Arkansas Acceptance of Election in a Limited Liability Company LLC

Description

How to fill out Acceptance Of Election In A Limited Liability Company LLC?

If you have to complete, obtain, or produce authorized document layouts, use US Legal Forms, the largest collection of authorized varieties, which can be found online. Utilize the site`s simple and convenient research to obtain the files you will need. Various layouts for organization and person reasons are categorized by categories and says, or search phrases. Use US Legal Forms to obtain the Arkansas Acceptance of Election in a Limited Liability Company LLC with a couple of mouse clicks.

In case you are already a US Legal Forms customer, log in in your bank account and then click the Down load option to find the Arkansas Acceptance of Election in a Limited Liability Company LLC. Also you can entry varieties you previously downloaded within the My Forms tab of your bank account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for that right metropolis/nation.

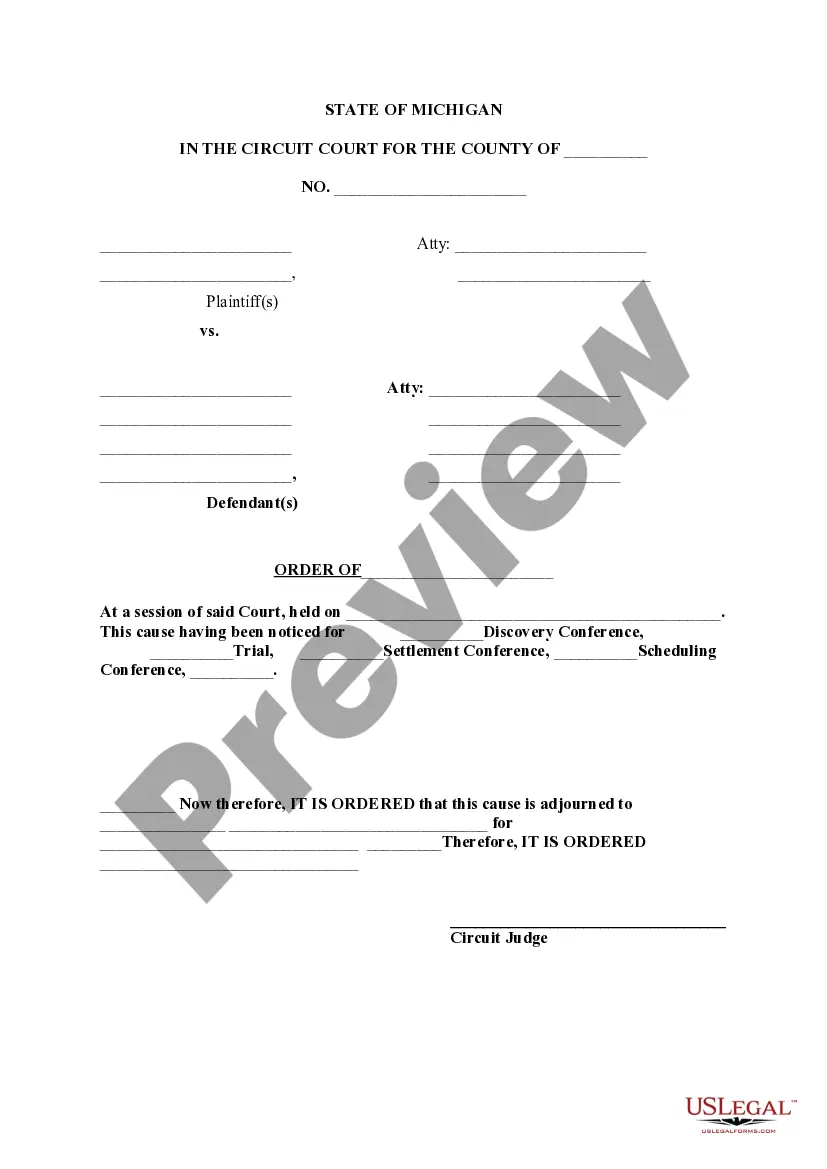

- Step 2. Make use of the Review option to look through the form`s content material. Never neglect to see the information.

- Step 3. In case you are unhappy together with the kind, make use of the Search area near the top of the screen to locate other types in the authorized kind web template.

- Step 4. After you have identified the shape you will need, select the Buy now option. Opt for the costs prepare you like and put your credentials to register on an bank account.

- Step 5. Approach the transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Find the structure in the authorized kind and obtain it in your system.

- Step 7. Full, revise and produce or indicator the Arkansas Acceptance of Election in a Limited Liability Company LLC.

Every authorized document web template you acquire is your own for a long time. You might have acces to each kind you downloaded with your acccount. Click the My Forms area and select a kind to produce or obtain again.

Remain competitive and obtain, and produce the Arkansas Acceptance of Election in a Limited Liability Company LLC with US Legal Forms. There are millions of professional and condition-specific varieties you may use for your personal organization or person needs.

Form popularity

FAQ

A small business corporation elects federal S corporation status by filing federal Form 2553 (Election By a Small Business Corporation) with the Internal Revenue Service. When a corporation elects federal S corporation status it automatically becomes an S corporation for California.

To make the election, the pass-through entity must file Form AR1100PET (e-file) or AR 362PT (by mail). The election must be made by the due date or extended due date of the return. Once made, the election is in effect for the entity for each year until revoked.

Here's an overview of the key steps you'll need to take to start your own business in Arkansas. Choose a Business Idea. ... Decide on a Legal Structure. ... Choose a Name. ... Create Your Business Entity. ... Apply for Arkansas Licenses and Permits. ... Pick a Business Location and Check Zoning. ... File and Report Taxes. ... Obtain Insurance.

Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

A.C.A. § 26-54-101 et al., also known as the ?Arkansas Corporate Franchise Tax Act of 1979?, requires all Corporations, LLC's, Banks, and Insurance Companies registered in Arkansas to pay an annual franchise tax.

Arkansas Business License and Permit Requirements As a business owner, it's your responsibility to make sure you have the proper state, federal or local business licenses to operate your Arkansas LLC. Some of the associated fees only need to be paid once, while others are ongoing charges.

For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and affirmatively elects to be treated as a corporation.

Along with many states, Arkansas does not require every business to obtain a generic business license at the state level. The only statewide permit or license applicable to most businesses is the Arkansas sales tax permit, often called a seller's permit, which registers your business for the Arkansas sales and use tax.