Arkansas Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status In the state of Arkansas, businesses who engage independent sales representatives to promote and sell their computer software products must have a well-drafted agreement in place to ensure compliance with the Internal Revenue Service's (IRS) guidelines for determining independent contractor status. This detailed description will provide an overview of the necessary provisions that such an agreement should include. 1. Identification of Parties: The agreement begins by clearly identifying the parties involved, namely the independent sales representative (referred to as the "Representative") and the developer of computer software (referred to as the "Developer"). 2. Independent Contractor Relationship: It is crucial to state that the Representative is an independent contractor and not an employee of the Developer. This distinction is essential to satisfy the IRS's 20 part test for determining independent contractor status. 3. Nature of Services: The agreement should specify that the Representative's role is to promote, market, and sell the Developer's computer software products within a designated territory. It should outline the representative's responsibilities, such as attending trade shows, meeting potential clients, and providing product demonstrations. 4. Compensation: The agreement should detail how the Representative will be compensated for their services. This may include commissions based on sales, bonuses for meeting specific targets, or any other agreed-upon payment structure. The compensation terms should be fair, clearly defined, and compliant with relevant tax laws. 5. Territory: The agreement should clearly define the geographical area or territory within which the Representative has the right to sell the Developer's software products. This ensures that there are no overlaps or conflicts with other Representatives. 6. Non-Exclusive Agreement: If the agreement is non-exclusive, it should explicitly state that the Developer retains the right to sell their computer software products through other channels and Representative remains free to represent other companies as well. 7. Termination: The agreement should outline the conditions under which either party can terminate the agreement, including breach of contract, non-performance, or mutual agreement. It may also specify a notice period for termination, providing adequate time for both parties to transition. 8. Confidentiality and Non-Disclosure: To protect the Developer's proprietary information and trade secrets, the agreement should include provisions requiring the Representative to maintain confidentiality and refrain from disclosing any confidential information obtained during the course of the representation. 9. Indemnification: This section would specify that the Representative agrees to indemnify and hold the Developer harmless against any claims, losses, or damages arising from their actions during the course of their representation. 10. Dispute Resolution: The agreement may include a section outlining the process for resolving any disputes that may arise between the parties, such as through mediation or arbitration, rather than going to court. It is important to note that there may be variations of the Arkansas Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status based on industry-specific requirements or particularities. However, the aforementioned provisions should serve as a foundation for such agreements, enabling businesses to meet compliance requirements while engaging independent sales representatives in Arkansas.

Arkansas Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status

Description

How to fill out Arkansas Independent Sales Representative Agreement With Developer Of Computer Software With Provisions Intended To Satisfy The Internal Revenue Service's 20 Part Test For Determining Independent Contractor Status?

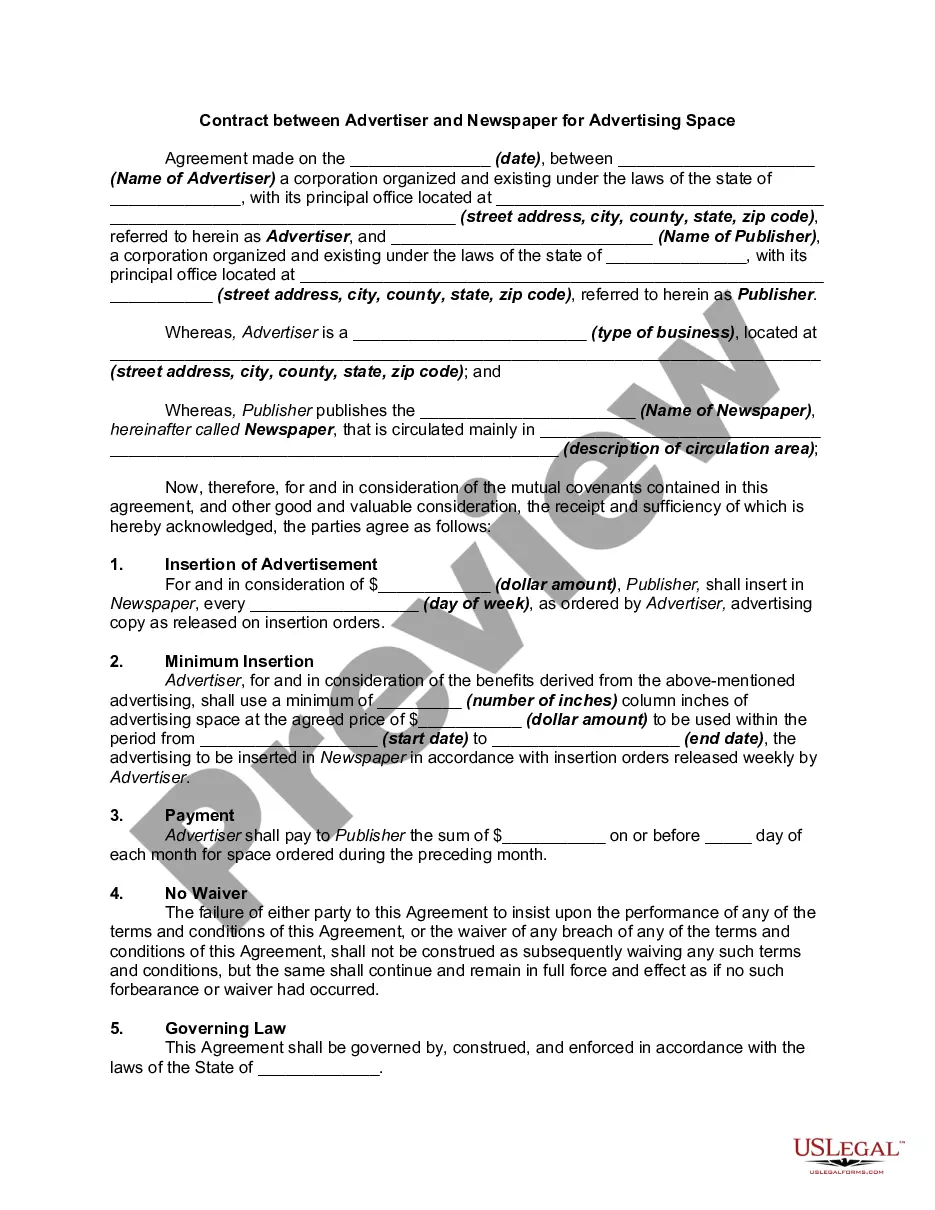

You may spend hours on-line trying to find the lawful file template that fits the state and federal needs you require. US Legal Forms gives a large number of lawful forms which can be analyzed by experts. It is possible to down load or print out the Arkansas Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status from our service.

If you already possess a US Legal Forms accounts, it is possible to log in and click the Acquire button. Next, it is possible to comprehensive, change, print out, or signal the Arkansas Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status. Each lawful file template you get is your own for a long time. To get an additional copy for any acquired kind, check out the My Forms tab and click the related button.

If you work with the US Legal Forms website the first time, keep to the simple guidelines listed below:

- Very first, ensure that you have selected the right file template for that county/town of your liking. Browse the kind information to ensure you have chosen the proper kind. If accessible, use the Review button to look throughout the file template too.

- In order to locate an additional version of the kind, use the Look for industry to discover the template that suits you and needs.

- When you have identified the template you want, click on Purchase now to proceed.

- Find the pricing prepare you want, enter your credentials, and register for a free account on US Legal Forms.

- Total the deal. You can use your Visa or Mastercard or PayPal accounts to purchase the lawful kind.

- Find the format of the file and down load it to the system.

- Make changes to the file if possible. You may comprehensive, change and signal and print out Arkansas Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status.

Acquire and print out a large number of file web templates utilizing the US Legal Forms website, that offers the greatest selection of lawful forms. Use specialist and condition-particular web templates to handle your company or person requirements.