The Arkansas Employment of Financial Analyst for Employer and Related Entities refers to the job role of a financial analyst working in Arkansas for a specific employer and their affiliated companies. Financial analysts play a crucial role in helping businesses make informed decisions by analyzing financial data and providing valuable insights. These professionals utilize their expertise in finance, accounting, and economics to assess investment opportunities, evaluate financial risks, and advise on strategies for maximizing profitability. The primary responsibility of a financial analyst is to conduct comprehensive financial research and analysis. This includes gathering financial data from various sources, such as company reports, market trends, and economic indicators. Using financial modeling techniques and statistical tools, analysts evaluate the data to identify trends, patterns, and potential risks. They also perform valuation analyzes to determine the value of assets, companies, or investment opportunities. In the context of Arkansas employment, financial analysts work for employers based in the state. They could be employed by a range of entities, such as corporations, financial institutions, investment firms, consulting firms, or government agencies. The scope of work may vary depending on the employer and their specific industry. Some specialized types of financial analyst roles in Arkansas may include: 1. Corporate Financial Analyst: These analysts work for corporations, analyzing their financial performance, conducting budgeting and forecasting, and providing financial insights to support strategic decision-making within the organization. 2. Investment Analyst: These professionals work in Arkansas for investment firms or financial institutions, researching investment opportunities, analyzing market trends, and making recommendations for portfolio management. 3. Risk Analyst: Risk analysts assess financial risks related to investments, market volatility, or economic conditions. They work for a variety of entities, including financial institutions, insurance companies, or regulatory agencies. 4. Quantitative Analyst: These analysts utilize advanced mathematical and statistical modeling techniques to analyze financial data and develop quantitative models for pricing derivatives, risk assessment, or portfolio optimization. 5. Credit Analyst: Credit analysts evaluate the creditworthiness of individuals or companies to determine the risk associated with lending money or extending credit. They provide insights on loan approvals, credit limits, and terms for financial institutions or corporations. In conclusion, the Arkansas Employment of Financial Analyst for Employer and Related Entities encompasses the crucial role of financial analysts working in Arkansas for specific employers. These professionals analyze financial data, provide insights, and support decision-making processes for maximizing profitability and managing risks. Various specialized roles exist within this domain, including corporate financial analysts, investment analysts, risk analysts, quantitative analysts, and credit analysts.

Arkansas Employment of Financial Analyst for Employer and Related Entities

Description

How to fill out Arkansas Employment Of Financial Analyst For Employer And Related Entities?

It is possible to commit time on the Internet looking for the lawful document format that suits the federal and state needs you will need. US Legal Forms gives a huge number of lawful types that are analyzed by specialists. It is possible to download or print the Arkansas Employment of Financial Analyst for Employer and Related Entities from the service.

If you have a US Legal Forms accounts, you may log in and click on the Down load button. Next, you may full, modify, print, or sign the Arkansas Employment of Financial Analyst for Employer and Related Entities. Each lawful document format you purchase is your own property eternally. To get one more version of any obtained develop, check out the My Forms tab and click on the related button.

If you are using the US Legal Forms internet site the first time, follow the straightforward guidelines below:

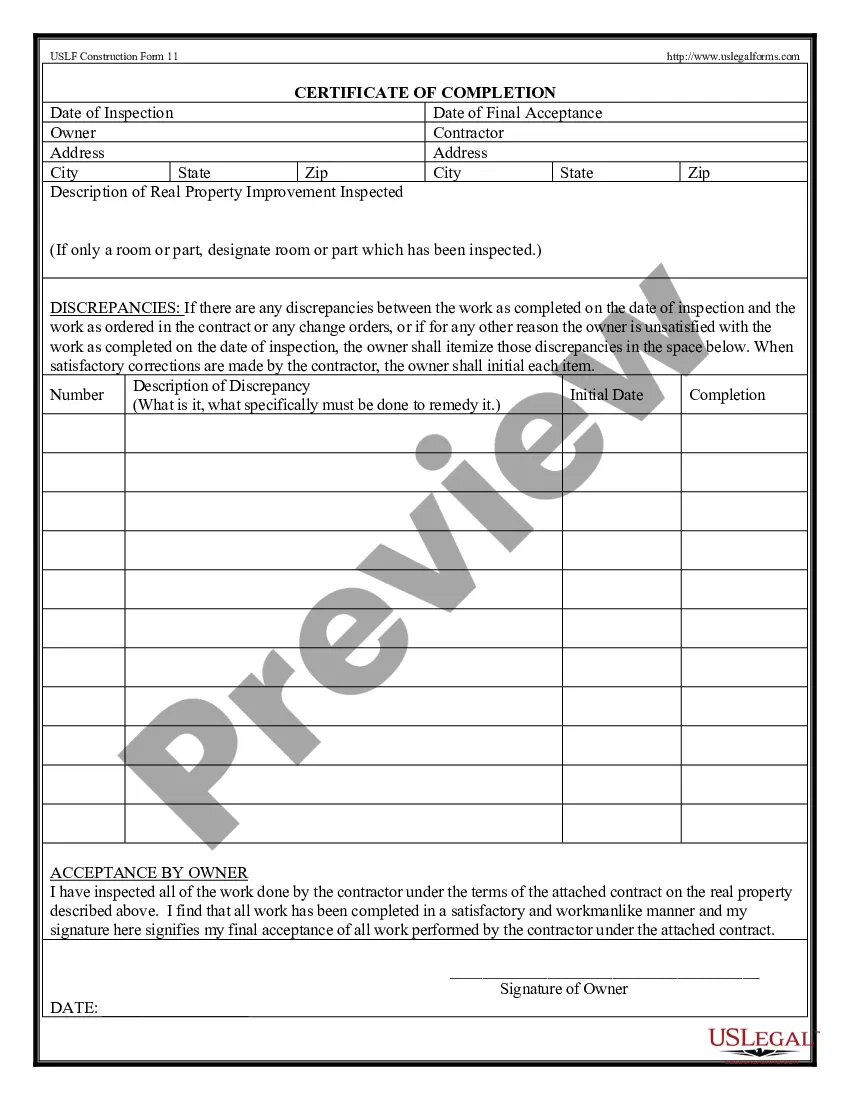

- First, ensure that you have chosen the proper document format for that region/metropolis of your liking. Browse the develop explanation to make sure you have picked the correct develop. If readily available, use the Review button to search throughout the document format as well.

- If you would like discover one more variation of your develop, use the Search field to get the format that meets your requirements and needs.

- Upon having found the format you would like, click on Purchase now to proceed.

- Select the rates strategy you would like, enter your accreditations, and register for a merchant account on US Legal Forms.

- Complete the transaction. You should use your credit card or PayPal accounts to pay for the lawful develop.

- Select the formatting of your document and download it for your product.

- Make adjustments for your document if needed. It is possible to full, modify and sign and print Arkansas Employment of Financial Analyst for Employer and Related Entities.

Down load and print a huge number of document web templates utilizing the US Legal Forms site, that provides the greatest selection of lawful types. Use skilled and state-specific web templates to deal with your business or personal needs.