Arkansas Farm Lease or Rental — General: Everything You Need to Know If you're looking for information on Arkansas farm lease or rental agreements, you've come to the right place. This comprehensive guide will walk you through the key aspects of such agreements, including their purpose, types, terms, and relevant keywords to ensure you're well-informed. The Purpose of an Arkansas Farm Lease or Rental Agreement: An Arkansas farm lease or rental agreement serves as a legally binding contract between a landlord (the farm owner) and a tenant (the person or entity leasing the farm). This agreement outlines the terms and conditions under which the farm is leased or rented, ensuring both parties are protected and aware of their rights and responsibilities. Types of Arkansas Farm Lease or Rental agreements: 1. Cash Rent Lease: In a cash rent lease, the tenant pays a fixed amount of cash annually or semi-annually to the landlord. The tenant typically assumes all production costs and retains the financial benefits of the crops. This type of lease is straightforward and commonly used. 2. Sharecropping Lease: A sharecropping lease allows the tenant to pay a portion of the crop produced rather than a fixed cash amount. The landlord and tenant divide the costs and profits according to an agreed-upon percentage. This type of agreement is popular when the tenant doesn't have sufficient financial resources. 3. Flexible Cash Rent Lease: This type of lease provides a farmer with flexibility when it comes to rental payments. The rent may vary based on factors like yield, commodity prices, and overall profitability. This allows both parties to share the risks associated with market fluctuations. Key terms and conditions in an Arkansas Farm Lease or Rental Agreement: 1. Duration: The lease specifies the duration of the agreement, which is typically for a specific number of years, e.g., 1, 3, 5, or 10 years. It ensures stability and security for both parties. 2. Rent Amount and Payment: The agreement clearly states the rent amount and frequency of payment, whether it is yearly, semi-annually, or monthly. 3. Improvements and Maintenance: The responsibilities for farm maintenance, such as repairs, fencing, infrastructure, and drainage, are outlined in the lease. It is important to define who is responsible for which tasks. 4. Land Use and Restrictions: The lease specifies the permitted use of the land, which may include agricultural purposes, livestock rearing, or specific crop cultivation. It may also include restrictions on the use of certain petrochemicals or environmentally sensitive areas. 5. Termination: The lease outlines the termination conditions, including notice periods, reasons for termination, and dispute resolution mechanisms. Relevant keywords to consider when searching for an Arkansas farm lease or rental agreement include: Arkansas farm lease, agricultural lease, farm rental agreement, cash rent lease, sharecropping lease, flexible cash rent lease, farm lease terms, farmland rental agreement, land use restrictions, termination of farm lease, and Arkansas farming regulations. By understanding the different types of Arkansas farm leases or rentals, as well as the key terms and conditions involved, you can enter into a legally sound and mutually beneficial agreement. Consulting with legal professionals knowledgeable in Arkansas farming regulations can ensure a smooth and successful leasing experience.

Arkansas Farm Lease or Rental - General

Description

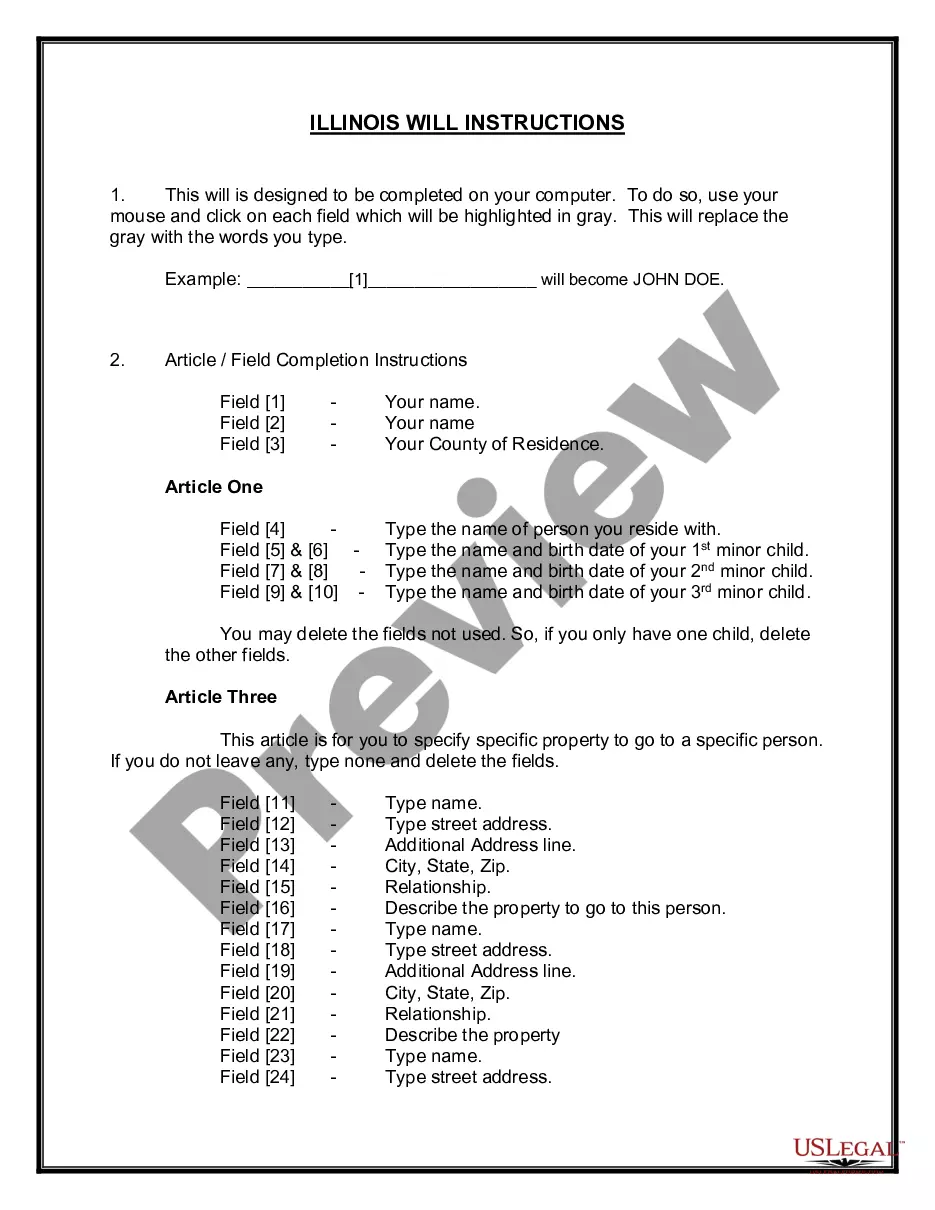

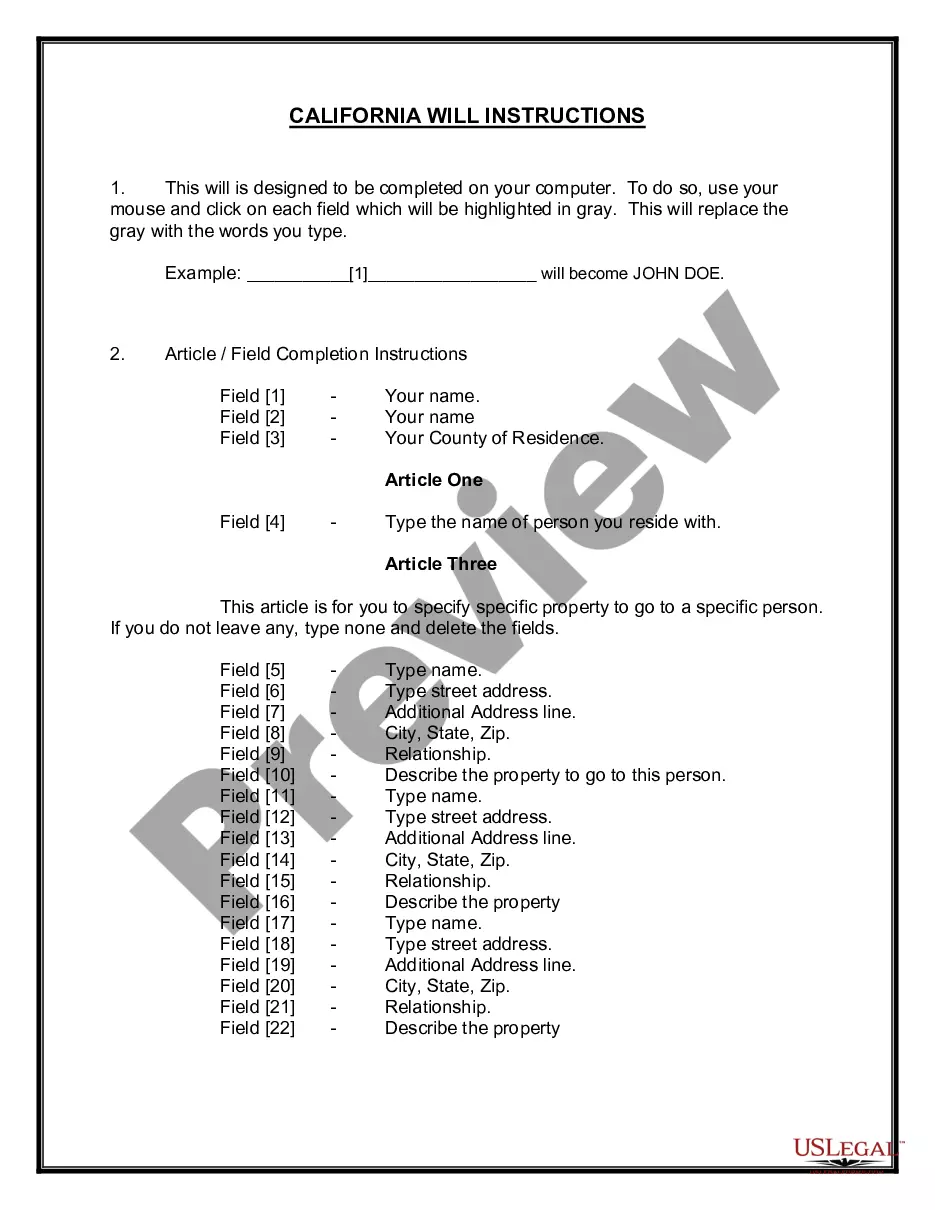

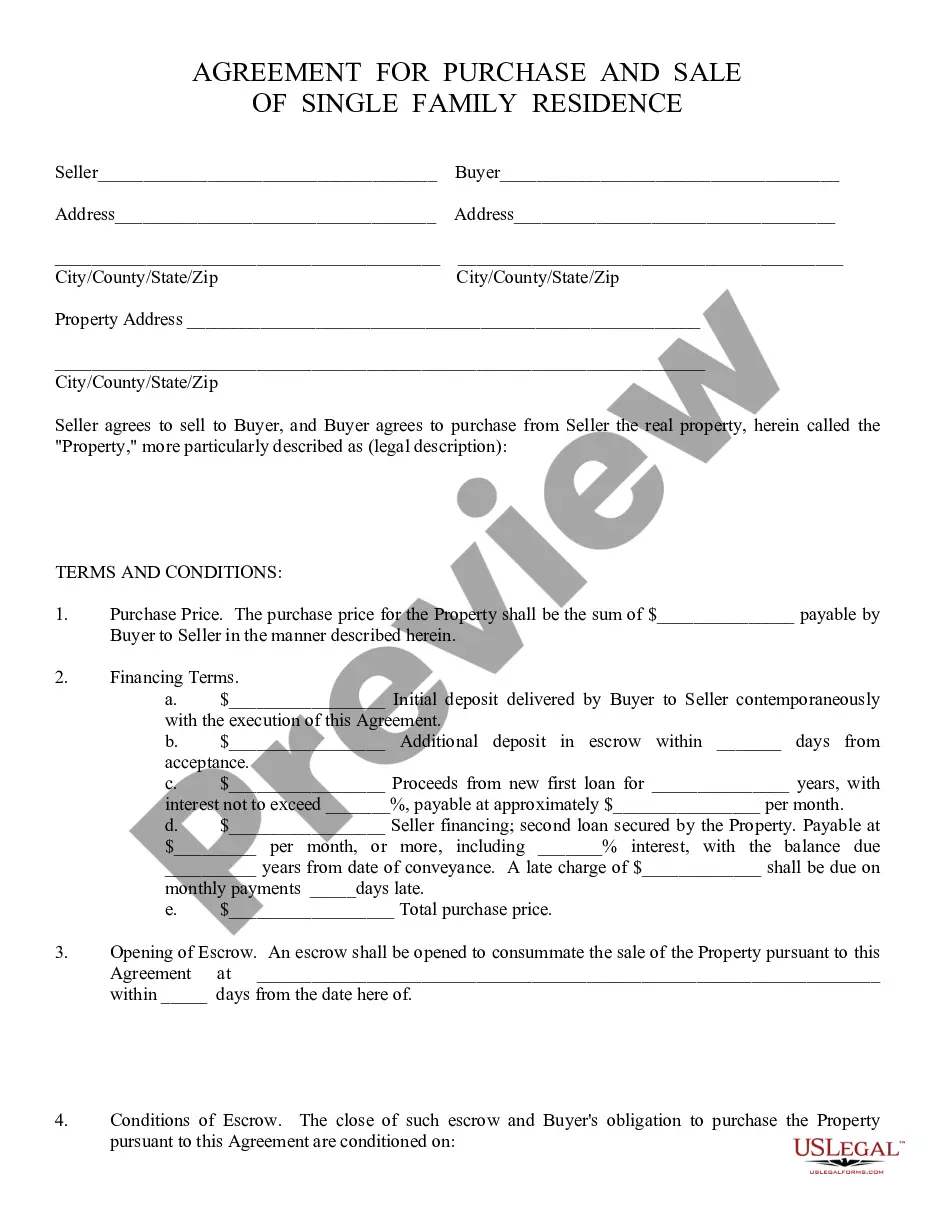

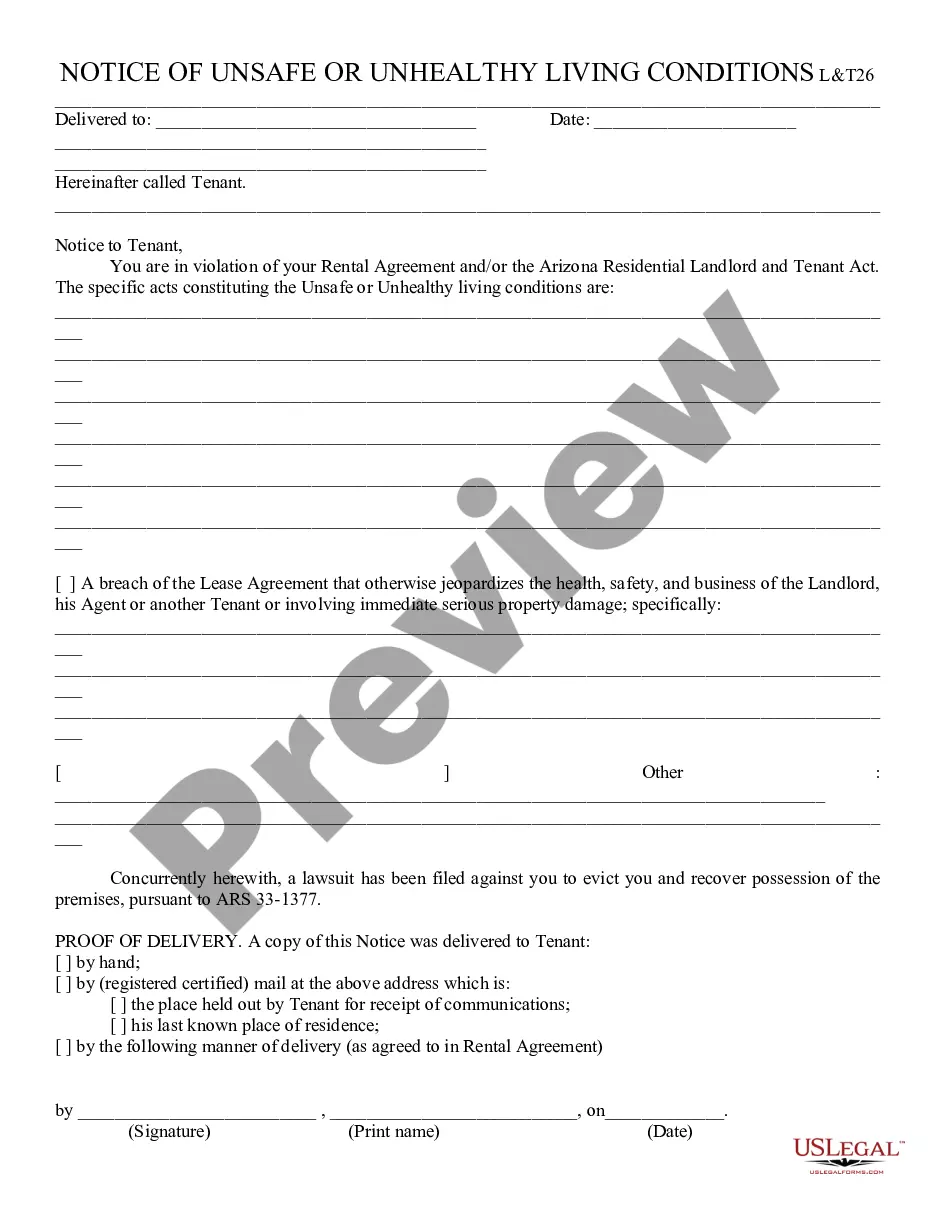

How to fill out Arkansas Farm Lease Or Rental - General?

Discovering the right legal papers web template can be a struggle. Of course, there are tons of web templates available on the Internet, but how can you find the legal kind you will need? Take advantage of the US Legal Forms site. The service offers a huge number of web templates, including the Arkansas Farm Lease or Rental - General, which you can use for enterprise and personal requires. All the kinds are examined by specialists and meet up with state and federal requirements.

When you are previously authorized, log in for your bank account and click on the Download option to get the Arkansas Farm Lease or Rental - General. Utilize your bank account to search through the legal kinds you have bought formerly. Check out the My Forms tab of your respective bank account and obtain one more backup from the papers you will need.

When you are a fresh customer of US Legal Forms, listed below are straightforward directions for you to follow:

- Very first, ensure you have selected the correct kind for your personal town/state. It is possible to examine the form utilizing the Review option and look at the form outline to ensure this is basically the right one for you.

- When the kind is not going to meet up with your preferences, make use of the Seach field to obtain the correct kind.

- When you are sure that the form is proper, click on the Purchase now option to get the kind.

- Select the prices strategy you want and type in the necessary details. Design your bank account and purchase an order with your PayPal bank account or credit card.

- Pick the data file structure and acquire the legal papers web template for your device.

- Total, change and printing and indicator the acquired Arkansas Farm Lease or Rental - General.

US Legal Forms may be the biggest library of legal kinds that you can discover numerous papers web templates. Take advantage of the company to acquire appropriately-manufactured files that follow state requirements.

Form popularity

FAQ

On a state-by-state basis, Arkansas irrigated cropland cash rent averaged $136/acre, which equates to a 3.9% cash return for a total return of 5.4% when appreciation is added. Arkansas non-irrigated cropland cash rent averaged $49/acre, leading to a 2.3% cash return for a total return of 5.8%.

Estimated 2021 farmland value equals $3,328 per acre.

Most farmers find that a combination of both ownership and leasing is desirable, especially when capital is limited. For many new farmers, especially in areas where land is quite expensive, leasing land is often the best option.

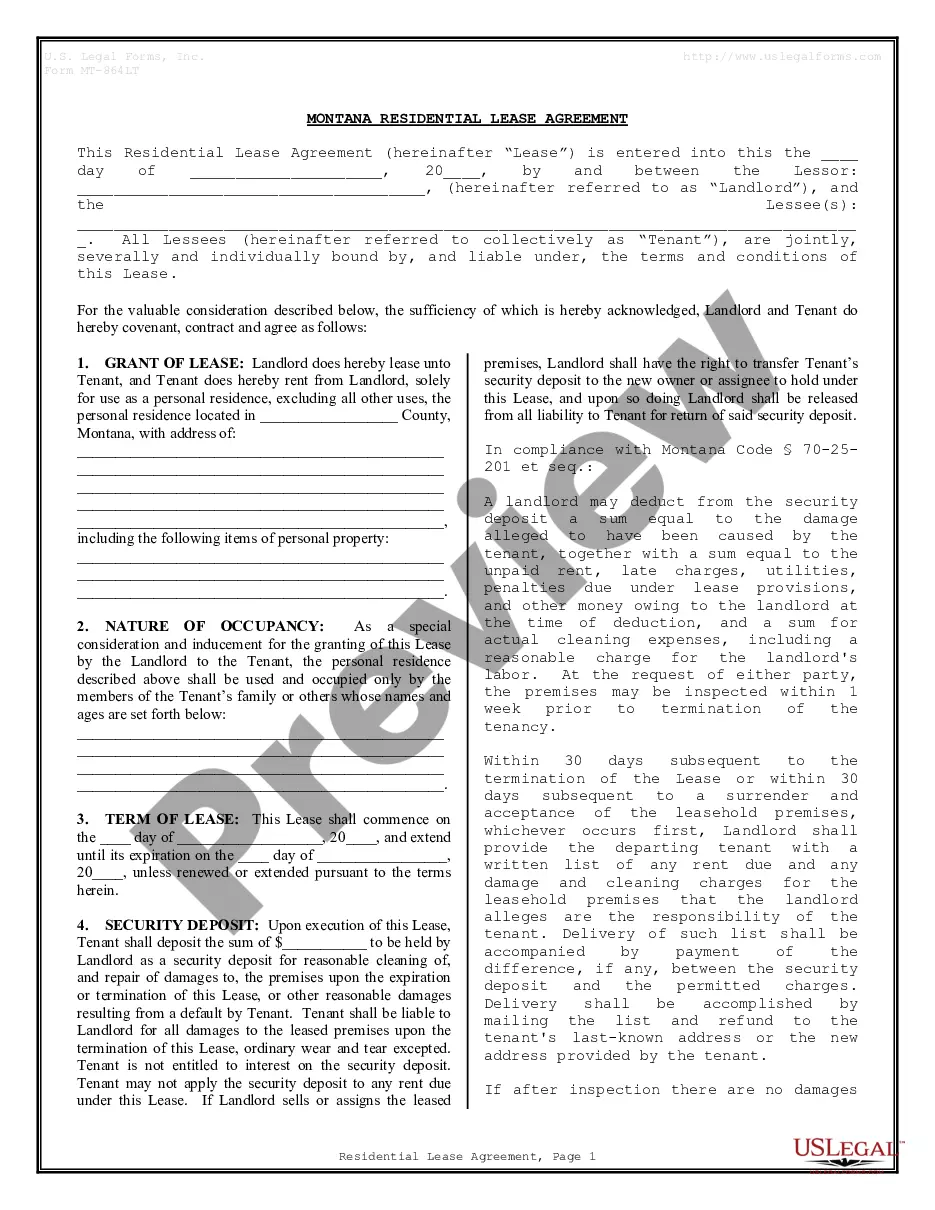

What is an Agricultural Land Lease? A agricultural land lease is an agreement between the property owner (lessor) and leasee that stipulates the terms of use for a piece of farmland. The tenancy may be either long-term or short-term, but typically lasts three to five years.

With a land lease agreement (also known as a ground lease), you purchase the home but rent the land. One of the main advantages is the lower price of this unique arrangement. One of the main disadvantages is that you will not be able to build valuable equity in the land on which you live.

Renting Pastures to $30 per acre per year in Arkansas. lessee and is based on many factors. Most of the rental agreements in Arkansas are made on a per-acre basis.

Farmland has historically been a good investment. Unfortunately, not many investors have been able to benefit from this asset class, given the high upfront costs of buying farmland.

The average cash rent per acre for pastureland in Arkansas remained the same as last year $19 per acre.