Arkansas Assignment of Contract as Security for Loan

Description

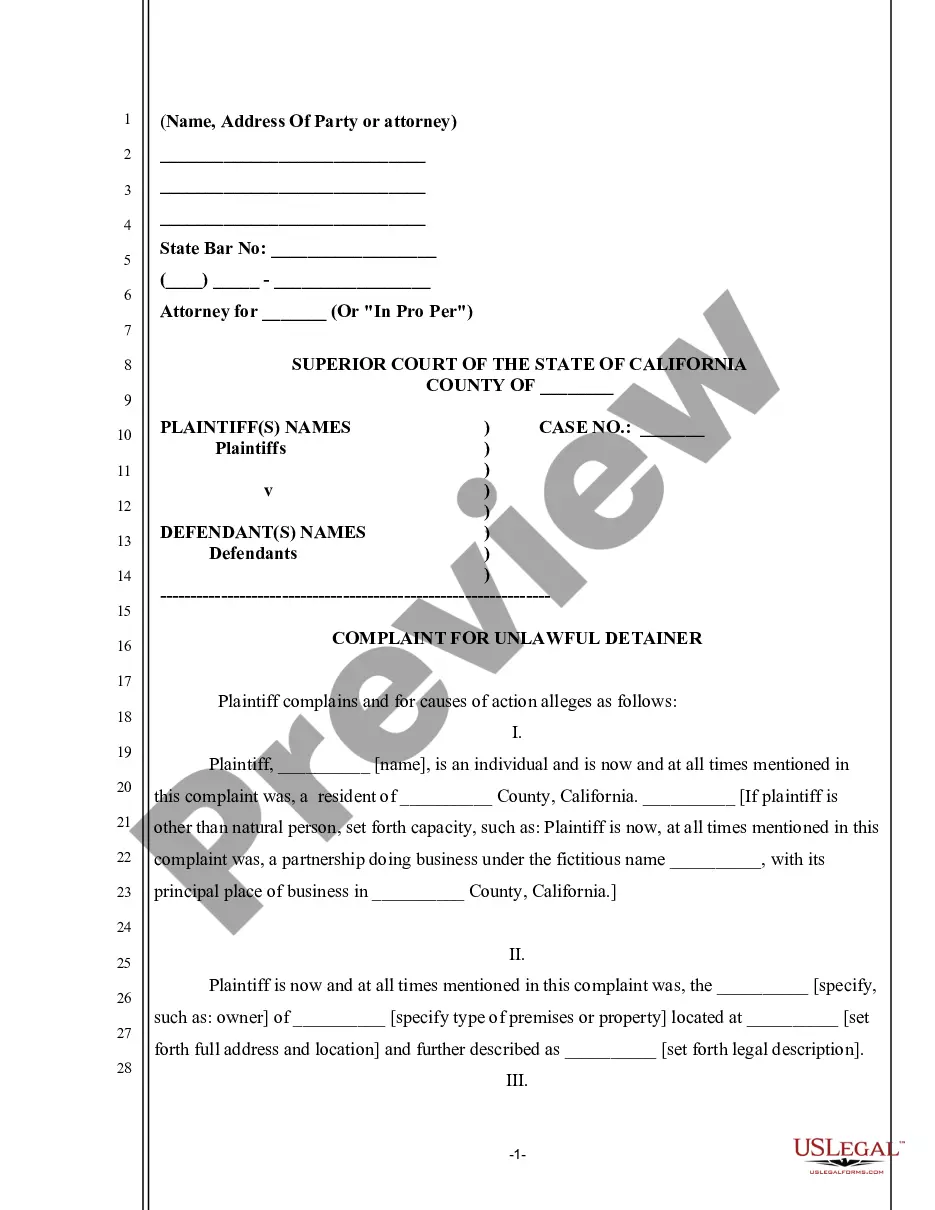

How to fill out Assignment Of Contract As Security For Loan?

Have you been within a position in which you require papers for sometimes organization or personal functions nearly every day time? There are plenty of legal papers themes accessible on the Internet, but discovering kinds you can trust is not simple. US Legal Forms offers thousands of form themes, such as the Arkansas Assignment of Contract as Security for Loan, which are written to meet federal and state specifications.

If you are presently acquainted with US Legal Forms web site and get a free account, just log in. Afterward, you can obtain the Arkansas Assignment of Contract as Security for Loan web template.

Unless you come with an account and want to start using US Legal Forms, follow these steps:

- Obtain the form you require and make sure it is for the proper area/state.

- Make use of the Preview key to review the form.

- Browse the explanation to ensure that you have chosen the right form.

- In the event the form is not what you`re looking for, use the Lookup field to get the form that meets your requirements and specifications.

- When you find the proper form, click on Get now.

- Select the rates plan you desire, submit the desired info to create your money, and pay for the transaction using your PayPal or Visa or Mastercard.

- Pick a practical document formatting and obtain your copy.

Find all the papers themes you might have bought in the My Forms menu. You can aquire a additional copy of Arkansas Assignment of Contract as Security for Loan any time, if needed. Just go through the needed form to obtain or print out the papers web template.

Use US Legal Forms, by far the most considerable selection of legal forms, to conserve efforts and prevent faults. The service offers professionally produced legal papers themes that can be used for an array of functions. Generate a free account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

Assignment is a legal term whereby an individual, the assignor, transfers rights, property, or other benefits to another known as the assignee. This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

A security agreement, in the law of the United States, is a contract that governs the relationship between the parties to a kind of financial transaction known as a secured transaction.

The assignment agreement is often seen in real estate but can occur in other contexts as well. An assignment is just the contractual transfer of benefits that will accrue or have accrued. Obligations don't transfer with the benefits of an assignment. The assignor will always keep the obligations.

While the financing statement should include the names of the secured party and the debtor (along with some indication of the collateral), it need not be authenticated or signed. The financing statement lacks several of the requirements attached to a security agreement, so it cannot serve as a valid substitute.

Security Assignment Agreement means a Global Assignment Agreement on the Global Assignment of Accounts Receivable, substantially in the form of EXHIBIT Q, entered into by the Subsidiary Borrower and the Administrative Agent for the benefit of the Lenders.

Assignment by way of security is a concept that comes up on many construction projects; typically as a condition of providing finance a funder will require an assignment by way of security of key construction documents, including building contracts and appointments, with the intention that if the borrower defaults on

The term 'assignment by way of charge only' is also often used. This just means that the security interest constitutes a charge, ie an encumbrance over the asset, rather than an assignment, ie a transfer of title to the chose in action (whether legal or beneficial) to the secured party.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.