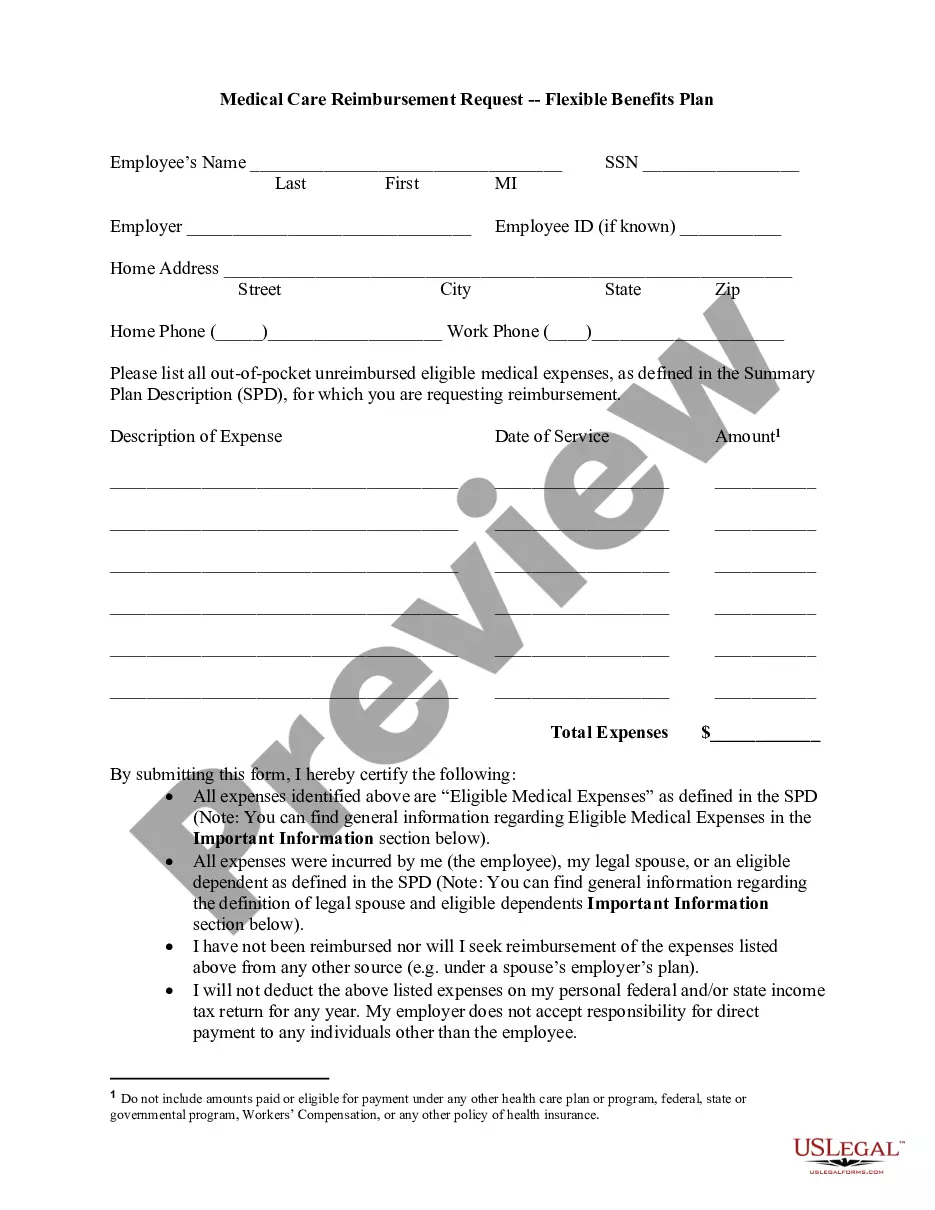

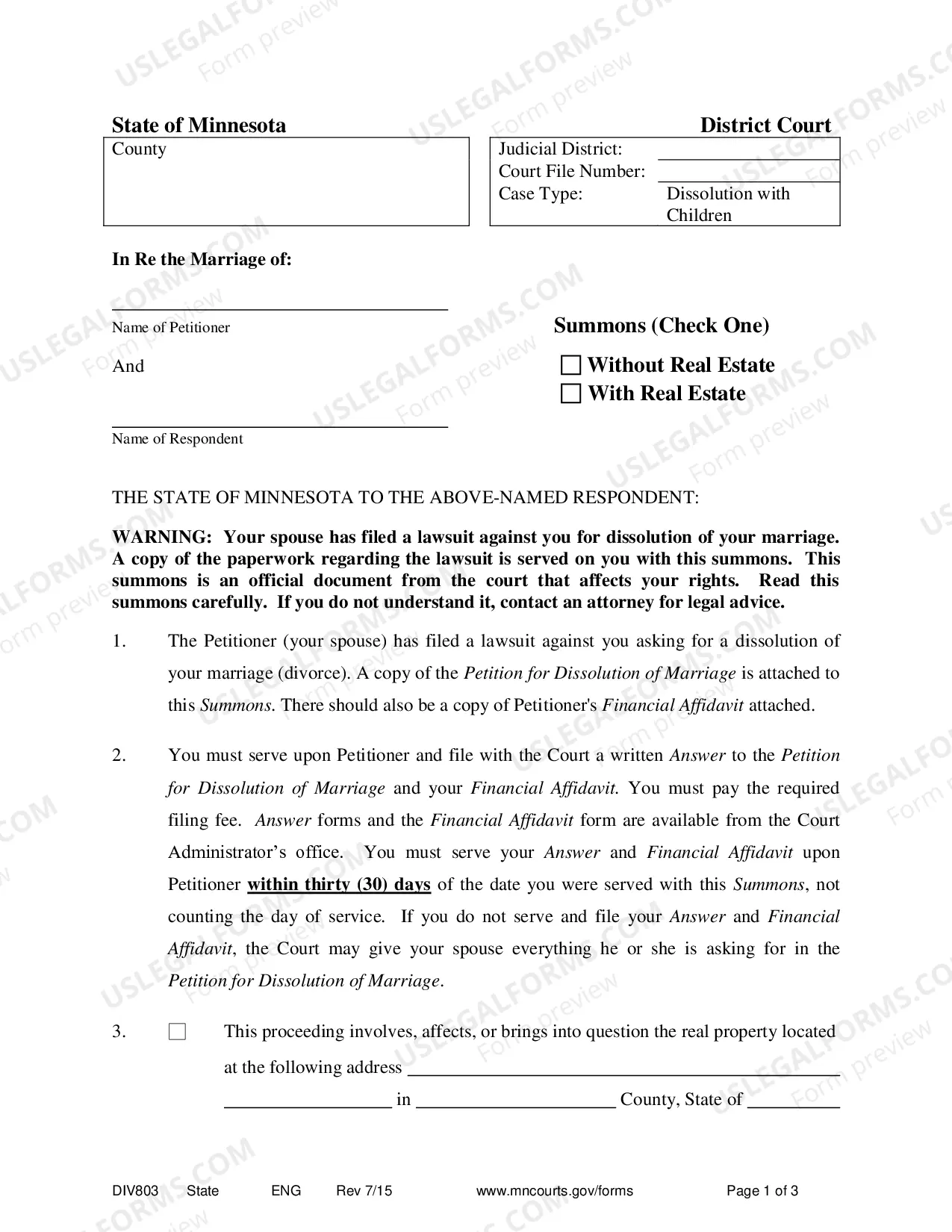

Arkansas Summons to Debtor in Involuntary Case — B 250E is a legal document used in bankruptcy proceedings. It serves as a notification to the debtor that they are being sued by their creditors and provides details about the upcoming court hearing. Involuntary bankruptcy cases are initiated by creditors who believe the debtor is unable to pay their debts. The B 250E summons is used specifically in Arkansas for such cases. The summons outlines the essential information that the debtor needs to know, including the date, time, and location of the court hearing. Keywords: Arkansas summons, debtor, involuntary case, B 250E, bankruptcy, legal document, creditors, court hearing, notification. Types of Arkansas Summons to Debtor in Involuntary Case — B 250E: 1. Basic Summons: This type of summons includes the essential information mentioned above, such as the court hearing details, and is used to officially notify the debtor of the lawsuit filed against them. 2. Supplementary Summons: If additional information or documents are required from the debtor, a supplementary summons may be issued. It instructs the debtor to provide specific documents or evidence to support their case before the hearing. 3. Amended Summons: In case of any changes or updates to the details of the court hearing, an amended summons may be issued. This type of summons replaces the original summons and provides the updated information. 4. Motion to Quash Summons: If the debtor believes that there are legal grounds to invalidate the summons, they can file a motion to quash. This requests the court to dismiss the summons based on reasons such as improper service or lack of jurisdiction. 5. Notice of Dismissal of Summons: If the creditors decide to withdraw their case against the debtor before the court hearing, a notice of dismissal of summons is issued. This informs the debtor that the lawsuit has been dropped and there will be no further legal proceedings. Remember that specific types of summons may vary based on the jurisdiction and the requirements of individual cases. It is crucial to consult an attorney or legal expert when dealing with bankruptcy matters to ensure compliance with local regulations and to obtain accurate information tailored to your specific situation.

Arkansas Summons to Debtor in Involuntary Case - B 250E

Description

How to fill out Arkansas Summons To Debtor In Involuntary Case - B 250E?

Choosing the best lawful record template can be quite a have difficulties. Needless to say, there are plenty of layouts available online, but how would you get the lawful type you need? Make use of the US Legal Forms web site. The assistance provides a huge number of layouts, like the Arkansas Summons to Debtor in Involuntary Case - B 250E, that can be used for company and personal requires. All of the forms are checked out by pros and satisfy state and federal specifications.

In case you are currently authorized, log in in your accounts and click on the Down load switch to get the Arkansas Summons to Debtor in Involuntary Case - B 250E. Make use of accounts to search from the lawful forms you possess bought formerly. Go to the My Forms tab of your own accounts and have one more version of the record you need.

In case you are a new customer of US Legal Forms, allow me to share easy directions for you to stick to:

- Initially, be sure you have selected the right type for your personal town/county. You are able to examine the form making use of the Preview switch and read the form explanation to make sure this is basically the best for you.

- In the event the type will not satisfy your expectations, use the Seach field to obtain the proper type.

- Once you are certain that the form is proper, click the Get now switch to get the type.

- Select the pricing strategy you need and type in the necessary information. Design your accounts and buy your order making use of your PayPal accounts or credit card.

- Select the file file format and download the lawful record template in your device.

- Complete, edit and print out and signal the received Arkansas Summons to Debtor in Involuntary Case - B 250E.

US Legal Forms is the largest collection of lawful forms for which you can see different record layouts. Make use of the company to download expertly-produced documents that stick to state specifications.