Title: Understanding the Arkansas Agreement for Auditing Services between an Accounting Firm and a Municipality Introduction: The Arkansas Agreement for Auditing Services is a legal contract between an accounting firm and a municipality in Arkansas. This agreement outlines the terms, conditions, and responsibilities of both parties involved in conducting auditing services for the municipality. It ensures transparency, adherence to financial regulations, and the effective management of public funds. In Arkansas, there are different types of agreements for auditing services tailored to various municipal requirements. Keywords: Arkansas Agreement, Auditing Services, Accounting Firm, Municipality, Terms, Conditions, Responsibilities, Transparency, Financial Regulations, Public Funds 1. General Terms and Scope of Engagement: This section outlines the general terms, scope, and duration of the agreement. It highlights the responsibilities of both the accounting firm and the municipality, ensuring alignment with the specified accounting standards, guidelines, and applicable state regulations. 2. Audit Procedures and Objectives: This section defines the audit procedures, objectives, and methodologies to be employed by the accounting firm. It covers data evaluation, risk assessment, internal control examination, compliance testing, and financial statement analysis. The objective is to provide an accurate and unbiased assessment of the municipality's financial records. 3. Communication and Availability: The agreement emphasizes the importance of effective communication between the accounting firm and the municipality's representatives. Regular meetings, progress updates, and discussions regarding findings, recommendations, and any potential issues should be promptly addressed. The agreement also specifies the availability of both parties during the auditing process. 4. Independent Opinion and Reporting: The accounting firm shall provide an independent opinion based on the audit's findings. A comprehensive audit report will be prepared, detailing the financial position, compliance status, and overall assessment of the municipality's financial health. The report will address any financial weaknesses, potential risks, or areas requiring improvement. 5. Fraud and Irregularities: This section highlights the need for the accounting firm to coordinate with the municipality to detect and report any fraudulent activities or irregularities identified during the audit process. It encourages proactive measures to prevent misappropriation of funds, ensuring accountability and adherence to ethical practices. Types of Arkansas Agreements for Auditing Services: 1. Municipal Financial Statement Audit Agreement: This agreement is designed for auditing the municipality's financial statements, including balance sheets, income statements, and cash flow statements. It focuses on the accuracy, completeness, and compliance of financial records. 2. Compliance Audit Agreement: This agreement primarily focuses on assessing the municipality's compliance with applicable laws, regulations, and contractual obligations. It ensures adherence to funding requirements, grant compliance, and proper expenditure management. 3. Performance Audit Agreement: This agreement assesses the efficiency and effectiveness of the municipality's operations, programs, and services. It provides insight into areas for improvement to enhance service quality and optimize resource allocation. Conclusion: The Arkansas Agreement for Auditing Services establishes a framework for a transparent and accountable partnership between an accounting firm and a municipality. By adhering to the terms and conditions outlined in this agreement, both parties can work together to ensure the proper management of public funds and strengthen financial practices within the municipality. Keywords: Arkansas Agreement, Auditing Services, Accounting Firm, Municipality, Terms, Conditions, Responsibilities, Transparency, Compliance, Financial Statements, Fraud, Risk Assessment, Compliance Testing.

Arkansas Agreement for Auditing Services between Accounting Firm and Municipality

Description

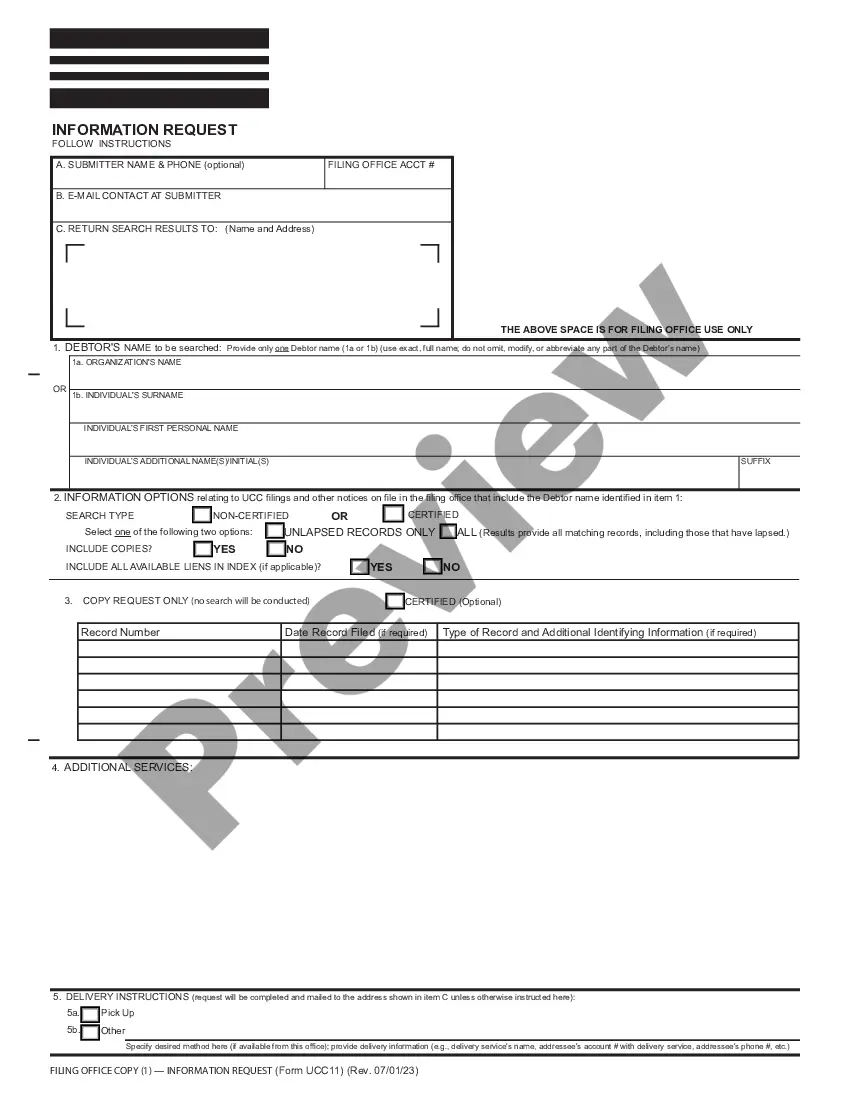

How to fill out Arkansas Agreement For Auditing Services Between Accounting Firm And Municipality?

US Legal Forms - one of the largest libraries of legitimate forms in America - offers an array of legitimate file templates you can down load or print. Utilizing the web site, you will get 1000s of forms for organization and individual purposes, sorted by classes, says, or keywords.You can get the most up-to-date models of forms just like the Arkansas Agreement for Auditing Services between Accounting Firm and Municipality in seconds.

If you have a subscription, log in and down load Arkansas Agreement for Auditing Services between Accounting Firm and Municipality in the US Legal Forms catalogue. The Down load switch can look on every single kind you see. You gain access to all earlier acquired forms within the My Forms tab of your respective accounts.

In order to use US Legal Forms for the first time, here are straightforward recommendations to help you started out:

- Be sure you have chosen the right kind for your personal city/state. Click on the Review switch to analyze the form`s content. Read the kind explanation to actually have chosen the right kind.

- In case the kind does not match your needs, utilize the Lookup discipline towards the top of the screen to discover the the one that does.

- When you are content with the form, validate your choice by visiting the Acquire now switch. Then, opt for the costs strategy you like and give your accreditations to register to have an accounts.

- Approach the transaction. Make use of your bank card or PayPal accounts to perform the transaction.

- Find the structure and down load the form in your product.

- Make alterations. Fill out, revise and print and indication the acquired Arkansas Agreement for Auditing Services between Accounting Firm and Municipality.

Each and every web template you included in your account does not have an expiry day and is the one you have permanently. So, in order to down load or print one more version, just visit the My Forms area and click on in the kind you want.

Gain access to the Arkansas Agreement for Auditing Services between Accounting Firm and Municipality with US Legal Forms, by far the most substantial catalogue of legitimate file templates. Use 1000s of skilled and status-distinct templates that meet your business or individual needs and needs.

Form popularity

FAQ

The Public Company Accounting Oversight Board (PCAOB) is a non-profit organization that regulates audits of publicly traded companies to minimize audit risk. The PCAOB was established at the same time as the Sarbanes-Oxley Act of 2002 to address the accounting scandals of the late 1990s.

To be independent, the auditor must be intellectually honest; to be recognized as independent, he must be free from any obligation to or interest in the client, its management, or its owners.

For financial institutions, the most common services performed by external auditors that require independence include audits of financial statements, audits of internal control over financial reporting, and attestations on manage- ment's assessment of internal control over financial reporting.

Like accountants, an auditor can work internally for a specific company or for a third party, such as a public accounting firm, to audit various businesses. Additionally, many auditors are employed by government and regulatory bodies, most notably the Internal Revenue Service (IRS).

Specific Prohibited Non-audit Services Bookkeeping. Financial information systems design and implementation. Appraisal or valuation services, fairness opinions, or contribution-in-kind reports. Actuarial services.

An accounting firm is a group of accounting professionals that provides clients with financial management services. These services could include auditing, tax preparation and planning, payroll processing, bookkeeping, and advisory services.

A CPA firm can perform three levels of service on a company's financial statements: compilation, review and audit.

The primary role of an accountant is to handle a variety of tasks including tax preparation, financial planning and audits.

An independent auditor is typically used to avoid conflicts of interest and to ensure the integrity of performing an audit. Independent auditors are often used?or even mandated?to protect shareholders and potential investors from the occasional fraudulent or unrepresentative financial claims made by public companies.

The audit can be conducted internally by employees of the organization or externally by an outside certified public accountant (CPA) firm.