The Arkansas Charity Subscription Agreement is a legal document that outlines the terms and conditions between a charity organization based in Arkansas and its subscribers. This agreement is essential as it establishes a contractual relationship between the charity and the subscriber, ensuring transparency and accountability. The Arkansas Charity Subscription Agreement typically includes the following details: 1. Parties Involved: It starts by clearly identifying the charity organization and the subscriber entering into the agreement. This includes the legal names, addresses, and contact information of both parties. 2. Subscription Details: The agreement outlines the subscription plan chosen by the subscriber, such as the amount and frequency of the contributions or donations. It may also specify if it is a one-time or recurring subscription. 3. Purpose of Subscription: This section defines the charitable purpose for which the subscription funds will be utilized. It provides a clear description of the charity's mission, goals, and the specific initiatives or projects being funded. 4. Payment Terms: The agreement includes details regarding the payment methods accepted by the charity, such as online payments, checks, or direct bank transfers. It also outlines any administrative fees, taxes, or processing charges associated with the subscription. 5. Duration and Termination: This section specifies the duration of the subscription agreement, including the start and end dates. It may also outline the termination process, allowing either party to opt-out of the agreement under certain circumstances. 6. Confidentiality and Data Protection: This section ensures that personal information provided by the subscriber remains confidential and is handled in accordance with applicable privacy laws. 7. Indemnification and Liability: The agreement may contain provisions concerning the responsibility of both parties regarding any losses, damages, or liabilities incurred during the subscription period. Types of Arkansas Charity Subscription Agreements: 1. One-Time Donation Agreement: This type of agreement covers a single contribution made by the subscriber to a specific charity initiative or project within Arkansas. 2. Recurring Donation Agreement: This agreement establishes a long-term subscription plan where the subscriber commits to regularly contribute funds to the charity organization. This could be a monthly, quarterly, or annual subscription. 3. Specific Cause Donation Agreement: In this type of agreement, the subscriber chooses to donate funds to support a particular cause or program of the charity. This allows the subscriber to allocate their contribution to a specific area of interest, such as education, healthcare, or environmental conservation. Overall, the Arkansas Charity Subscription Agreement serves as a binding contract that ensures both the charity and the subscriber are aware of their rights and obligations. It promotes trust and transparency, enabling the charity to make a significant impact in the community through sustained financial support from subscribers.

Arkansas Charity Subscription Agreement

Description

How to fill out Arkansas Charity Subscription Agreement?

You may invest several hours on the Internet searching for the legitimate file design which fits the state and federal specifications you need. US Legal Forms offers 1000s of legitimate varieties which can be reviewed by specialists. It is simple to download or produce the Arkansas Charity Subscription Agreement from your support.

If you have a US Legal Forms profile, it is possible to log in and click the Down load key. Following that, it is possible to total, change, produce, or indicator the Arkansas Charity Subscription Agreement. Each and every legitimate file design you purchase is yours permanently. To acquire another version of the acquired type, check out the My Forms tab and click the corresponding key.

If you use the US Legal Forms site the first time, stick to the straightforward recommendations under:

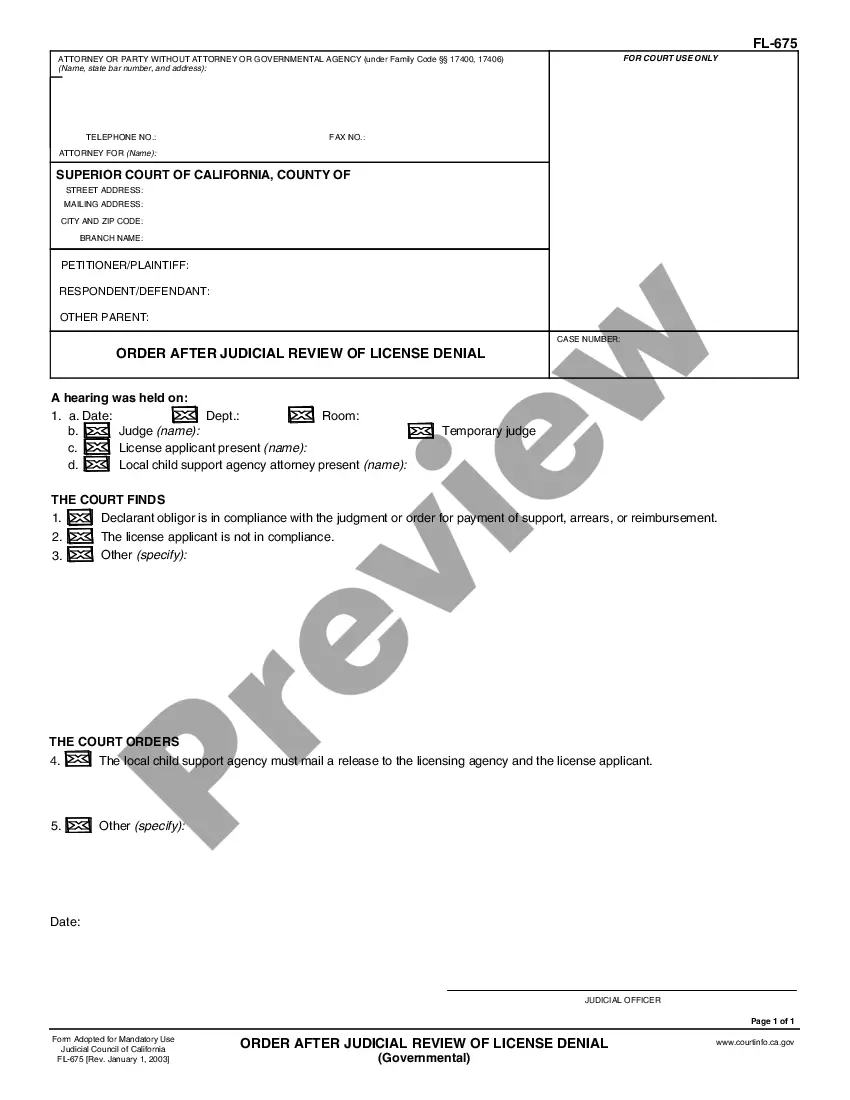

- Very first, make sure that you have chosen the best file design for the region/city of your choosing. See the type explanation to ensure you have chosen the correct type. If offered, take advantage of the Review key to look throughout the file design as well.

- If you want to discover another edition in the type, take advantage of the Lookup area to find the design that meets your needs and specifications.

- After you have located the design you would like, simply click Purchase now to move forward.

- Pick the rates plan you would like, enter your credentials, and register for your account on US Legal Forms.

- Full the purchase. You can utilize your Visa or Mastercard or PayPal profile to pay for the legitimate type.

- Pick the format in the file and download it in your gadget.

- Make alterations in your file if possible. You may total, change and indicator and produce Arkansas Charity Subscription Agreement.

Down load and produce 1000s of file web templates using the US Legal Forms web site, that provides the most important collection of legitimate varieties. Use specialist and express-specific web templates to tackle your business or individual requires.

Form popularity

FAQ

How to Start a Nonprofit in Arkansas Name Your Organization. ... Recruit Incorporators and Initial Directors. ... Appoint a Registered Agent. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. ... Establish Initial Governing Documents and Policies.

If you have questions or inquiries, please contact the Charities Bureau via email at charities@sos.arkansas.gov, via phone at (501) 683-0094, or via mail to Arkansas Secretary of State, Business and Commercial Services, ATTN: Charities Registration, 1401 W. Capitol, Suite 250, Little Rock, AR 72201.

How To Start A Charity Organization Define your ?Why? ... Make a decision on the type of charity. ... Choose your charity name. ... Create a plan on how to stand out. ... Prepare your business plan. ... Hire staff, select board members, and choose leadership. ... Register your nonprofit. ... Prepare to go online.

Hear this out loud PauseTo start a nonprofit corporation in Arkansas, begin by filing nonprofit articles of incorporation with the Arkansas Secretary of State. You can file the document online or by mail. The articles of incorporation cost $45 to file online and $50 to file by mail.

All California nonprofits must file the Statement of Information (Form SI-100) every two years ? with the Secretary of State. The form may be filed electronically and has a fee of $20.

Hear this out loud PauseThe Arkansas Nonprofit Corporation Act of 1993 governs nonprofit corporations incorporated on or after January 1, 1994 or those incorporated prior to that date that have elected to be governed under the 1993 Act in amendments to their articles of incorporations.