The Arkansas Job Expense Record is an essential document used by employees and employers in the state of Arkansas to track and report job-related expenses. This record serves as a detailed account of the various expenses incurred by employees while performing their job duties. Keywords: Arkansas, job expense record, employees, employers, track, report, job-related expenses, detailed account, job duties. The Arkansas Job Expense Record is a critical tool that enables individuals to maintain accurate records of their job-related expenses, ensuring that they are properly reimbursed or that they can claim tax deductions. It plays a vital role in maintaining financial transparency and compliance with tax laws. Employees can utilize this record to meticulously record their work-related expenses, such as transportation costs, accommodation expenses during business trips, meals, entertainment, and other miscellaneous expenses directly connected to their job duties. By documenting these expenses, employees can present a clear and organized record to their employers or use them for tax purposes. Employers, on the other hand, rely on the Arkansas Job Expense Record to facilitate the reimbursement process, ensuring that employees receive the appropriate compensation for their expenses. Additionally, employers can use these records for internal audit purposes, verifying and justifying any financial disbursements made for job-related expenses. Different types of Arkansas Job Expense Records may exist depending on the industry, job position, or company policies. For example, there might be specific expense records for sales representatives, contractors, traveling employees, or those working in hazardous conditions. These specialized records may contain additional fields or sections to cater to the unique requirements of the individual's job. To summarize, the Arkansas Job Expense Record is a crucial tool for both employees and employers in Arkansas. It simplifies the process of tracking, reporting, and reconciling job-related expenses, ensuring financial accuracy and transparency. By utilizing this record, employees can claim their rightful reimbursements, while employers can keep a systematic record of all job-related expenses incurred by their workforce.

Arkansas Job Expense Record

Description

How to fill out Arkansas Job Expense Record?

If you want to total, download, or printing legal document themes, use US Legal Forms, the largest selection of legal types, that can be found online. Utilize the site`s easy and handy research to get the files you need. Various themes for company and personal functions are categorized by classes and states, or keywords. Use US Legal Forms to get the Arkansas Job Expense Record within a number of clicks.

When you are already a US Legal Forms consumer, log in for your accounts and then click the Download option to get the Arkansas Job Expense Record. Also you can gain access to types you earlier acquired from the My Forms tab of the accounts.

If you use US Legal Forms initially, follow the instructions beneath:

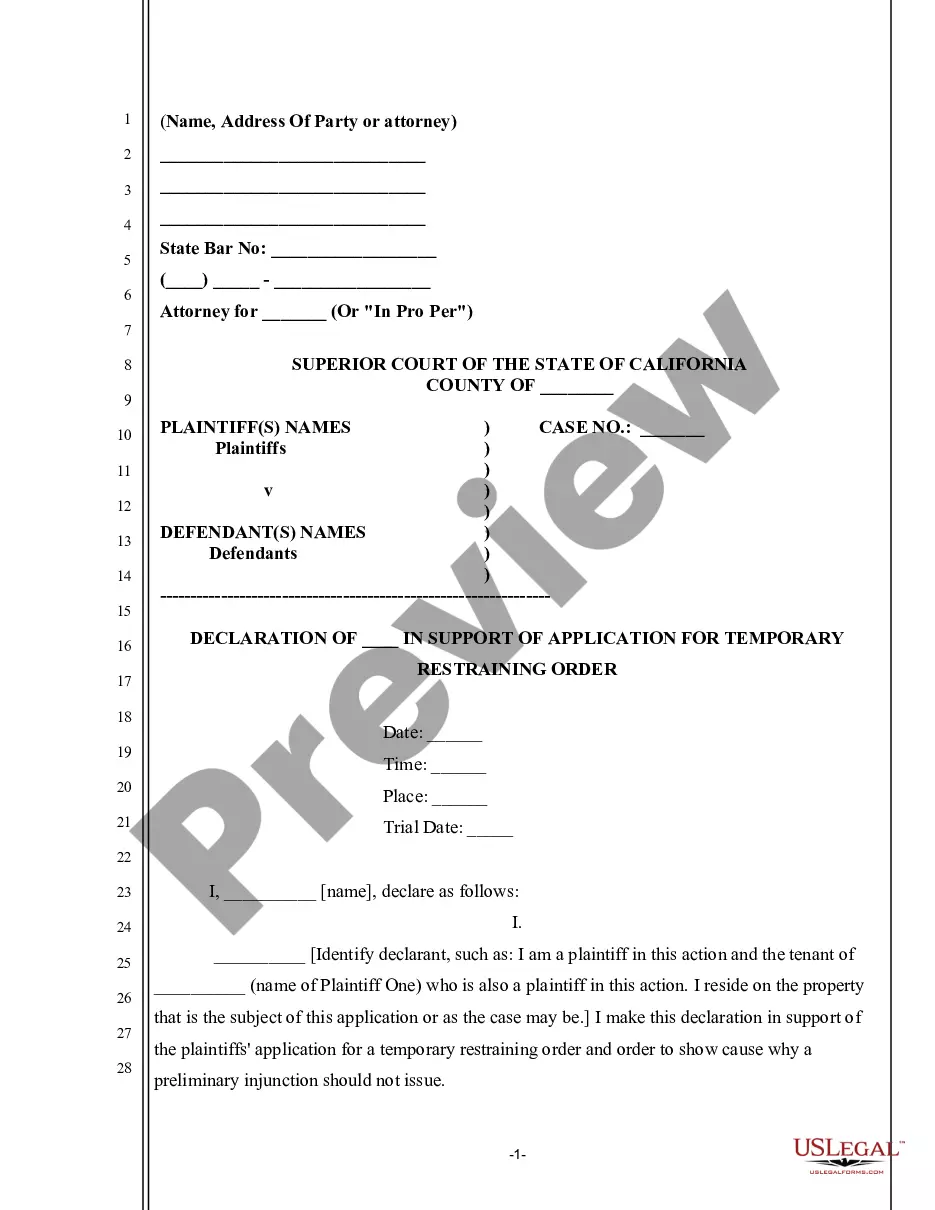

- Step 1. Ensure you have chosen the shape for the right metropolis/country.

- Step 2. Use the Review solution to examine the form`s content material. Do not overlook to read through the explanation.

- Step 3. When you are not happy together with the form, make use of the Research industry near the top of the display to get other types of your legal form web template.

- Step 4. When you have identified the shape you need, go through the Buy now option. Select the rates program you prefer and put your credentials to register for the accounts.

- Step 5. Process the purchase. You may use your Мisa or Ьastercard or PayPal accounts to perform the purchase.

- Step 6. Select the format of your legal form and download it on the system.

- Step 7. Total, change and printing or sign the Arkansas Job Expense Record.

Each and every legal document web template you purchase is your own for a long time. You might have acces to every single form you acquired within your acccount. Select the My Forms section and select a form to printing or download yet again.

Be competitive and download, and printing the Arkansas Job Expense Record with US Legal Forms. There are thousands of skilled and condition-specific types you may use for your company or personal demands.