Arkansas Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is a legally binding document that outlines the terms and conditions between a company in Arkansas and a financial consultant engaged to provide services concerning financial matters and reporting. This agreement ensures that both parties understand their respective roles, responsibilities, and obligations throughout the consultancy engagement. The Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions typically includes the following key provisions: 1. Consultancy Scope: It defines the specific services the consultant will be providing, such as financial analysis, budgeting, forecasting, financial reporting, tax planning, or any other related financial activities. 2. Compensation: The agreement stipulates the consultant's compensation structure, which can be a fixed fee, hourly rate, commission-based, or milestone-based, depending on the nature of the engagement. It also includes payment terms and any additional expenses that may be reimbursed. 3. Term and Termination: This section outlines the duration of the consultancy engagement, specifying the start and end dates. It may also include provisions for early termination by either party and any related penalties or notice periods. 4. Confidentiality: Given the sensitivity of financial information, confidentiality provisions are crucial. These clauses ensure that the consultant keeps all company-related financial data and information confidential, prohibiting disclosure to any third parties without prior written consent. 5. Non-Competition and Non-Solicitation: To protect the company's interests, this provision restricts the consultant from engaging in similar consulting services with direct competitors or soliciting company clients or employees for a specified period after the termination of the agreement. 6. Intellectual Property: If the consultant develops any intellectual property during the engagement, it is essential to outline the ownership rights and any licensing arrangements agreed upon. 7. Indemnification: Both the company and consultant may seek indemnification from each other in case of any claims, losses, or damages arising from the consultancy engagement, thereby allocating risks appropriately. 8. Governing Law and Jurisdiction: This section identifies the applicable laws of Arkansas that govern the agreement and determines the jurisdiction where any disputes arising from the agreement will be resolved. There might be variations of this agreement depending on the specific services rendered or the preferences of the parties involved. It is essential to review and tailor the agreement to meet the unique needs of each consultancy engagement. Some of these variations may include specific provisions for tax consulting, financial audits, compliance-related services, or financial advisory services. Consultant agreements are crucial in ensuring a clear understanding between the company and the consultant while protecting the company's financial information and interests. Seeking legal advice and tailoring the agreement to individual circumstances is recommended to ensure compliance with Arkansas laws and regulations.

Arkansas Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions

Description

How to fill out Arkansas Consultant Agreement For Services Relating To Finances And Financial Reporting Of Company With Confidentiality Provisions?

Choosing the best legitimate papers format could be a have a problem. Of course, there are a variety of layouts available on the Internet, but how can you find the legitimate type you require? Utilize the US Legal Forms site. The assistance provides 1000s of layouts, including the Arkansas Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions, which can be used for organization and personal demands. All of the kinds are examined by experts and satisfy state and federal needs.

When you are previously authorized, log in in your profile and click the Acquire switch to find the Arkansas Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions. Make use of profile to check through the legitimate kinds you might have purchased previously. Check out the My Forms tab of your own profile and acquire an additional duplicate in the papers you require.

When you are a whole new end user of US Legal Forms, listed here are straightforward directions for you to follow:

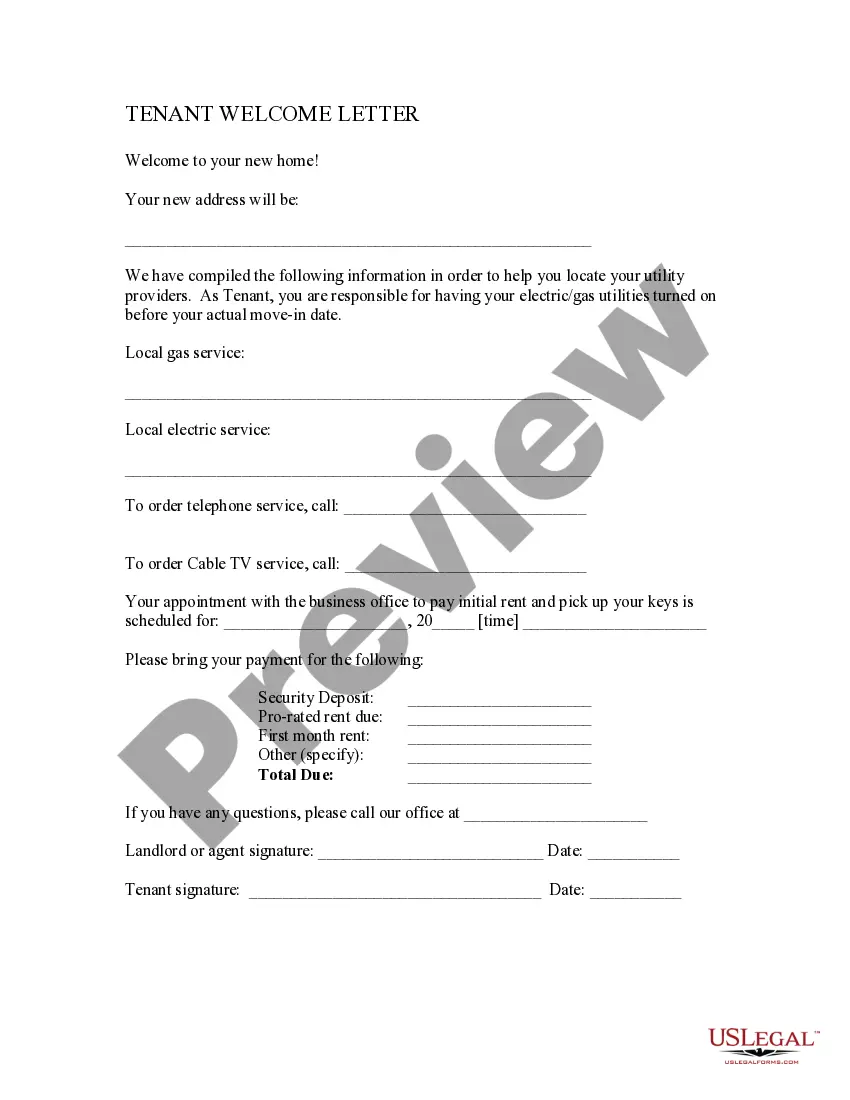

- Initially, make certain you have chosen the correct type for your city/area. You can look through the form making use of the Preview switch and browse the form explanation to ensure it is the right one for you.

- If the type does not satisfy your requirements, take advantage of the Seach discipline to obtain the proper type.

- Once you are certain the form is acceptable, select the Get now switch to find the type.

- Select the prices prepare you need and enter the required details. Build your profile and pay money for the order using your PayPal profile or Visa or Mastercard.

- Pick the file file format and down load the legitimate papers format in your device.

- Comprehensive, revise and printing and signal the obtained Arkansas Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions.

US Legal Forms is the greatest library of legitimate kinds in which you can discover various papers layouts. Utilize the company to down load skillfully-manufactured documents that follow condition needs.