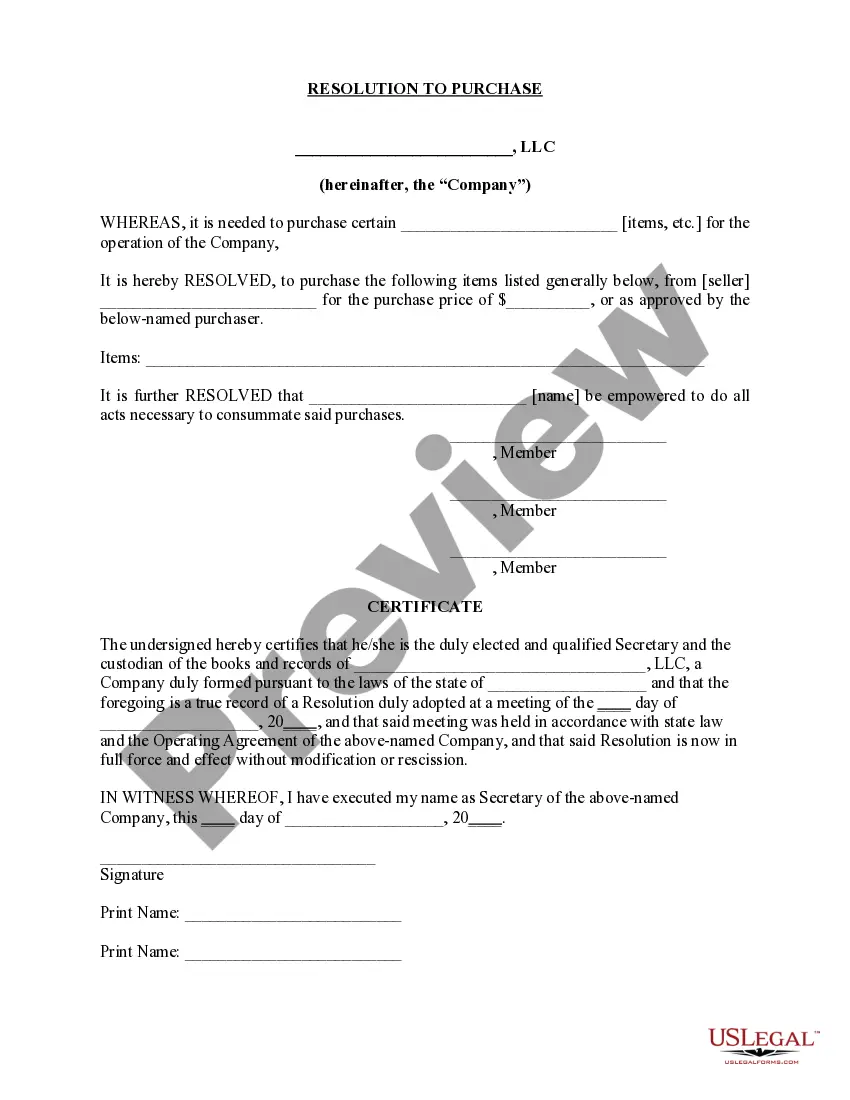

How to fill out Arkansas Breakdown Of Savings For Budget And Emergency Fund?

Choosing the best legitimate record design can be quite a have a problem. Of course, there are a lot of web templates available on the Internet, but how do you obtain the legitimate develop you want? Make use of the US Legal Forms site. The service offers a large number of web templates, including the Arkansas Breakdown of Savings for Budget and Emergency Fund, which you can use for business and personal requires. Each of the types are checked out by professionals and meet state and federal demands.

In case you are currently listed, log in for your accounts and then click the Obtain key to get the Arkansas Breakdown of Savings for Budget and Emergency Fund. Utilize your accounts to check from the legitimate types you possess purchased formerly. Proceed to the My Forms tab of the accounts and have yet another copy of the record you want.

In case you are a fresh customer of US Legal Forms, allow me to share simple directions that you can follow:

- Initial, ensure you have selected the right develop to your area/county. It is possible to check out the form making use of the Preview key and study the form description to make certain it is the right one for you.

- In case the develop will not meet your preferences, use the Seach industry to get the right develop.

- When you are certain that the form is acceptable, click the Acquire now key to get the develop.

- Opt for the pricing program you want and enter the needed information. Create your accounts and buy your order utilizing your PayPal accounts or charge card.

- Opt for the submit format and obtain the legitimate record design for your product.

- Full, edit and produce and sign the acquired Arkansas Breakdown of Savings for Budget and Emergency Fund.

US Legal Forms is the largest catalogue of legitimate types where you can find a variety of record web templates. Make use of the service to obtain professionally-created files that follow express demands.

Form popularity

FAQ

Emergency funds can really save the day if you need them, but it can be tough to know how much to save. According to a popular rule of thumb, you should aim for between three and six months' worth of expenses. But in some circumstances, you may want to save up to 12 months' of living expenses.

The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt. By regularly keeping your expenses balanced across these main spending areas, you can put your money to work more efficiently.

Like a retirement fund or college savings fund, an emergency fund is a type of savings fund. The purpose of an emergency fund is to provide enough money to cover high, unexpected costs or to prepare you for a major financial change.

The best place to keep your emergency fund (think three to six months of living expenses) is separate from your regular checking and savings accounts so it can be earmarked for emergencies only.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

The rule of thumb is that individuals should have enough in an emergency fund to cover three to six months of living expenses. Add up essential living expenses for one month and multiply that amount by either three or six (this will depend on how much you're most comfortable having in case of emergency).

What is the 50/30/20 rule? The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

It's recommended to have 3-6 months' worth of expenses saved in your emergency fund, to cover your monthly costs if you're out of work. However, if you're currently paying down debt, your emergency fund should be smaller, in the range of $2,500 to $5,000.

Emergency funds can really save the day if you need them, but it can be tough to know how much to save. According to a popular rule of thumb, you should aim for between three and six months' worth of expenses. But in some circumstances, you may want to save up to 12 months' of living expenses.

Bottom line. An emergency fund is the best way to save for unplanned events. It can eliminate the need for taking on credit card debt or taking out a personal loan. Putting your emergency savings in a high-yield savings account allows you to earn interest while you build your nest egg.