The Arkansas Prospectus of Scudder Growth and Income Fund offers investors an in-depth overview of this investment fund's objectives, strategies, risks, and historical performance. By examining this prospectus, potential investors can gain a comprehensive understanding of the fund's investment approach and make informed investment decisions. Scudder Growth and Income Fund is designed for investors seeking long-term capital appreciation and regular income. The fund achieves this through a diversified portfolio of both growth and income securities. The objective is to invest primarily in common stocks of large and medium-sized companies that offer growth potential and also provide a regular income stream through dividends. The prospectus highlights that the fund aims to generate returns by investing in companies that show strong growth potential, robust financials, and sound management teams. Moreover, it emphasizes the importance of selecting stocks that offer competitive dividend yields, ensuring steady income flow to investors. To manage risk and attain diversification, the Arkansas Prospectus of Scudder Growth and Income Fund states that the fund may also invest in bonds, convertible securities, and preferred stocks. By having exposure to fixed-income securities, the fund seeks to add stability to the portfolio and cushion against market volatility. This diversification strategy aims to strike a balance between growth potential and income stability. The prospectus further explains that the Scudder Growth and Income Fund employ a research-driven approach. A seasoned team of investment professionals conducts thorough fundamental analysis to identify companies with attractive growth prospects while considering their valuation. Additionally, the team actively manages the portfolio by monitoring market trends and adjusting holdings accordingly. Potential investors should be aware of the risks associated with the Scudder Growth and Income Fund. These risks may include market fluctuations, economic downturns, changes in interest rates, and credit risks. By detailing these risks, the prospectus ensures transparency and helps investors make well-informed decisions. While there might not be different types of Arkansas Prospectus of Scudder Growth and Income funds per se, it is worth mentioning that Scudder may offer variations of this fund that cater to different investor preferences or specific market sectors. These variations could include sector-focused funds, such as technology, healthcare, or energy. Each may have its own prospectus detailing its investment objectives, strategies, and risks unique to that sector. In summary, the Arkansas Prospectus of Scudder Growth and Income Fund provides a comprehensive overview of an investment fund that seeks capital appreciation and income through a diversified portfolio of securities. It outlines the fund's investment objectives, strategies, risk factors, and performance history, assisting potential investors in evaluating its suitability to their investment goals and risk appetite.

Arkansas Prospectus of Scudder growth and income fund

Description

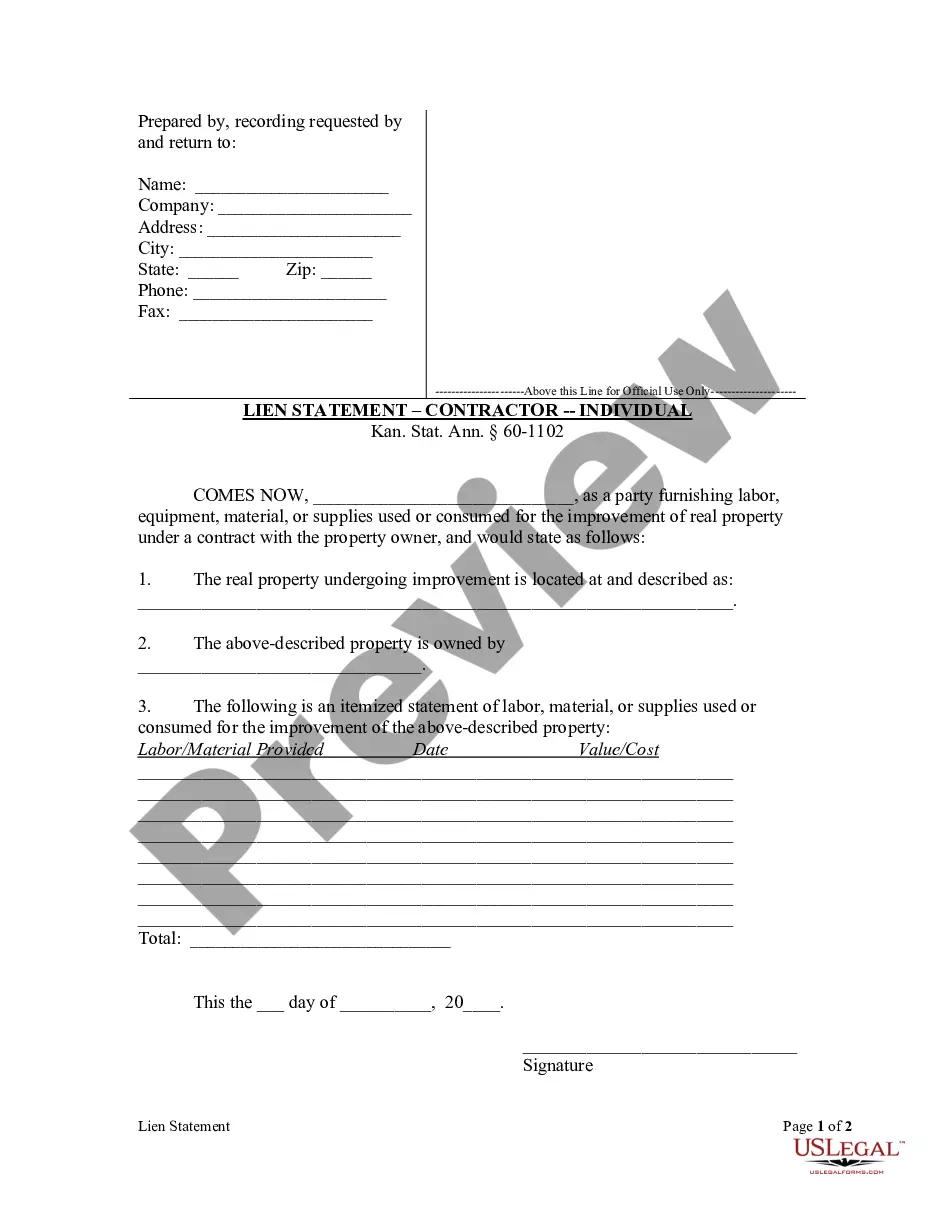

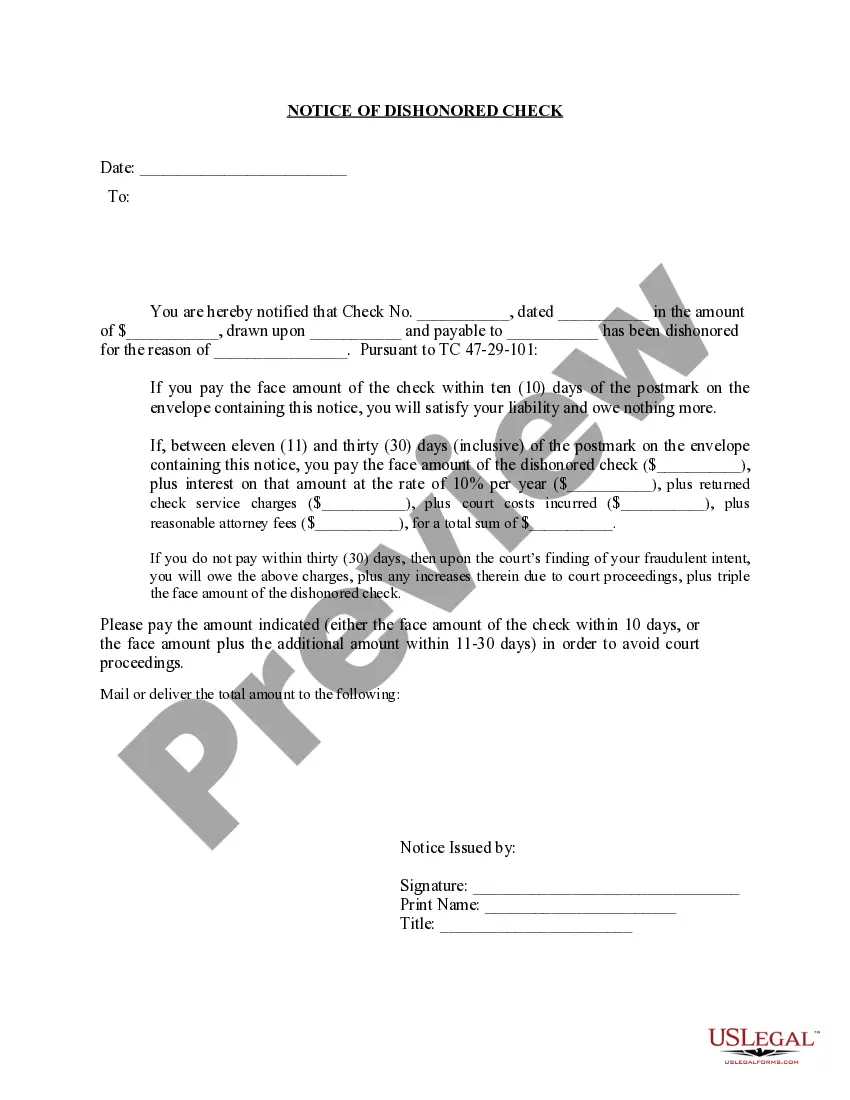

How to fill out Prospectus Of Scudder Growth And Income Fund?

If you wish to complete, down load, or printing authorized record web templates, use US Legal Forms, the biggest assortment of authorized forms, that can be found on the Internet. Make use of the site`s simple and easy practical research to discover the documents you need. Different web templates for company and specific functions are sorted by categories and suggests, or search phrases. Use US Legal Forms to discover the Arkansas Prospectus of Scudder growth and income fund within a few click throughs.

In case you are presently a US Legal Forms consumer, log in in your profile and click on the Down load key to find the Arkansas Prospectus of Scudder growth and income fund. Also you can gain access to forms you earlier saved inside the My Forms tab of the profile.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that right town/country.

- Step 2. Take advantage of the Review solution to check out the form`s information. Never forget to see the information.

- Step 3. In case you are unsatisfied with the kind, make use of the Research industry near the top of the monitor to locate other variations of your authorized kind template.

- Step 4. After you have found the shape you need, select the Get now key. Opt for the rates strategy you prefer and add your credentials to register for the profile.

- Step 5. Approach the deal. You can use your credit card or PayPal profile to perform the deal.

- Step 6. Find the format of your authorized kind and down load it on the gadget.

- Step 7. Complete, revise and printing or indication the Arkansas Prospectus of Scudder growth and income fund.

Each authorized record template you acquire is the one you have for a long time. You possess acces to each and every kind you saved inside your acccount. Select the My Forms portion and choose a kind to printing or down load yet again.

Be competitive and down load, and printing the Arkansas Prospectus of Scudder growth and income fund with US Legal Forms. There are millions of specialist and status-specific forms you can use for your personal company or specific requires.

Form popularity

FAQ

Growth and income funds strike a balance between risk and reward by including both growth and income assets. While growth stocks have the potential for high returns, they come with increased volatility and risk. Income investments, while generating a steady income, usually offer slower growth.

They are considered to have higher risk because many of them do not guarantee an income and may also go down in value. Growth and income investments include: fixed income mutual funds. market-linked GICs. Investing for growth, income or both - GetSmarterAboutMoney.ca GetSmarterAboutMoney.ca ? making-a-plan GetSmarterAboutMoney.ca ? making-a-plan

A mutual fund prospectus is a document detailing the investment objectives and strategies of a particular fund or group of funds, as well as the finer points of the fund's past performance, managers and financial information. You can obtain these documents directly from fund companies through mail, email or phone.

?Typically in a pension I would tend to focus primarily on growth funds, but then look to a smaller amount of income funds where there is a specific opportunity,? he says. Another factor is the market in which you invest for income. Should you invest for income or growth? - Investors' Chronicle investorschronicle.co.uk ? ideas ? 2023/11/07 investorschronicle.co.uk ? ideas ? 2023/11/07