Arkansas Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

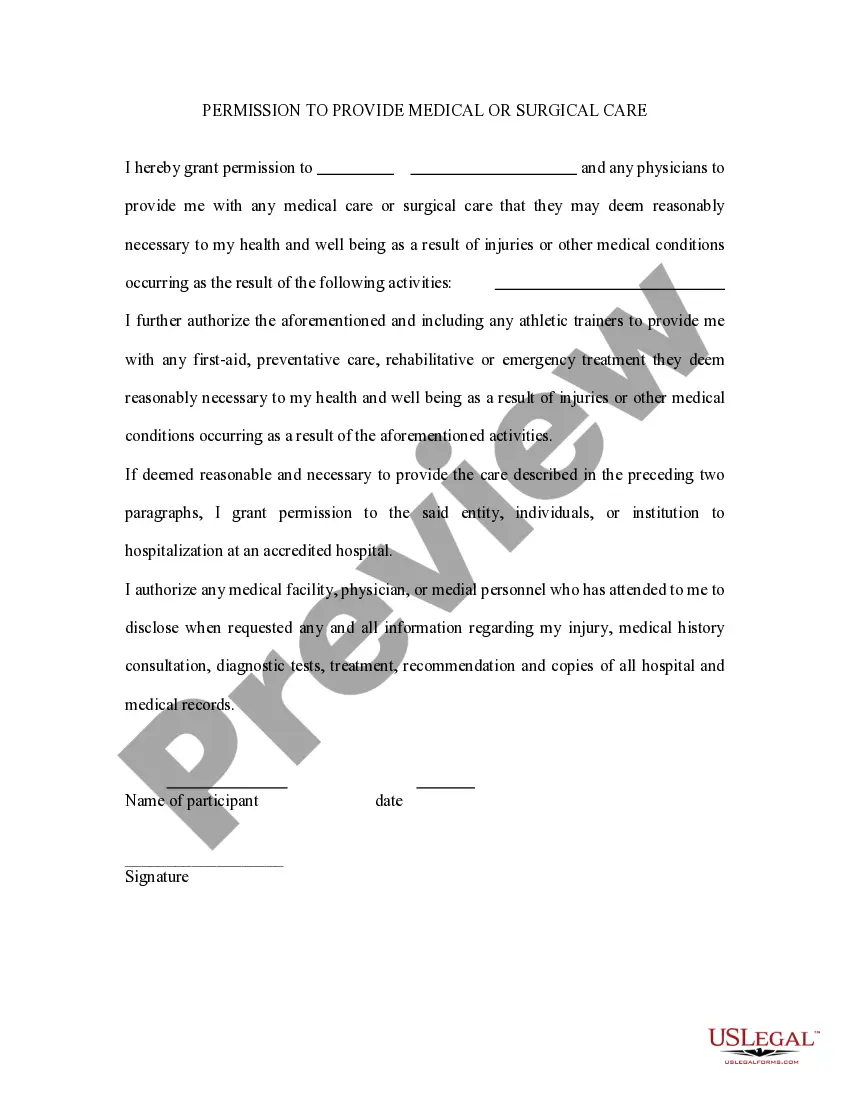

How to fill out Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

If you need to total, download, or print legitimate document web templates, use US Legal Forms, the greatest selection of legitimate types, which can be found online. Utilize the site`s simple and handy search to obtain the papers you want. A variety of web templates for organization and person uses are categorized by types and claims, or keywords and phrases. Use US Legal Forms to obtain the Arkansas Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss in just a handful of clicks.

If you are previously a US Legal Forms customer, log in to the bank account and then click the Down load button to have the Arkansas Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss. You can even entry types you in the past downloaded from the My Forms tab of your respective bank account.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for your right city/land.

- Step 2. Use the Review solution to look through the form`s information. Don`t forget to read through the information.

- Step 3. If you are unhappy using the kind, make use of the Research discipline near the top of the monitor to locate other variations in the legitimate kind web template.

- Step 4. Upon having identified the form you want, click on the Acquire now button. Select the prices strategy you favor and include your qualifications to register for the bank account.

- Step 5. Method the financial transaction. You should use your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Choose the structure in the legitimate kind and download it on your own product.

- Step 7. Total, modify and print or signal the Arkansas Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss.

Every single legitimate document web template you acquire is your own eternally. You have acces to every single kind you downloaded with your acccount. Select the My Forms segment and pick a kind to print or download yet again.

Be competitive and download, and print the Arkansas Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss with US Legal Forms. There are many expert and status-specific types you can use to your organization or person demands.