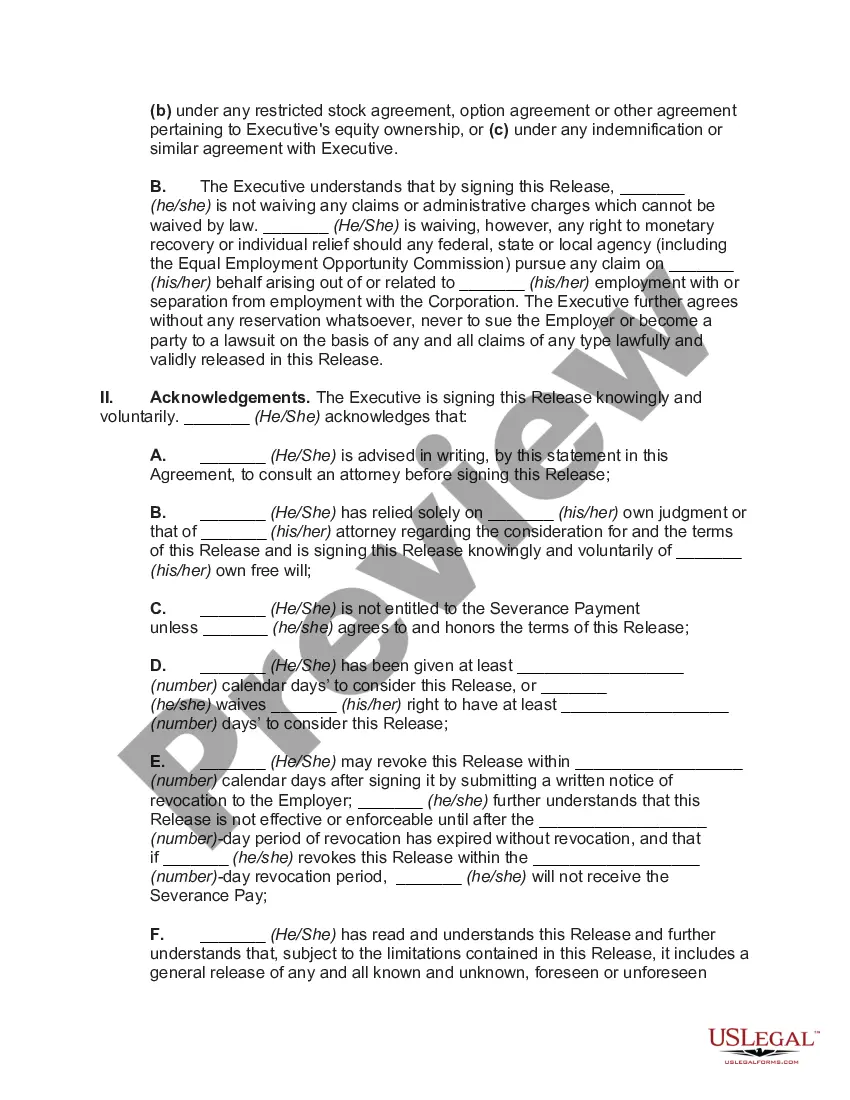

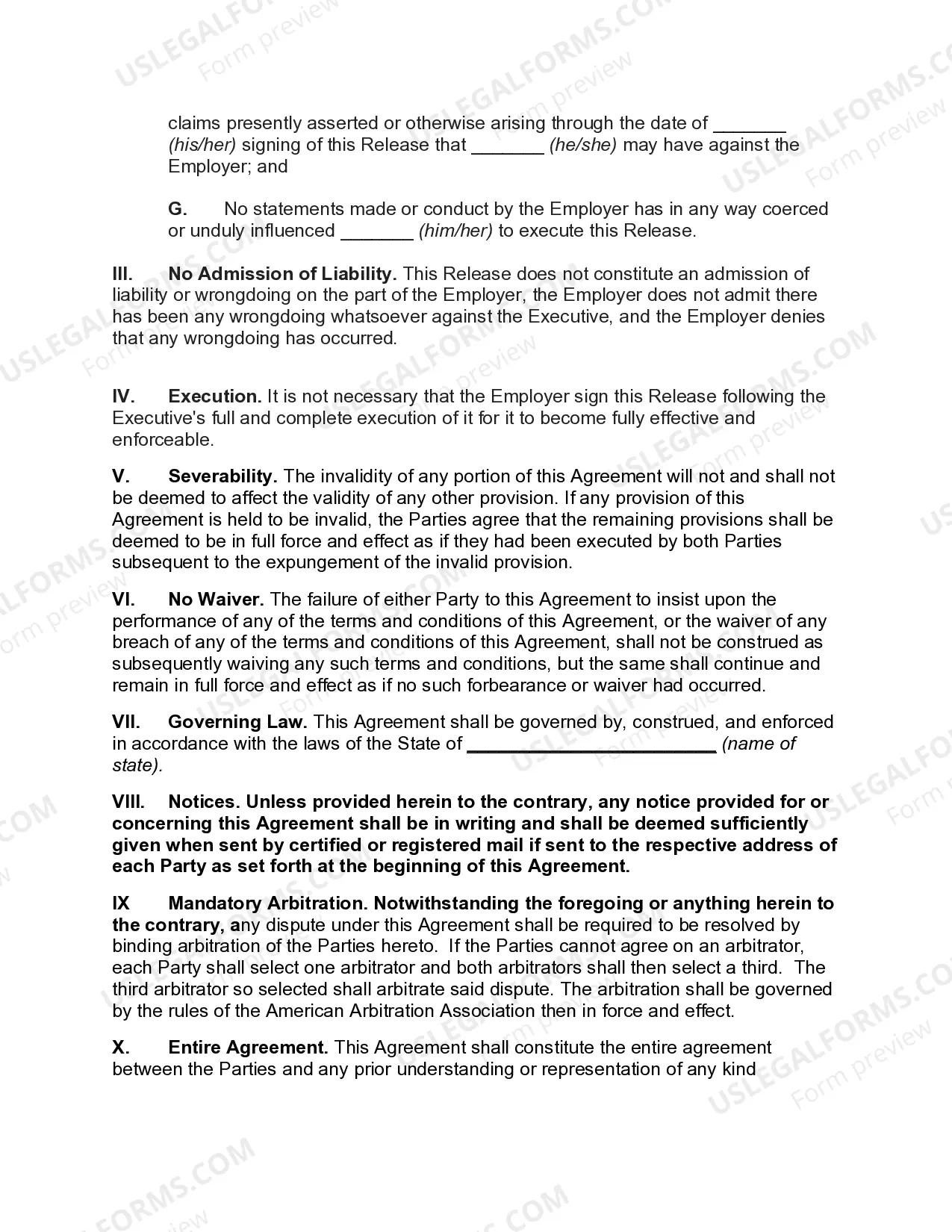

Arkansas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits is a legal document that outlines the terms and conditions for an executive's departure from a corporate employer in Arkansas. This agreement is entered into between the executive, who is leaving the company, and the corporate employer, who agrees to provide severance pay and benefits in return for the executive's release of certain legal claims. The Arkansas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits document specifies the rights and responsibilities of both parties involved. It is crucial for executives and corporate employers to understand the details of this document to ensure a smooth transition and avoid any potential legal disputes. Keywords within this context may include: 1. Severance pay: The document outlines the amount and duration of the agreed-upon severance pay that the executive will receive after termination. This payment is typically an additional financial package beyond the executive's regular salary. 2. Benefits: The document specifies the continuation or termination of employee benefits such as healthcare, insurance plans, pension plans, stock options, and other perks provided by the corporate employer. 3. Termination: The agreement defines the circumstances under which termination occurs, whether voluntary or involuntary, and the impact it has on the executive's entitlement to severance pay and benefits. 4. Release of claims: The executive releases the corporate employer from any potential legal claims arising from the employment relationship, such as employment discrimination, wrongful termination, or breach of contract. This clause ensures that the executive waives their right to pursue legal action against the employer. 5. Confidentiality: The document may include a confidentiality clause stating that the executive must not disclose any trade secrets or proprietary information they have acquired during their employment. This safeguards the corporate employer's intellectual property and maintains business confidentiality. 6. Non-compete agreement: In some cases, the document may include a non-compete clause that restricts the executive's ability to work for competitors or start a competing business for a specified period. This protects the corporate employer's business interests. 7. Arbitration or mediation: The document may include a provision outlining the dispute resolution process, which may involve arbitration or mediation rather than traditional litigation. Different types of Arkansas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits may exist based on factors such as the executive's position, contractual agreements, and the employer's specific policies. It is essential for executives and employers to review and tailor the document to reflect their unique circumstances, while ensuring compliance with Arkansas employment laws and regulations.

Arkansas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits

Description

How to fill out Arkansas Release Of Corporate Employer By Executive Upon Termination In Consideration Of Severance Pay And Benefits?

If you want to complete, download, or print lawful document web templates, use US Legal Forms, the greatest selection of lawful varieties, which can be found on-line. Make use of the site`s simple and easy convenient look for to find the papers you need. Various web templates for business and individual purposes are sorted by types and states, or keywords and phrases. Use US Legal Forms to find the Arkansas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits within a handful of mouse clicks.

If you are already a US Legal Forms buyer, log in to the accounts and click on the Acquire option to have the Arkansas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits. Also you can access varieties you in the past saved from the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for your proper town/nation.

- Step 2. Make use of the Review solution to look over the form`s content material. Do not forget to see the explanation.

- Step 3. If you are unhappy together with the form, utilize the Lookup area near the top of the monitor to get other models in the lawful form template.

- Step 4. Upon having identified the shape you need, click on the Get now option. Pick the prices prepare you favor and add your accreditations to register on an accounts.

- Step 5. Process the financial transaction. You may use your bank card or PayPal accounts to finish the financial transaction.

- Step 6. Find the formatting in the lawful form and download it on your gadget.

- Step 7. Complete, change and print or indicator the Arkansas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits.

Each and every lawful document template you buy is your own property for a long time. You might have acces to each form you saved within your acccount. Select the My Forms section and choose a form to print or download once again.

Be competitive and download, and print the Arkansas Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits with US Legal Forms. There are thousands of expert and status-distinct varieties you may use for the business or individual requires.

Form popularity

FAQ

ERISA applies to two types of plans "Employee Welfare Benefit Plans" and "Employee Pension Benefit Plans."...Employee Pension Benefit Plans include:Profit-sharing retirement plans.Stock bonus plans.Money purchase plans.401(k) plans.Employee stock ownership plans.Defined benefit retirement plans.

A severance package is an offer an employer provides to an employee leaving the company. Employers often provide them to employees leaving the company for no reason related to the employee's performance, such as layoffs or structural changes within the company.

Is severance pay taxable? Yes, severance pay is taxable in the year that you receive it. Your employer will include this amount on your Form W-2 and will withhold appropriate federal and state taxes.

A severance policy may be treated as an ERISA plan even if the policy is not in writing. For example, if an employer has established a practice of providing employees who are involuntarily terminated with one week of pay for each year of service, then the practice will be treated as a plan subject to ERISA.

Very generally, "deferred compensation" is broadly defined as any form of compensation which is payable in the year after the year in which the legal right to payment arises. Severance payments are considered a form of deferred compensation subject to Section 409A unless an exception or exemption applies.

What is a severance agreement? A severance agreement is a contract that an employer may ask an employee to sign when they are terminated from a job. Severance pay is often offered in exchange for an employee's release of their claims against the employer.

Some employers choose to offer severance pay to employees who are terminated, either involuntarily or voluntarily. The primary reasons for offering a severance package are to soften the blow of an involuntary termination and to avoid future lawsuits by having the employee sign a release in exchange for the severance.

A severance policy may be treated as an ERISA plan even if the policy is not in writing. For example, if an employer has established a practice of providing employees who are involuntarily terminated with one week of pay for each year of service, then the practice will be treated as a plan subject to ERISA.

Severance pay is often granted to employees upon termination of employment. It is usually based on length of employment for which an employee is eligible upon termination. There is no requirement in the Fair Labor Standards Act (FLSA) for severance pay.

There is no single definition of an appropriate severance package, as they vary greatly by industry and company. However, severance packages typically include pay through the termination date and any accrued vacation time, unreimbursed business expenses, and an additional lump sum.