Arkansas Agreement Acquiring Share of Retiring Law Partner: A Comprehensive Guide Introduction: The Arkansas Agreement Acquiring Share of Retiring Law Partner refers to a legal contract that establishes the terms and conditions surrounding the acquisition of a retiring law partner's share in a law firm located in Arkansas. This agreement is crucial to ensure a smooth transition and a fair distribution of assets as the retiring partner exits the firm. In this article, we will delve into the key aspects of this agreement, its purpose, and potential variants. Key Elements of the Agreement: 1. Share Valuation and Purchase Price: The agreement outlines how the retiring partner's share in the law firm will be valued. This valuation acts as the basis for determining the purchase price, which reflects the retiring partner's interest in the firm's assets, liabilities, and goodwill. 2. Payment Terms: The agreement clearly states how the purchase price will be paid, whether through a lump sum payment, installments, or other agreed-upon methods. These terms ensure mutual understanding and a feasible payment structure for both the acquiring partners and the retiring partner. 3. Restrictive Covenants: To protect the firm's interests, the agreement may specify any restrictive covenants applicable to the retiring partner post-departure. These covenants may include non-competition clauses, non-solicitation of clients and employees, confidentiality provisions, and other relevant restrictions. 4. Allocation of Assets and Liabilities: The agreement addresses the allocation of assets and liabilities among the remaining partners after the retirement. It outlines the process for determining the allocation, taking into account factors such as the retiring partner's capital contribution, length of service, client relationships, and any other agreed-upon criteria. 5. Retiring Partner's Rights and Obligations: The agreement clarifies the extent to which the retiring partner will retain certain rights, such as access to client files, involvement in pending cases, or participation in ongoing firm management decisions during the transition period. It also defines the retiring partner's obligations, such as providing a complete and accurate inventory of their assets within the firm or cooperating with the transfer of clients. Types of Arkansas Agreement Acquiring Share of Retiring Law Partner: 1. Buyout Agreement: This type of agreement governs the outright purchase of the retiring partner's share in the firm, where the acquiring partners assume complete ownership and control over the assets and liabilities involved. 2. Continuation Agreement: In this agreement, the retiring partner agrees to transfer their share to the remaining partners, who will take over the responsibility of servicing their clients and managing ongoing cases. The retiring partner may retain a financial interest and continue receiving a percentage of the firm's profits for a specified period. 3. Succession Agreement: This agreement outlines the gradual transition of the retiring partner's client base to the acquiring partners, allowing them to take over existing relationships and continue providing services seamlessly. The retiring partner may assist in the client handover process under mutually agreed terms. Conclusion: The Arkansas Agreement Acquiring Share of Retiring Law Partner is a critical document for law firms in Arkansas when dealing with the departure of a partner. It ensures a fair and well-organized transfer of the retiring partner's share, asset allocation, and payment terms. By understanding the agreement's key elements and potential variations, law firms can efficiently manage the transition and maintain stability throughout the process.

Arkansas Agreement Acquiring Share of Retiring Law Partner

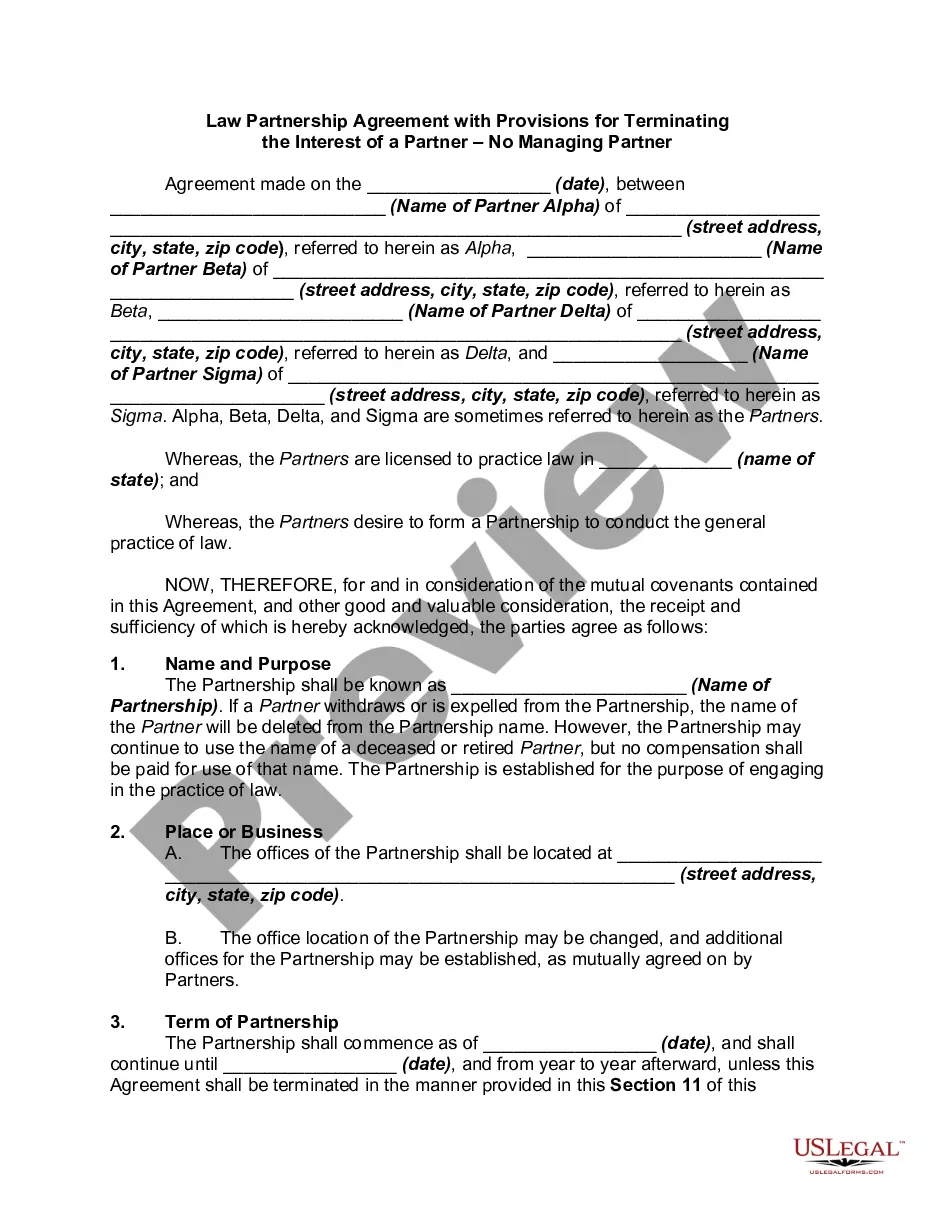

Description

How to fill out Agreement Acquiring Share Of Retiring Law Partner?

You may devote hrs on the web searching for the lawful record design which fits the federal and state demands you need. US Legal Forms offers a large number of lawful varieties which are examined by experts. It is possible to down load or print out the Arkansas Agreement Acquiring Share of Retiring Law Partner from your service.

If you already have a US Legal Forms bank account, you are able to log in and click on the Download option. Afterward, you are able to total, edit, print out, or indication the Arkansas Agreement Acquiring Share of Retiring Law Partner. Each and every lawful record design you acquire is your own property permanently. To acquire one more copy of any purchased type, proceed to the My Forms tab and click on the related option.

If you are using the US Legal Forms web site the very first time, stick to the simple guidelines listed below:

- Initially, make sure that you have chosen the best record design for the area/metropolis of your choice. See the type description to ensure you have picked out the appropriate type. If accessible, take advantage of the Review option to search throughout the record design at the same time.

- If you would like find one more version of your type, take advantage of the Search field to obtain the design that suits you and demands.

- When you have identified the design you desire, just click Purchase now to proceed.

- Find the costs plan you desire, key in your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the lawful type.

- Find the file format of your record and down load it to the device.

- Make adjustments to the record if needed. You may total, edit and indication and print out Arkansas Agreement Acquiring Share of Retiring Law Partner.

Download and print out a large number of record themes making use of the US Legal Forms site, that offers the greatest assortment of lawful varieties. Use specialist and state-particular themes to take on your company or person requires.

Form popularity

FAQ

Section 32(1): Right to retireEvery partner of a partnership firm has the right to withdraw from the business with the consent of all the other partners. In the case of a partnership formed at will, this may be done by giving a notice to that effect to all the other partners.

A retired partner continues to be liable to the third party for acts of the firm till such time that he or other members of the firm give a public notice of his retirement. However, if the third party deals with the firm without knowing that he was a partner in the firm, then he will not be liable to the third party.

1 AnswerChange in the Profit sharing ratio.Adjustment of goodwill.Treatment of accumulated profits and losses.Revaluation of the assets and liabilities.Calculation of the profit and loss up to the date of retirement.Ascertainment of the total amount due to the retiring partner.More items...?

In case of partnership at will, a partner may retire from the partnership by giving notice of his intention to retire to all the other partners. In partnership at will, a partner has also a right to get a firm dissolved by giving a notice in writing to all the other partners of his intention to dissolve the firm.

Retirement of a partner leads to reconstitution of a partnership firm as the original agreement between the partners comes to an end. The business may continue with a new agreement with the remaining partners. When a partner retires, his share in the firm is to be correctly ascertained and settled.

Do partnership agreements need to be in writing? Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

According to Section 37, of the Partnership Law, if a member of the firm dies or otherwise ceases to be a partner of the firm, and the remaining partners carry on the business without any final settlement of accounts between them and the outgoing partner, then the outgoing partner or his estate is entitled to share of

Legally, UpCounsel says, one partner leaving may dissolve the partnership but not in the sense that it ends the business. If A, B and C buy out D, or D sells their interest to E, the action dissolves the original partnership and launches a new one. The partnership's business, however, remains operational.

Company name, status, and duration.Liability of the partners.Number of owners/control of the business.Capital.Management, decision-making and binding the partnership.Dissolution.Death and disability.Transfer of partnership interests.More items...?11-Mar-2021

Right to access books and accounts: Each partner can inspect and copy books of accounts of the business. This right is applicable equally to active and dormant partners. Right to share profits: Partners generally describe in their deed the proportion in which they will share profits of the firm.