Arkansas Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

Have you been in the situation that you need to have papers for both business or specific functions nearly every time? There are a lot of legal file layouts available on the Internet, but finding types you can depend on isn`t simple. US Legal Forms delivers a huge number of kind layouts, like the Arkansas Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, that are published to meet state and federal requirements.

If you are currently informed about US Legal Forms web site and get an account, just log in. Following that, it is possible to obtain the Arkansas Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 template.

Unless you come with an bank account and want to begin using US Legal Forms, adopt these measures:

- Get the kind you require and make sure it is for the correct city/state.

- Use the Preview option to analyze the form.

- Browse the information to actually have selected the proper kind.

- In the event the kind isn`t what you`re seeking, make use of the Lookup industry to get the kind that suits you and requirements.

- Once you obtain the correct kind, just click Purchase now.

- Pick the rates plan you desire, fill out the necessary details to produce your money, and pay money for the order utilizing your PayPal or bank card.

- Pick a convenient paper formatting and obtain your duplicate.

Find every one of the file layouts you might have bought in the My Forms food list. You can get a further duplicate of Arkansas Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 at any time, if necessary. Just go through the needed kind to obtain or print the file template.

Use US Legal Forms, one of the most comprehensive selection of legal varieties, to save lots of time as well as avoid errors. The support delivers appropriately made legal file layouts which you can use for a variety of functions. Produce an account on US Legal Forms and commence producing your life easier.

Form popularity

FAQ

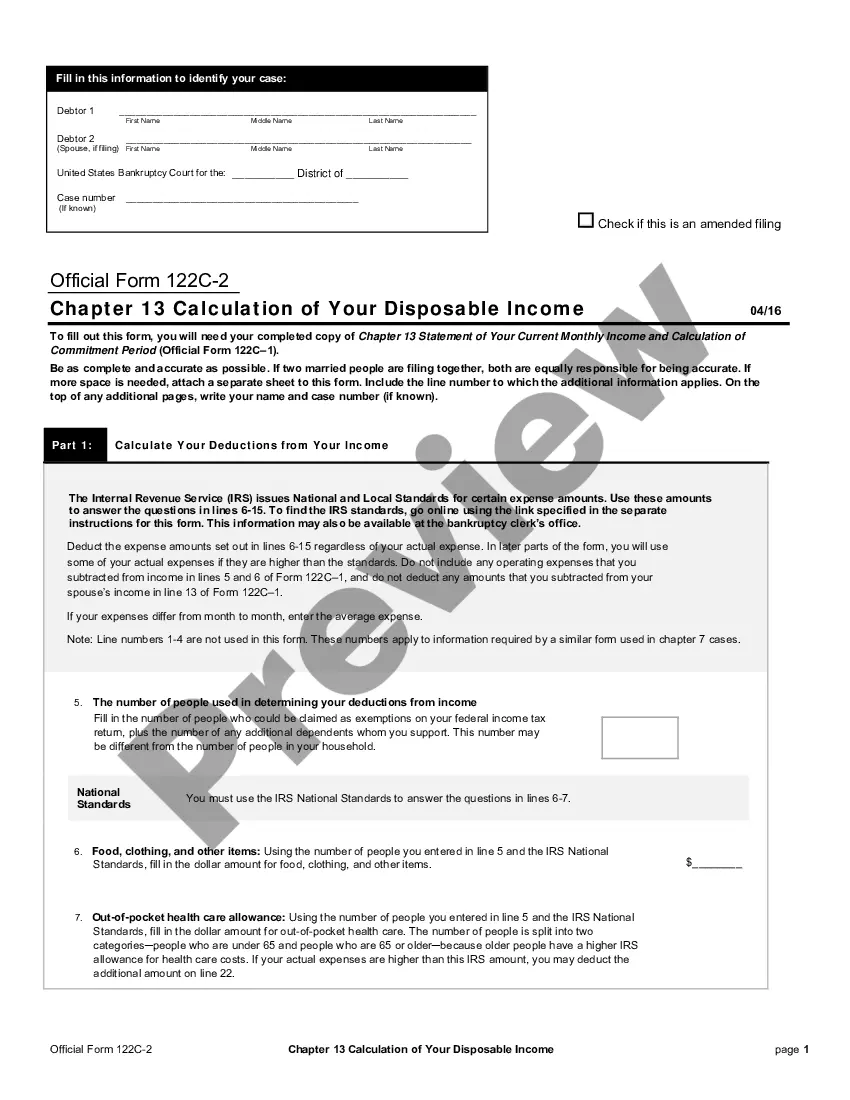

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

Your disposable income is what remains after you've deducted all living expenses such as food, clothing, housing, utilities, insurance, childcare expenses, medical expenses and insurance costs and mandatory payments.

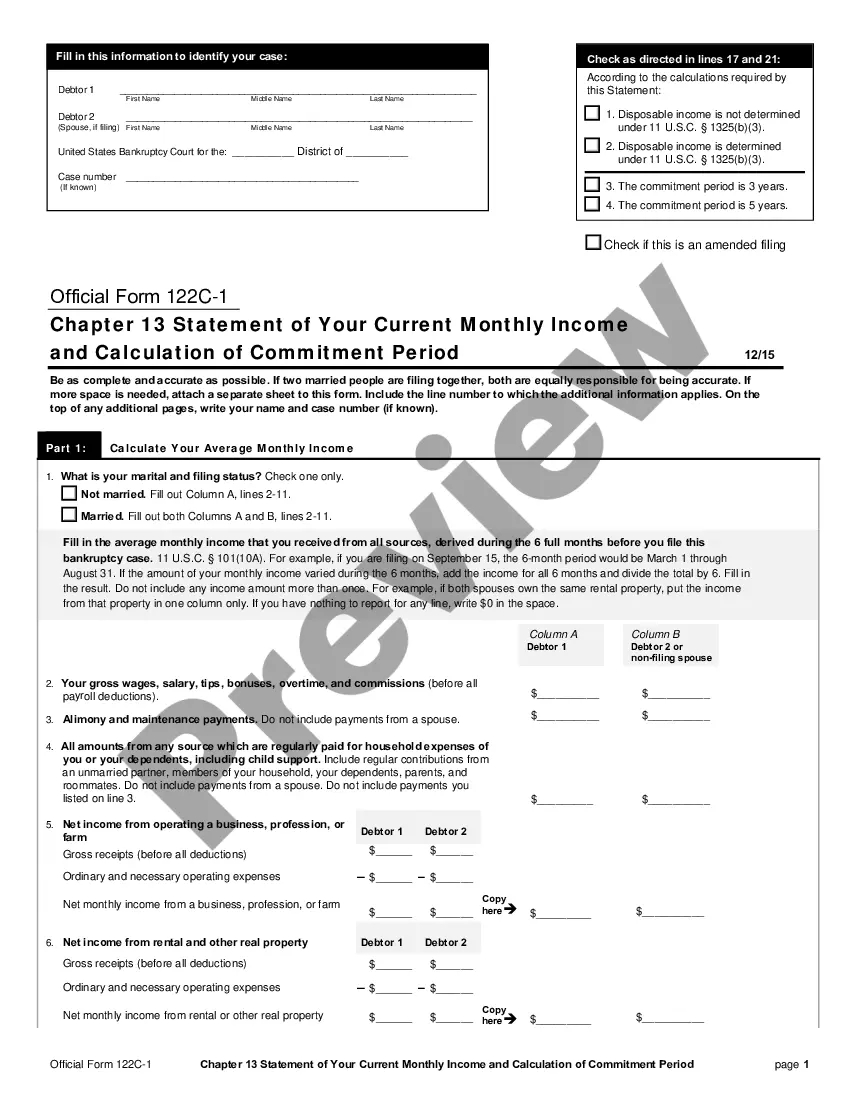

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

How Is Disposable Income Calculated? Your last six months of income divided by six to get average monthly income. If you own a business or work for yourself, you must calculate average monthly income. Any money you get from rent on an asset you own, interests, dividends or royalties.

A debtor must have enough income, after deducting allowable expenses, for all debt obligations. A debtor may include income from a working spouse even if the spouse has not filed jointly for bankruptcy, wages and salary, self-employment income, Social Security benefits, and unemployment benefits.

11 U.S.C. § 1325. In chapter 13, "disposable income" is income (other than child support payments received by the debtor) less amounts reasonably necessary for the maintenance or support of the debtor or dependents and less charitable contributions up to 15% of the debtor's gross income.

Those who earn too much money may be forced into Chapter 13. If you undergo a substantial reduction in income while the Chapter 13 plan is in place, you can file a notice of conversion. The Chapter 13 plan ends and the case proceeds as a Chapter 7.