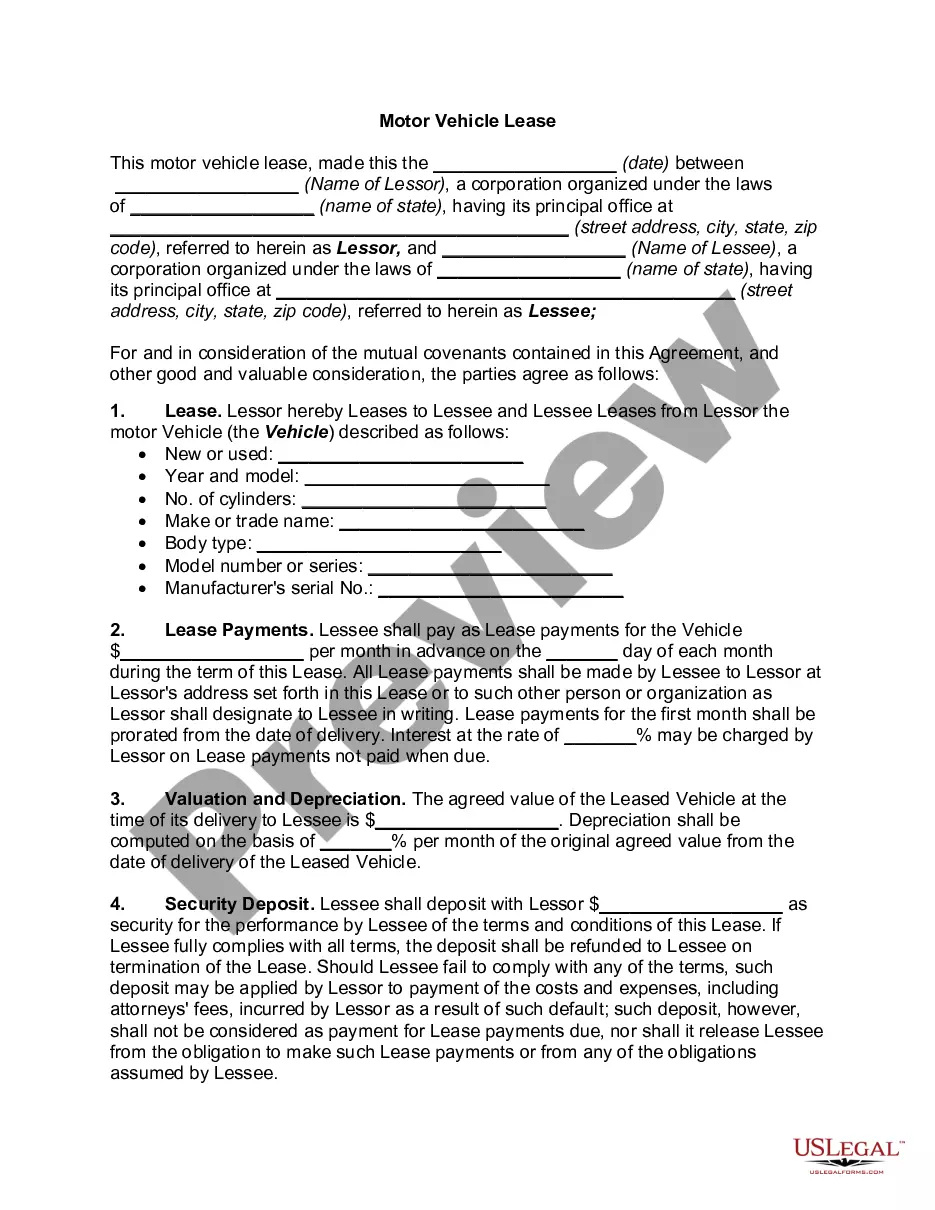

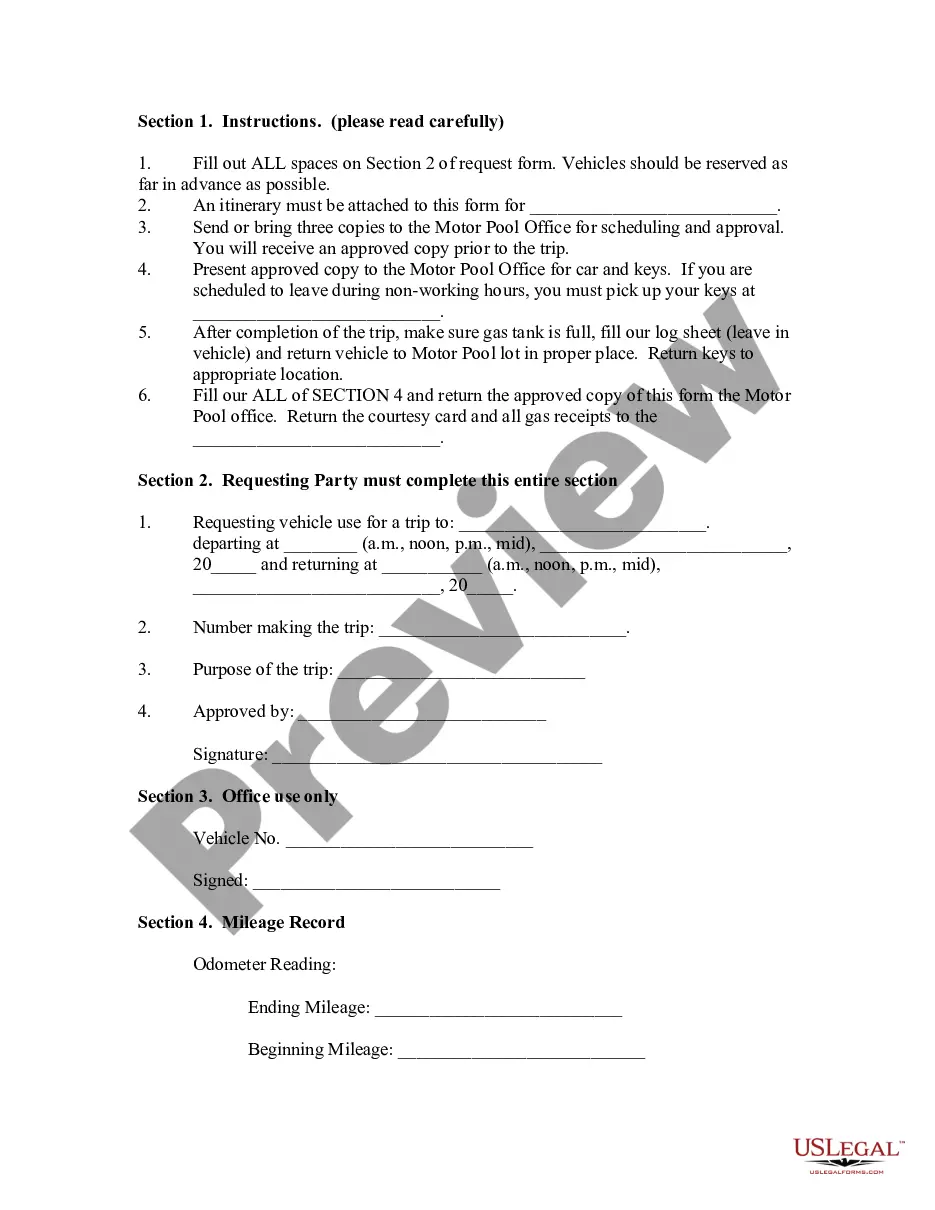

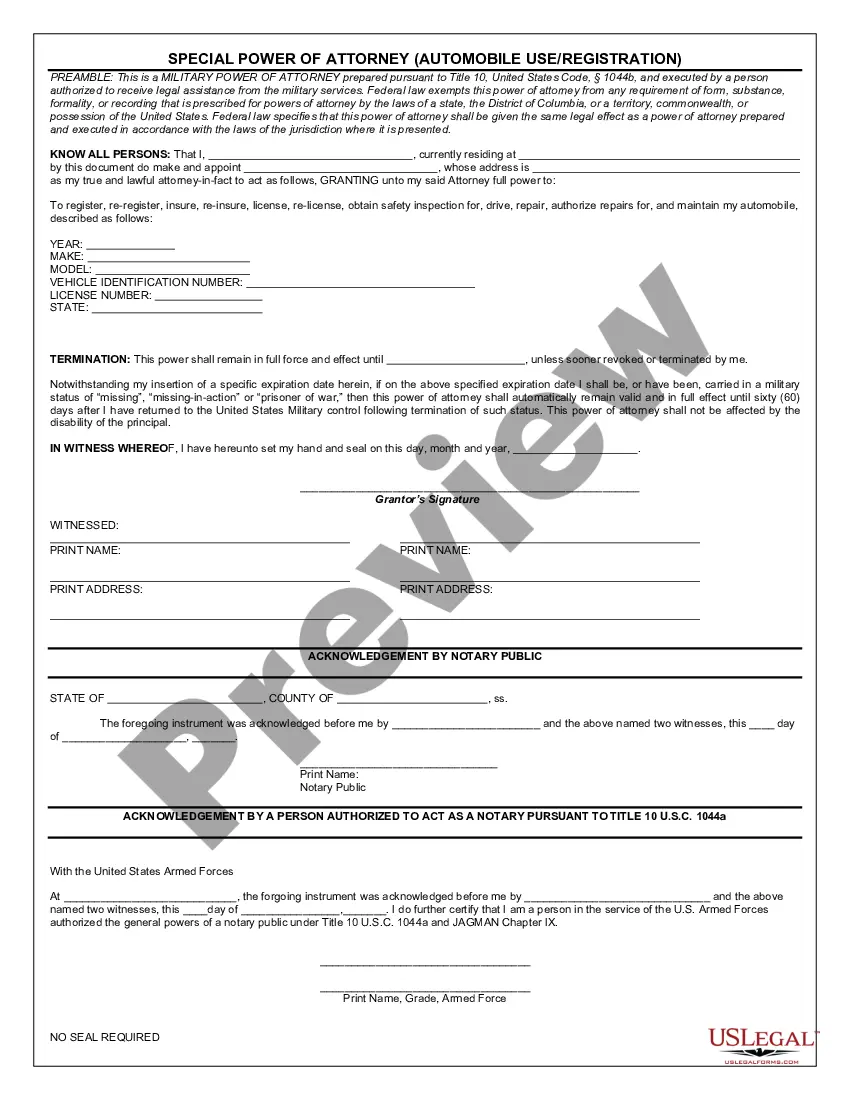

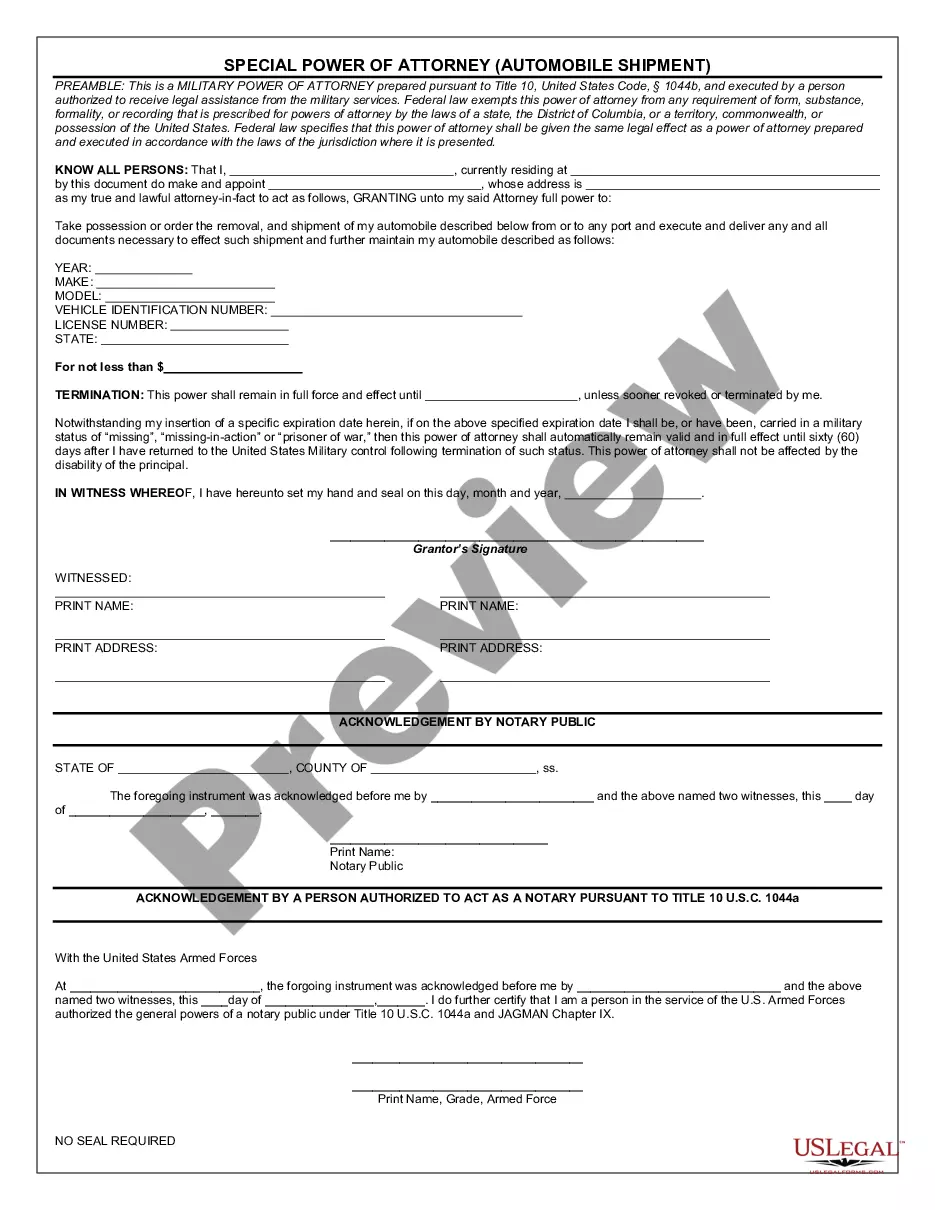

Arkansas Motor Vehicle Pool Use of Vehicle Authorization

Description

How to fill out Motor Vehicle Pool Use Of Vehicle Authorization?

Are you presently in a placement that you need files for possibly company or person functions virtually every working day? There are a lot of authorized file web templates available online, but getting ones you can depend on isn`t effortless. US Legal Forms provides 1000s of develop web templates, just like the Arkansas Motor Vehicle Pool Use of Vehicle Authorization, which can be composed to meet state and federal requirements.

Should you be currently familiar with US Legal Forms web site and have your account, just log in. Afterward, you are able to obtain the Arkansas Motor Vehicle Pool Use of Vehicle Authorization format.

Unless you come with an accounts and wish to begin using US Legal Forms, follow these steps:

- Get the develop you want and ensure it is to the proper metropolis/area.

- Utilize the Preview button to check the shape.

- Read the outline to ensure that you have selected the appropriate develop.

- In case the develop isn`t what you are looking for, utilize the Search discipline to find the develop that suits you and requirements.

- When you discover the proper develop, simply click Purchase now.

- Pick the costs program you would like, complete the required information and facts to create your money, and purchase the transaction utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free data file structure and obtain your copy.

Get all the file web templates you may have bought in the My Forms menus. You can obtain a extra copy of Arkansas Motor Vehicle Pool Use of Vehicle Authorization anytime, if necessary. Just click the needed develop to obtain or print out the file format.

Use US Legal Forms, probably the most substantial assortment of authorized forms, to save lots of efforts and avoid mistakes. The services provides professionally produced authorized file web templates which you can use for a selection of functions. Make your account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

Acceptable proof is either a statement from your county tax collector, or certification of "FIRST ASSESSMENT" stamped on your assessment papers. Proof of liability insurance coverage on the vehicle being registered and titled.

Ark. Code Ann. § 27-14-1004(a) imposes a late registration penalty of $3.00 for each ten days a person fails to properly register a motor vehicle until the penalty reaches the same amount as the annual license fee of the vehicle, which may range from $17.00 to $30.00.

Vehicle Assessment Before renewing your license you are required by Arkansas law to assess your vehicle with your county assessor. Assessments are due by May 31 each year.

Most counties offer online assessment. You must assess between January 1 and May 31 each year.

(c) In the case of a violation, the department shall terminate the suspension upon payment by the owner of the motor vehicle of a reinstatement fee of one hundred dollars ($100) and submission of proof of current insurance as verified through the online insurance verification system.

You'll need the Title or Bill or Sale, the latter of which includes a federal odometer statement, as well as your insurance card. You should also bring your county tax assessment if you've lived in the county the previous year. Also provide proof of any property taxes you've paid on the vehicle.

Personal Property is assessed annually and it's value determined as of January 1 of each assessment year. Personal Property should be itemized and reported to the assessor by May 31 to avoid a late assessment penalty of 10%.

Assessed value is equal to 20% of the appraised value of a property. For example, a home that has a market value of $100,000 would have an assessed value of $20,000. So tax rates only apply to that $20,000. One important note about assessed value in Arkansas is that it cannot increase by more than 5% in any one year.